A Friendly Guide for Foreign-Owned LLCs

Introduction

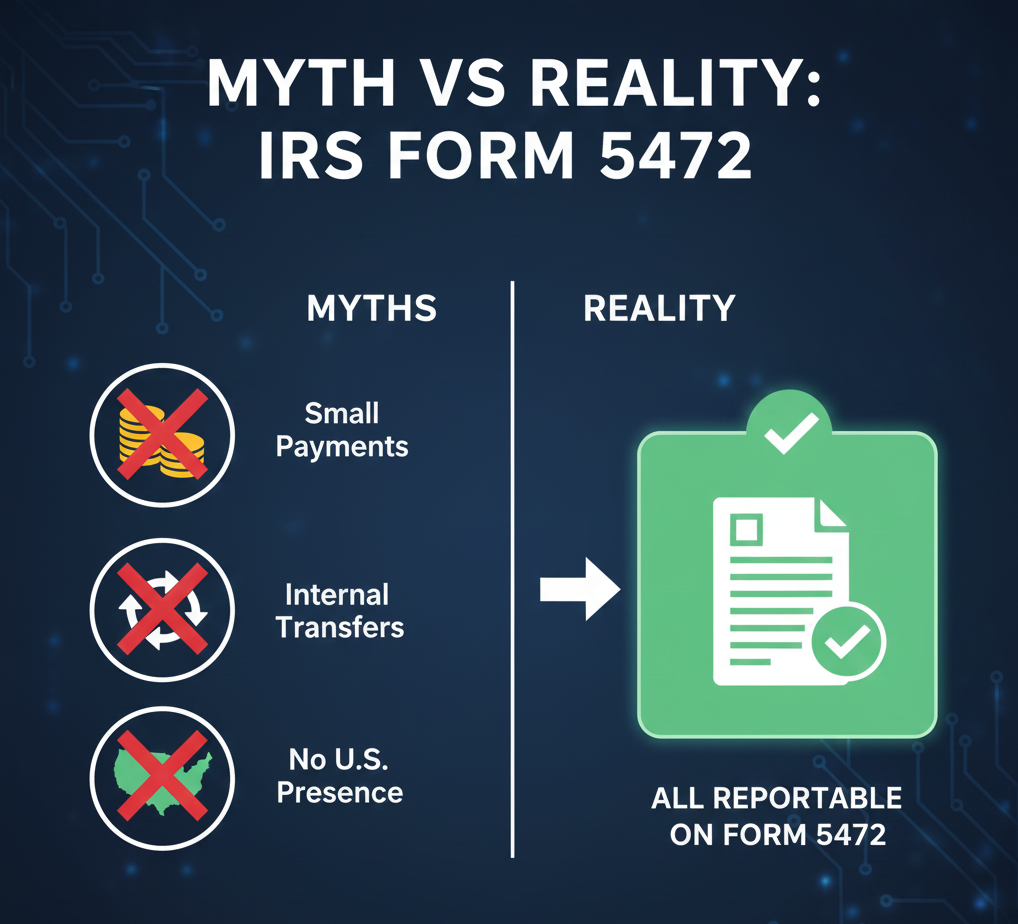

If you own a foreign-owned LLC in the U.S., you’ve probably heard about Reportable Transactions Form 5472. Many business owners are confused about what counts as a reportable transactions Form 5472. Some think, “Only big payments count,” or “I don’t have to report if the LLC isn’t physically in the U.S.”

In reality, it can affect everyday freelancers, small businesses, investors, and even individuals receiving or moving money. A reportable transaction is any financial activity that must be disclosed to a government authority.

The goal is transparency; governments want to track money flows, income, ownership, and major transfers. Reporting does not imply wrongdoing; it is simply a legal requirement.

This guide clears up the Reportable Transactions Form 5472 myths, explains the IRS rules in simple terms, and gives practical examples so you can file confidently the Reportable Transactions Form 5472.

What Is a Reportable Transaction?

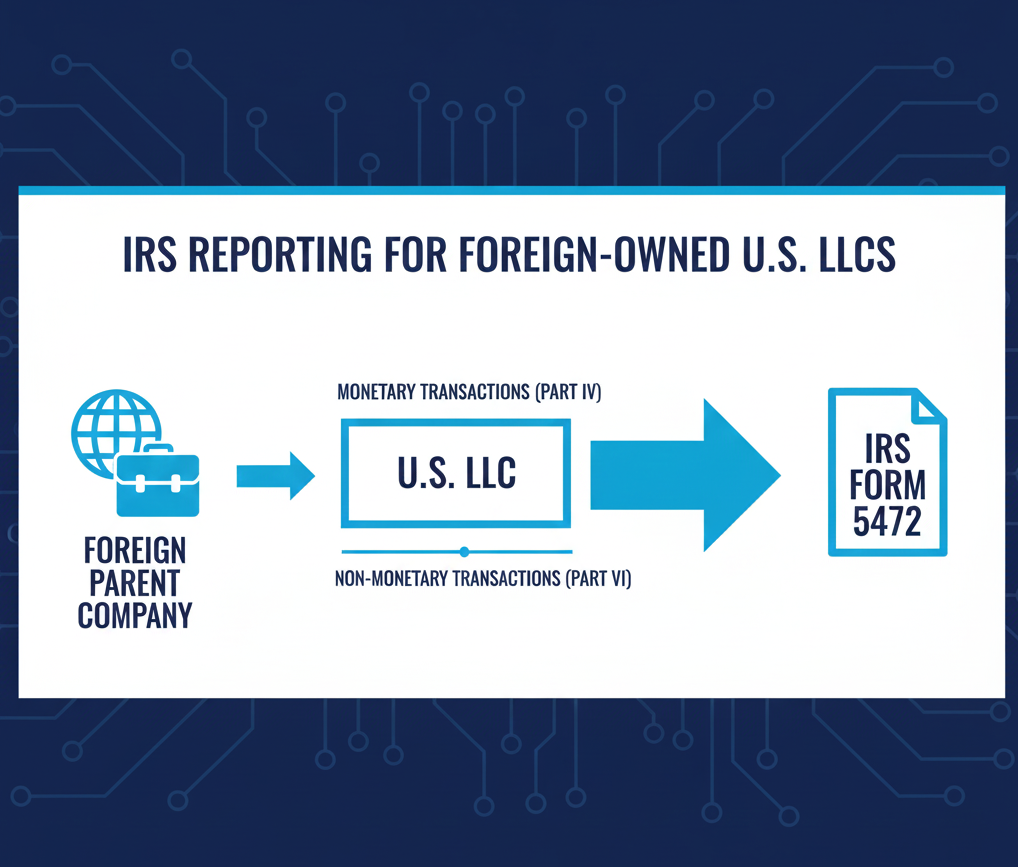

A reportable transaction is any interaction between your U.S. LLC and its foreign-related parties (parent companies, shareholders, or affiliates) that must be disclosed to the IRS.

Reportable transactions can be monetary (involving money) or non-monetary (involving property or other value transfers).

Examples include:

- Payments for goods or services to a foreign parent

- Reimbursements for expenses

- Capital contributions from a foreign shareholder

- Loans from foreign owners

- Transfers of assets

Key point: Even small amounts, like a $100 reimbursement to a foreign parent, are reportable.

Who Requires Transactions to Be Reported?

Various authorities require reportable transactions Form 5472 to be disclosed, each with a specific focus. Tax agencies, financial crime units, corporate registries, and securities regulators may all demand reporting in certain situations.

For example, the IRS monitors income and tax-related transactions for foreign-owned LLCs, while banks track large cash movements to prevent money laundering. Corporate registries like FinCEN require disclosure of beneficial ownership information (BOI), which includes details of the individuals who own or control a company. Even small businesses or startups with intercompany transactions must ensure compliance.

Common Myths About Reportable Transactions Form 5472

Many foreign-owned LLC owners misunderstand the rules. Here are the most common myths:

- Myth 1: “Only huge payments count.”

Reality: Any transaction, large or small, is reportable. Even minor reimbursements or internal transfers must be reported. - Myth 2: “My LLC doesn’t have a U.S. office, so nothing needs reporting.”

Reality: Physical presence in the U.S. is irrelevant. Reporting depends on ownership and transactions with foreign-related parties. - Myth 3: “Internal contributions or capital injections aren’t reportable.”

Reality: Any contribution of cash, property, or other assets from a foreign owner must be disclosed in Part VI.

Part IV and Part VI: IRS Breakdown

Form 5472 is divided into two key sections:

Part IV – Monetary Transactions

Part IV covers any transaction involving money, such as:

- Payments for goods or inventory

- Service fees to foreign parent or affiliate

- Rent or lease payments

- Royalties

- Reimbursements

Example: Your U.S. LLC pays $2,000 to a German parent company for consulting services. This is reportable under Part IV, even though it is a small payment relative to revenue.

Part IV also includes loans, interest payments, and reimbursements for business expenses, even if the amounts are minor. Essentially, any financial exchange between the U.S. LLC and a foreign-related party falls under this section. Reporting ensures the IRS can track income, expenses, and financial flows accurately.

Part VI – Non-Monetary Transactions

Part VI covers transactions without cash but with value transfer, including:

- Capital contributions (cash or property from foreign owners)

- Transfer of property or equipment

- Ownership or stock transfers

Example: Your foreign parent contributes a software license valued at $5,000. This must be reported in Part VI.

Non-monetary transactions can include contributions of intellectual property, inventory, or other assets. Even if no cash changes hands, these transfers affect the LLC’s value and ownership structure, making disclosure mandatory.

Our experts at scounts can assist with monetary and non-monetary transactions, Schedule M, and any tricky reporting requirements.

Comparison Table Part IV (Monetary Transactions) and Part VI (Non-Monetary Transactions) for IRS Form 5472

| Category | Part IV – Monetary Transactions | Part VI – Non-Monetary Transactions |

|---|

| Definition | Transactions involving money or cash equivalents. | Transactions not involving cash but transferring value or ownership. |

| Examples | – Payments for goods or inventory – Service fees to foreign parent or affiliate – Rent or lease payments – Royalties – Reimbursements – Loans and interest payments | – Capital contributions (cash or property from foreign owners) – Transfer of property or equipment – Ownership or stock transfers – Intellectual property contributions – Non-cash asset transfers |

| Key Points | – Even small payments are reportable – Includes reimbursements for expenses paid on behalf of a foreign party | – No money changes hands, but value is transferred – Affects ownership and LLC equity, so IRS disclosure is mandatory |

| Example | Your U.S. LLC pays $2,000 to a German parent company for consulting. | Your foreign parent contributes a software license valued at $5,000. |

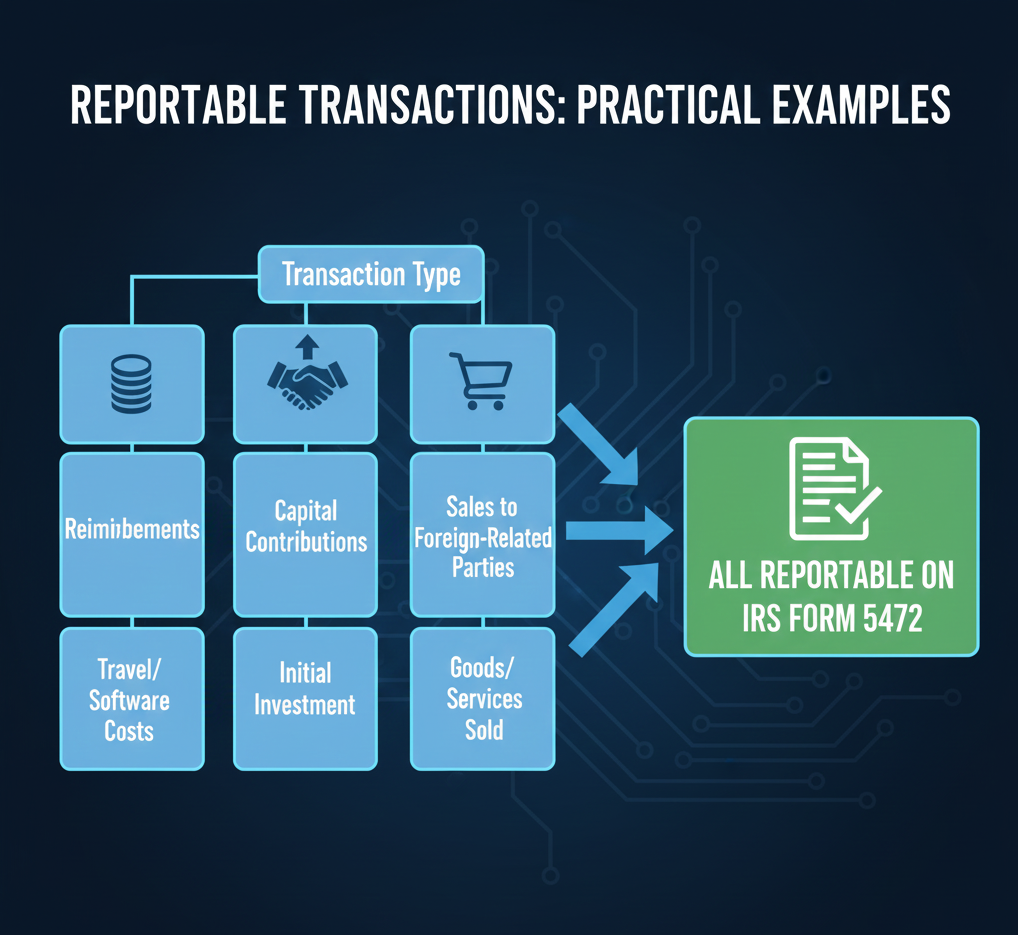

Practical Examples of Reportable Transactions Form 5472

Reimbursement to foreign parent for office expenses:

Even if you only repay $500 for office software or travel expenses, it’s still a reportable monetary transaction under Part IV. This includes reimbursements for any business-related costs initially paid by the foreign parent on behalf of the U.S. LLC. The IRS wants to see all financial flows between the LLC and its foreign owners, no matter the amount, to ensure proper tracking of income and expenses.

Capital contribution from foreign shareholder:

Any cash, property, or other asset added to the LLC’s capital by a foreign owner must be reported in Part VI. This includes contributions like office equipment, intellectual property, or even software. Even if the contribution seems minor, it changes the LLC’s ownership or value, which the IRS tracks for compliance purposes.

Intercompany Loan:

Loans from a foreign parent to your U.S. LLC, whether large or small, are considered monetary reportable transactions. Interest payments on these loans also need to be disclosed. For example, if your LLC borrows $2,000 from a foreign shareholder to cover operational costs, this transaction must appear in Part IV.

Sale of inventory to foreign related party:

Any sale or purchase of goods, inventory, or services between the U.S. LLC and a foreign-related party is reportable. The size of the transaction does not matter. This ensures the IRS can monitor transfer pricing and related-party dealings, which are common compliance risks.

Hypothetical scenario:

Ali owns a German parent company and a U.S. LLC. His LLC reimburses the parent $1,000 for travel costs related to a business meeting. Even though this is a relatively small amount, it must be reported on Form 5472 Part IV because it is a monetary transaction with a foreign-related party. Similarly, if Ali’s parent contributed a piece of software valued at $5,000, that would be a non-monetary transaction reportable in Part VI.

Filing Tips for Form 5472

To avoid penalties, follow these best practices:

- Maintain organized records for all transactions with foreign owners.

- Identify monetary vs non-monetary transactions.

- Use Schedule M to summarize transactions; annotate details if necessary.

- Cross-check with IRS instructions.

- File on time to avoid $25,000 penalties per violation.

Step-by-Step Checklist:

- List all foreign-related parties.

- Track monetary transactions: sales, reimbursements, services, rent.

- Track non-monetary transactions: capital contributions, asset transfers.

- Complete Schedule M with annotations.

- Review IRS instructions and cross-check entries.

- Submit Reportable Transactions Form 5472 with your LLC’s tax return.

Need help filing Form 5472 or reporting your foreign-related transactions?

Scounts is here to guide you through every step, making sure your LLC stays fully compliant with IRS rules.

Final Thoughts

Reportable Transactions Form 5472 is straightforward once you understand the key rule: any transaction with a foreign-related party may be reportable. Even small or internal transactions count.

Stay compliant by:

- Keeping organized records

- Understanding Part IV and Part VI

- Completing Schedule M accurately

When in doubt, always disclose. Proactive reporting is safer than assuming a transaction is insignificant.

Frequently Asked Questions (FAQs)

A: Yes, any loan from a foreign-related party is reportable.

A: Yes, any foreign-related ownership triggers reporting obligations.

A: Yes. Any repayment of expenses to foreign-related parties is reportable.

A: No. Foreign-owned LLCs must file regardless of U.S. physical presence.

A: $25,000 per violation, and repeated violations can increase penalties.

A: Yes. Part VI requires reporting any property, software, or asset contributions from foreign-related parties.

Disclaimer: This article is authored by a writer at Scounts Private Limited. Please note that the fees mentioned are subject to change and may not be accurate at the time of reading. The content has not yet reviewed by any of our LLC taxation experts. For expert advice or services, feel free to contact us.

Sources & References:

- IRS Form 5472 Instructions 2023

- IRS Schedule M Guidance

- KPMG Guide on Form 5472

- PwC US Tax Guide for Foreign-Owned LLCs

- IRS Tax Code references for reporting foreign transactions and penalties