Understanding State Economic Nexus (WA/TX Taxes) is not optional if you sell into the U.S. market. Many foreign sellers think that selling from abroad means no U.S. tax duty. That’s false. If your sales into Washington or Texas cross certain thresholds, you must register, collect, and remit sales tax even with no physical location in the U.S., and this applies to products, software, and many digital services.

This article explains State Economic Nexus (WA/TX Taxes), and we go beyond general info. You’ll learn real numeric thresholds, how Washington and Texas define nexus, how they differ from many states, and what to do next.

What Does State Economic Nexus (WA/TX Taxes) Mean?

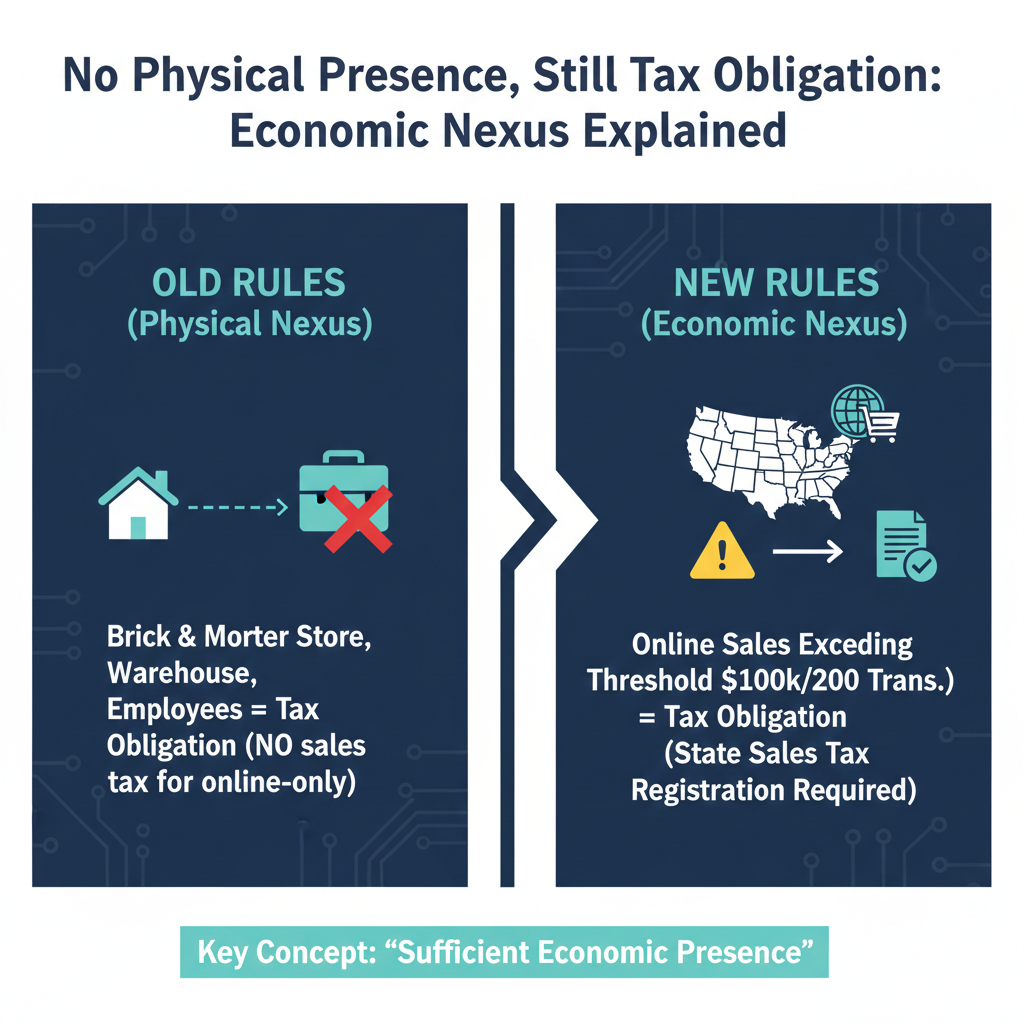

State Economic Nexus (WA/TX Taxes) means a legal tax connection between your business and a state based on economic activity, not physical presence.

In the past, you only had to worry about sales tax if you had a warehouse, office, or employee in the state. After the U.S. Supreme Court’s South Dakota v. Wayfair decision, states could require sales tax collection from sellers with only economic activity in the state.

So, if a foreign seller’s sales into Washington or Texas exceed certain limits, you may owe tax. This can surprise many international sellers who think, “No U.S. physical presence = no tax.”

Myth vs. Reality: “If my sales exceed $100K, I only worry in CA/NY/etc.”

A common myth is that “if my sales exceed $100K, I only worry in states like California or New York.” But:

- Washington has a $100,000 combined gross receipts threshold that triggers both sales tax and B&O tax reporting obligations for out-of-state sellers.

- Texas uses a $500,000 total Texas revenue threshold to trigger economic nexus for remote sellers.

These thresholds are different from many states with the typical $100K / 200 transactions pattern. Understanding these specific standards is crucial for compliance.

How Economic Nexus Works Across U.S. States

Most states use one of these tests for economic nexus:

- $100,000 in sales in a year, and/or

- 200 separate sales transactions in that state.

However, recent changes have moved many states away from the transaction count and focus mainly on sales revenue alone, especially states like Washington that eliminated the transactions test.

Here’s a simplified comparison:

| Type of Test | Standard Pattern in U.S. | Exceptions (e.g., WA/TX) |

|---|---|---|

| Revenue limit | ~$100,000 in sales | Washington: $100,000 (gross receipts) |

| Transactions test | ~200 transactions | Washington eliminated transactions test |

| Higher revenue states | $500,000 | Texas: $500,000 total revenue |

As you can see, Washington and Texas don’t follow the typical formula that many sellers think applies everywhere.

Washington Economic Nexus Rules

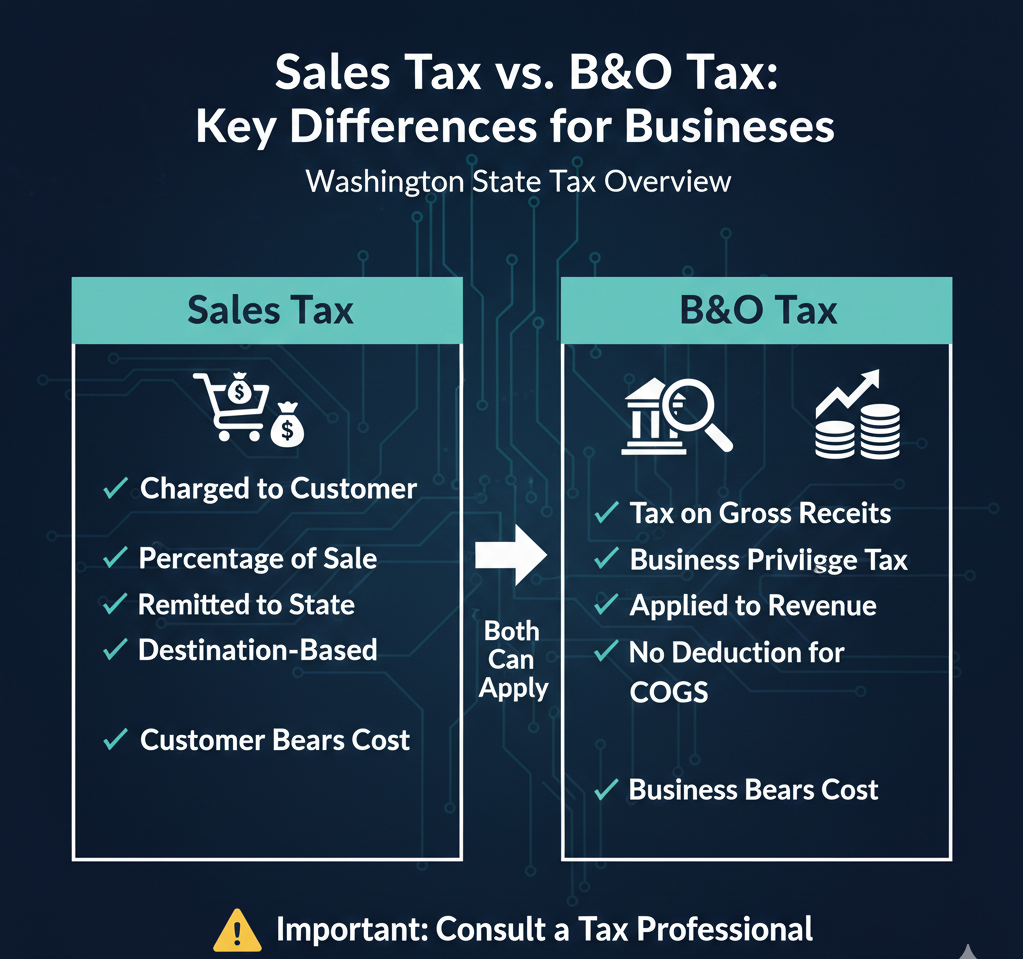

For Washington, the State Economic Nexus (WA/TX Taxes) concept includes both retail sales tax and Business & Occupation (B&O) tax requirements.

The Washington Threshold

Washington’s Department of Revenue states that an out-of-state business must register and report if it has more than $100,000 in combined gross receipts sourced to Washington in the current or prior year.

This combined gross receipts test includes all sales into Washington, regardless of whether they are retail sales, wholesale, services, digital goods, or exempt sales. It’s broad.

Official Washington guidance can be read here: Out-of-state businesses reporting thresholds and economic nexus on the Department of Revenue website.

In Washington, economic nexus means TWO things:

- Retail Sales Tax Nexus (You must collect retail sales tax from customers): You must collect and remit sales tax on taxable goods/services delivered into WA.

- B&O Tax Reporting Nexus: You must report gross income for Business & Occupation (B&O) tax purposes.

This is unusual because many states only trigger a simple sales tax obligation without B&O tax reporting.

What Counts in Washington

Washington doesn’t just count taxable sales:

- All gross receipts sourced to Washington count toward the $100k test, including exempt and wholesale sales.

- Marketplace sales and direct sales into WA must be counted.

This broad definition means even foreign sellers could hit the threshold quickly if they sell frequently.

Washington Registration and Compliance

When you exceed the Washington economic nexus threshold:

- You must register with the WA Department of Revenue.

- You will receive a Unified Business Identifier (UBI).

- You must collect retail sales tax and file returns.

- You must also report for the WA B&O tax.

This combination is unique and often surprising to sellers who only think about collecting sales tax.

Texas Economic Nexus Rules

Texas’s approach to State Economic Nexus (WA/TX Taxes) is focused on total revenue from sales into Texas.

The Texas Threshold

The Texas Comptroller’s office states that a remote seller must obtain a Texas sales tax permit (one simplified rate instead of many city rates), and begin collecting if its total Texas revenue exceeds $500,000 in the preceding 12 calendar months.

You count:

- All taxable and non-taxable sales,

- Handling, shipping, and installation fees,

- Marketplace sales (included in revenue calculations).

Official details are available on the Texas Comptroller site under Remote Sellers – Sales Tax.

No Transaction Test in Texas

Unlike many states, Texas does not use a transaction count trigger. If your revenue into Texas crosses $500,000, economic nexus exists, period.

This simplifies some compliance but raises the bar, making tax due only at a higher sales volume.

What Happens After You Exceed the Texas Threshold

Once you exceed $500,000:

- You must apply for a Texas sales tax permit.

- You must register with the Texas Comptroller.

- You must collect and remit tax on taxable sales beginning no later than the first day of the fourth month after exceeding the threshold.

Texas also allows remote sellers to use a single local use tax rate instead of a complex local rate, which can simplify remote seller compliance.

How WA and TX Fit the Broader U.S. Pattern

If you compare Washington and Texas to the general U.S. landscape:

| State | Revenue Threshold | Transaction Threshold |

|---|---|---|

| Most States | $100K | 200 (or removed) |

| Washington | $100K | None |

| Texas | $500K | None |

| New York | $500K + 100 transactions | Both required |

This helps you see when companies typically cross reporting lines. Many sellers first trigger nexus in states with $100K thresholds. But with Washington’s B&O tax obligations or Texas’s higher revenue requirement, you need to track each state separately.

Practical Examples for Foreign Sellers

Example 1: Washington Sales

You sell digital subscriptions and physical goods from Pakistan.

- You had $120,000 in total sales in Washington last year.

- You did 50 individual transactions, no problem there.

- Because Washington’s nexus is based on gross receipts and not transaction count, you must register and collect taxes.

This triggers State Economic Nexus (WA/TX Taxes) even if no sales tax physically appears at checkout.

Example 2: Texas Sales

Your UK SaaS business sold $450,000 of SaaS and goods into Texas in the last 12 months.

- You are under the $500K threshold, no sales tax duty yet.

- If this grows to $510,000 next quarter, you exceed the Texas economic nexus trigger.

- You then have until the first day of the fourth month after crossing $500K to register and begin collecting tax.

How Your Business Type Matters

Your business structure doesn’t change the nexus test, but it changes compliance.

If you operate as:

- Single Member LLC — you still face sales tax obligations. Learn more about Single Member LLC taxation here.

- Multi-Member LLC — compliance is more complex, you can get full details here.

- C-Corp — compliance planning may differ. You can explore here.

For a broader overview of U.S. LLC compliance, check:

https://scounts.pk/us-llc-tax-filing-services/

Managing your sales tax obligations correctly can protect your business from penalties.

4 Common Compliance Traps and How to Avoid Them

1. Waiting for a State Notice (states audit later)

States often audit years after you exceed thresholds. Don’t wait, but track sales monthly.

2. Assuming Marketplaces Cover Everything

Platforms like Amazon may collect tax on marketplace transactions, but you still must report and register if your total sales exceed thresholds.

3. Ignoring B&O Tax in Washington

Many sellers know about sales tax but miss Washington’s Business & Occupation (B&O) tax.

4. Counting Only Taxable Sales

States like Washington and Texas count all gross revenue, not just taxable sales.

Invite for Assistance Compliance in multiple U.S. states can be confusing. Professional help can save mistakes and money.

Scounts.pk helps you register your company, manage taxes, handle all compliance in Pakistan and the UK, while ensuring your U.S. tax obligations are met. If you’d like guidance, explore support at https://scounts.pk/contact/ or message via WhatsApp.

FAQs: State Economic Nexus (WA/TX Taxes)

1. Must foreign sellers collect U.S. sales tax?

Yes. If your sales into Washington or Texas exceed the state’s economic nexus threshold, you must collect and remit sales tax.

2. What if I sell only digital services?

Many states count digital services toward thresholds, and Washington counts gross receipts (not just products).

3. Is transaction count a factor?

Washington and Texas do not use a transaction threshold for economic nexus, though some states do.

4. Does forming a U.S. LLC remove sales tax obligations?

No, nexus depends on activity, not your legal structure.

5. What if I have a marketplace handle taxes?

Marketplaces may collect tax on your behalf, but economic nexus reporting still applies if thresholds are met.

Conclusion

Understanding State Economic Nexus (WA/TX Taxes) is critical for international sellers growing in the U.S. market. Washington’s broad $100K gross receipts standard and Texas’s higher $500K revenue trigger show how different states can be.

State laws change frequently, always monitor your sales by state and act early to minimize penalties. If you want expert help aligning your U.S. compliance with your global business, professional support is available through advisors like Scounts.pk.

Disclaimer: This article is authored by a writer at Scounts Private Limited. Please note that the fees mentioned are subject to change and may not be accurate at the time of reading. The content has not yet reviewed by any of our LLC taxation experts. For expert advice or services, feel free to contact us.