Many foreign entrepreneurs who own US companies get confused about one critical question:

Is my company a domestic reporting company or a foreign reporting company under the Corporate Transparency Act (CTA)?

This confusion is very common, especially among non-resident founders who believe that foreign ownership automatically makes a company a foreign reporting company.

That is not true.

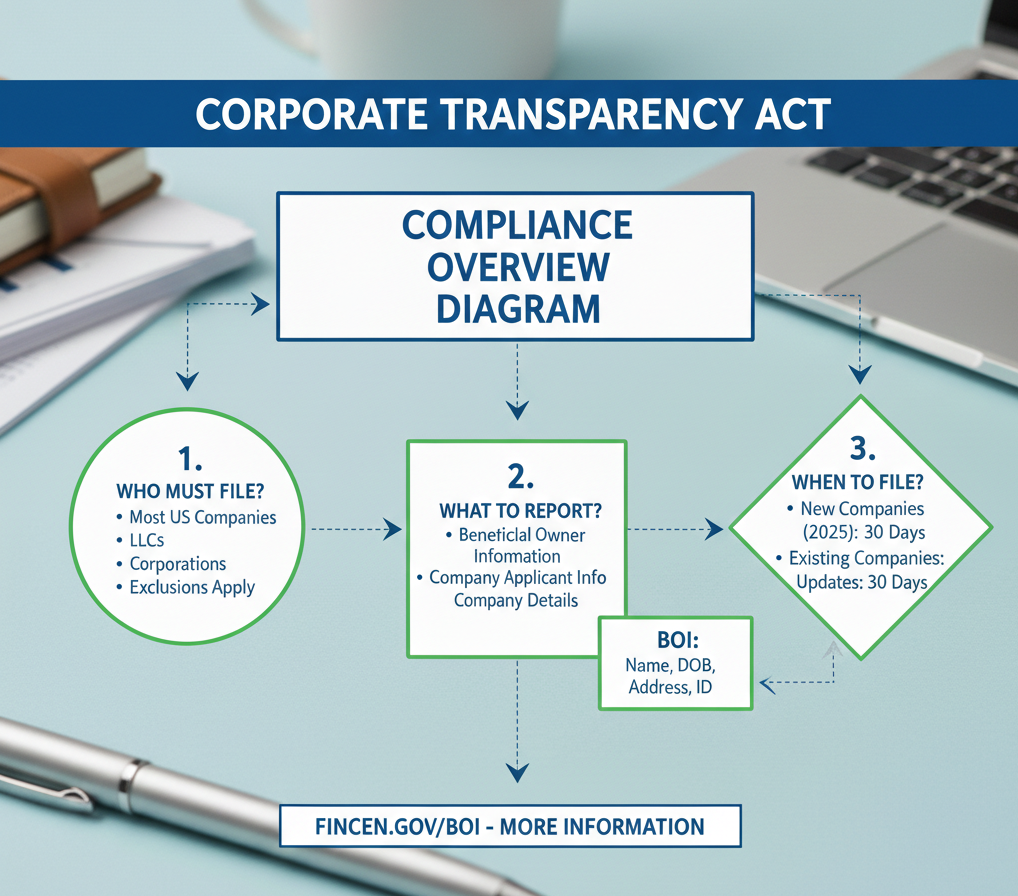

The Corporate Transparency Act (CTA) introduced by FinCEN requires certain US businesses to report beneficial ownership information (BOI -> information about who actually controls or benefits from the company) to prevent financial crime and improve transparency.

You can read official BOI reporting guidance from FinCEN here:

https://www.fincen.gov/boi

The most important rule is simple:

Company formation location matters, not the owner’s nationality or residence.

This is where many foreign entrepreneurs get caught in compliance mistakes.

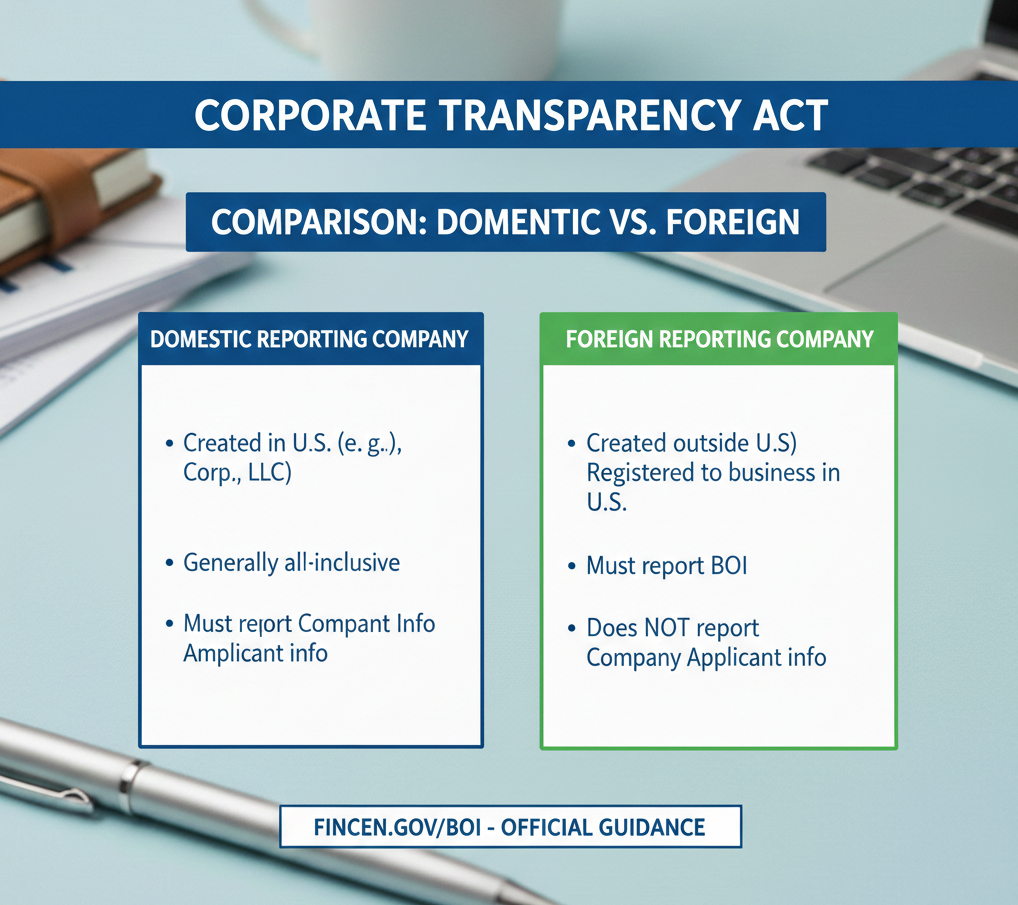

Domestic Reporting Company vs Foreign Reporting Company

Domestic Reporting Company

A domestic reporting company is a business formed by filing formation documents in a US state.

Examples:

- LLC formed in Delaware

- Corporation formed in Texas

- Wyoming registered business entity

Even if:

- 100% of owners are foreign

- Owners live outside the US

The company is still considered domestic because it was created under US state law.

Think of it this way:

The birthplace of the company determines domestic status, not the birthplace of the owner.

Foreign Reporting Company

A foreign reporting company is a business that was formed outside the United States but later registered to operate in a US state (called foreign qualification).

Example:

- A company incorporated in Pakistan registers to do business in Delaware

- The company is still legally Pakistani-formed, even though it operates in the US

This distinction is important for CTA compliance.

Domestic vs Foreign Reporting Company Examples Under CTA Compliance

Example 1 — Domestic Reporting Company

Ali is a Pakistani entrepreneur who forms a Wyoming LLC to run an online business serving US customers and receiving payments through Stripe while operating from Lahore.

In this case, the company is classified as a domestic reporting company because, under Corporate Transparency Act (CTA) rules, classification depends on where the company was legally formed, not the owner’s nationality or residence.

A domestic reporting company simply means the business was created by filing formation documents with a US state. Even if the company is:

- 100% foreign owned

- Operated remotely from outside the US

- Never physically managed inside the US

It still remains a domestic reporting company.

Example 2 — Foreign Reporting Company

Sara owns a company that was originally incorporated in Pakistan. Later, she registers this company in New York to legally operate in the US market.

In this case, the company is considered a foreign reporting company because its original formation happened outside the United States. Registration in a US state only allows business operations but does not change the company’s origin under CTA compliance rules.

This is where many international business owners get confused because they mix up US business registration with US company formation. Formation location determines reporting classification, not business activity location.

Why FinCEN Created This Classification

The Corporate Transparency Act was introduced to stop:

- Money laundering

- Anonymous shell company misuse

- Financial crime through hidden ownership

FinCEN (Financial Crimes Enforcement Network) requires BOI reporting for compliance monitoring.

Official CTA compliance guidance:

https://home.treasury.gov/policy-issues/financial-crimes/corporate-transparency-act

Myth Clarification: “If Owner Is Foreign, Company Is Foreign Reporting Company”

This is completely false.

Ownership location does NOT determine reporting classification.

The only thing that matters is:

- Where the company was legally formed

OR - Whether a foreign company was registered to operate in the US

Many foreign founders think:

“I am foreign → My company must be foreign reporting.”

This mistake can cause compliance violations.

Who Must File BOI Reports Under the CTA?

Under the Corporate Transparency Act (CTA), most small and medium-sized businesses must file Beneficial Ownership Information (BOI) reports with FinCEN unless they qualify for specific exemptions.

Generally, reporting companies include businesses formed by filing documents with a US state authority, such as:

- Limited Liability Companies (LLCs)

- Corporations

- Other similar legal business entities created under US state law

The purpose of BOI reporting is to identify who actually owns or controls the business (called beneficial owners, people who directly or indirectly control or profit from the company).

However, not every business must file.

Some businesses may qualify as exempt entities, especially:

- Large operating companies that meet employee, revenue, and physical presence requirements

- Certain regulated financial institutions

- Publicly traded companies and highly regulated entities

These exemptions mainly apply to businesses that already provide ownership transparency through other regulatory systems.

You can review official exemption rules and BOI filing guidance from FinCEN here:

https://www.fincen.gov/boi-faqs

If you are unsure whether your business qualifies for BOI reporting, especially as a foreign entrepreneur operating a US entity, compliance mistakes can be costly. This is where services like Scounts.pk help founders avoid filing errors and penalties.

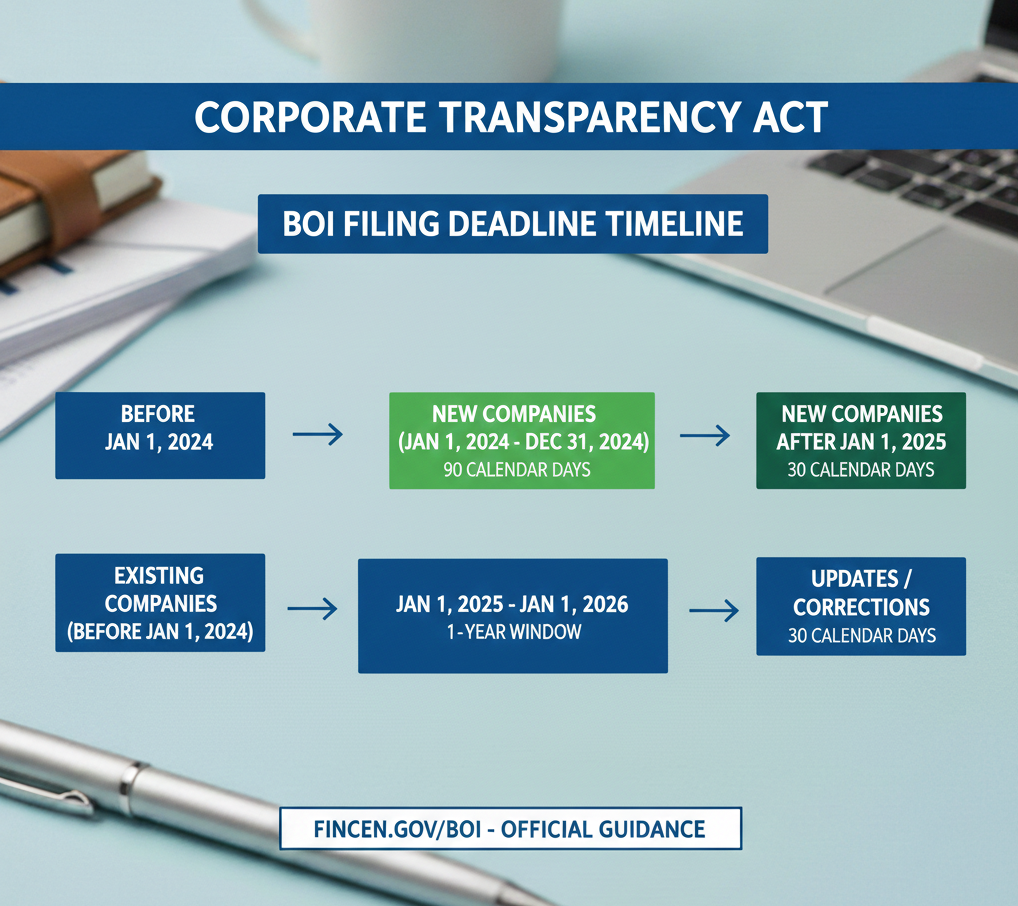

CTA Filing Timeline (Important Compliance Risk Area)

The Beneficial Ownership Information (BOI) reporting deadline under the Corporate Transparency Act depends on when the company was formed.

For companies formed before 2024, FinCEN provided specific transition deadlines, and businesses must follow the reporting schedule announced by FinCEN.

For newly formed companies, BOI reports must generally be filed within 30 days of company formation. This timeline is strict because CTA compliance focuses on real-time ownership transparency.

It is important to know that compliance rules may be updated by FinCEN over time, so businesses should regularly check official guidance.

Missing the filing deadline can result in penalties even if the business is:

- Newly registered

- Not generating revenue yet

- Not actively operating

BOI compliance is based on legal entity existence, not business activity.

You can check official CTA reporting guidance here:

https://www.fincen.gov/boi

What Happens If You Ignore BOI Reporting?

Ignoring BOI reporting obligations can create serious compliance risks.

Possible consequences include:

- Civil penalties (financial fines imposed by authorities)

- Criminal penalties in serious cases involving intentional non-compliance

- Banking and financial service complications in the US

Many foreign entrepreneurs are surprised to learn that penalties can apply even if the company:

- Has zero income

- Has no active business transactions

- Is temporarily dormant

CTA compliance is about transparency of ownership, not business profitability.

US financial institutions are also increasingly asking for BOI compliance verification during:

- Bank account opening

- Payment processor onboarding

- Investor due diligence processes

This is why ignoring BOI filing can indirectly create business operational problems.

How Domestic vs Foreign Classification Affects Foreign Founders

For foreign entrepreneurs, especially Pakistan-based founders, CTA classification is often misunderstood.

If you:

- Formed a company by registering with a US state → The company is usually classified as a domestic reporting company.

- Incorporated your business outside the US and later registered it to operate in the US → The company is typically a foreign reporting company.

Many founders confuse:

- US banking compliance requirements

with - CTA ownership reporting requirements

These are completely separate systems.

US banking rules focus on:

- Financial verification

- Anti-money laundering compliance

CTA rules focus on:

- Legal ownership transparency

- Identification of beneficial owners

Flowchart: How To Decide Your Reporting Status

You can quickly determine your reporting classification using this simple logic:

Company Formation Location

↓

Was the company legally formed in a US state?

↓

Yes → Domestic reporting company

No → Foreign reporting company (if registered to operate in US)

If you are unsure, it is better to verify before filing because incorrect classification can cause reporting errors.

Conclusion

Understanding Domestic vs Foreign Reporting Companies under the Corporate Transparency Act (CTA) is essential for businesses operating in the US. The most important rule to remember is that company formation location determines reporting classification, not the owner’s nationality or residence. CTA compliance focuses on ownership transparency, helping businesses maintain legal compliance, good standing, and smooth banking relationships.

If you are unsure about your BOI or CTA filing requirements, getting proper guidance early can help avoid penalties and compliance risks. At Scounts.pk, we help foreign and domestic founders manage US compliance filings safely and correctly.

If you need assistance with CTA compliance or US tax filing requirements, the team at Scounts.pk provides support for both domestic and foreign founders.

Frequently Asked Questions (FAQs)

No, a US LLC is usually considered a domestic reporting company because classification depends on where the company was legally formed, not who owns it.

Yes, BOI reporting is based on legal entity existence and ownership transparency, not business income or operational activity.

A beneficial owner is a person who owns a significant share of the company or has significant control over company decisions or operations. This helps FinCEN monitor real ownership structures.

New companies generally must file BOI reports within 30 days of formation, though reporting deadlines may change based on FinCEN updates.

Disclaimer: This article is authored by a writer at Scounts Private Limited. Please note that the fees mentioned are subject to change and may not be accurate at the time of reading. The content has not yet reviewed by any of our LLC taxation experts. For expert advice or services, feel free to contact us.