If you’re a non-resident founder running a US LLC (Wyoming/Delaware, etc.) or you own US operations through a foreign corporation, you will eventually hear this line:

“I owe $0, so I don’t need to file anything.”

That’s where people get trapped.

A protective Form 1120-F is a defensive filing. You file it when you believe the US cannot tax you (often due to a tax treaty or because you think you have no effectively connected income (ECI)), but you want to lock in your rights if the IRS later disagrees. The IRS instructions explicitly allow protective filing and explain exactly how to do it, including the “Protective return” box and what you must complete.

This guide shows you:

- when a protective 1120-F makes sense,

- how to file it step-by-step,

- when to attach Form 8833 for treaty disclosure,

- what to do if you don’t have an EIN yet (“Applied For”),

- and which deadlines matter.

Who This Article Is For (and Why Protective 1120-F Exists)

This article is for you if you are not a US resident and you have either:

- A US LLC (often a Wyoming/Delaware single-member LLC) used to invoice US clients, or

- A foreign corporation that earns US-related income (directly or through a disregarded US LLC),

…and you rely on a position like:

- “I have no US trade or business,” or

- “A tax treaty means the US can’t tax my business profits because I don’t have a permanent establishment.”

A protective 1120-F exists because the IRS recognizes a real-world problem:

You can think you have no ECI today, then later the IRS decides your activity looked like a US trade or business. The 1120-F instructions explain that a foreign corporation may file a protective return and specify what to complete—Page 1 identification, the protective checkbox, key Page 2 items, and what to do if claiming treaty exemption (attach Form 8833). IRS

In short: you file protectively to avoid getting cornered later.

If you’re still operating under the “US LLC = zero tax” belief, read this next because it connects directly to why protective filing exists: Do Foreign-Owned US LLCs Really Pay Zero Tax?

Protective 1120-F in One Minute (What it is + what it protects)

A protective Form 1120-F is a defensive filing for a foreign corporation (including cases where a US LLC is disregarded and owned by a foreign corporation) when you believe:

- you have no effectively connected income (ECI), or

- a tax treaty eliminates US tax (often because you have no permanent establishment),

…but you still file to protect your rights if the IRS later challenges your conclusion.

The IRS instructions describe this exact use case and tell you to file a protective return by checking the “Protective return” box and completing specific required items. (Internal Revenue Service)

What a protective 1120-F protects

It mainly protects two things:

- Your ability to claim deductions/credits later

If the IRS later decides you actually had ECI, deductions and credits can become a fight; especially if you didn’t file properly and on time. The IRS’s guidance on delinquent/late 1120-F and deductions emphasizes the “timely filed” concept and the 18-month window rule tied to the allowance of deductions/credits. (Internal Revenue Service) - Your treaty position trail

If your protective return is filed due to a treaty exemption, the IRS instructions say to attach Form 8833. (Internal Revenue Service)

Costly Assumptions That Get Non-Residents in Trouble (This replaces the “myths” section)

These aren’t “myths.” These are the exact assumptions that turn into expensive cleanup later.

Assumption #1: “If my tax is $0, I don’t need to file.”

This is where most non-residents go wrong.

A protective 1120-F exists because the IRS knows people can honestly believe they have no ECI—and later the IRS may disagree. The instructions explicitly discuss filing protectively in that situation. (Internal Revenue Service)

Assumption #2: “A treaty exemption means no paperwork.”

Treaties can reduce or eliminate US tax only if you claim the position correctly.

On Form 1120-F itself, the treaty question notes that if you’re taking a treaty position that reduces tax, you’re generally required to complete and attach Form 8833 (with exceptions). (Internal Revenue Service)

Also, the 1120-F instructions are direct: if the protective return is filed pursuant to a treaty exemption, attach Form 8833. (Internal Revenue Service)

Assumption #3: “The IRS won’t accept my return because I don’t have an EIN.”

Not true.

The IRS guidance is clear: if you don’t have an EIN by the time a return is due, write “Applied For” and the date you applied in the EIN field. (Internal Revenue Service)

But there’s a practical catch: if you’re filing electronically, an EIN is generally required at the time the return is filed. (Internal Revenue Service)

Plain-English takeaway:

If your EIN is delayed, you may need to file a paper file to meet deadlines and preserve your position.

Assumption #4: “My LLC is disregarded, so none of this applies.”

This is where people mix entity types.

- Form 1120-F is for foreign corporations.

- Many non-resident founders run a US LLC and assume it’s all the same. It’s not.

If your US LLC is disregarded and the owner is a foreign corporation, the foreign corporation sits in the 1120-F world—especially when US-touch activities create uncertainty.

If you have a US LLC and you’re not sure what IRS forms apply (especially penalty-trigger forms), read: Avoiding IRS Form 5472 Penalties in 2026

Real-World Scenario: Pakistan-Based Founder + Wyoming LLC (Why “Protective” Matters)

Let’s make this real.

You’re a Pakistan-based founder. You form a Wyoming single-member LLC to bill US clients. You deliver the work remotely from Pakistan. You assume:

- “I’m not in the US.”

- “My income isn’t US-taxable.”

- “So I don’t need US income tax filings.”

Now add one detail that happens all the time:

- You travel to the US for client meetings, even for a short period, or

- You hire a US-based sales rep/agent, or

- You start doing part of the service delivery in the US (onsite setup, workshops, training).

Suddenly, your “100% foreign” story becomes a gray zone.

This is exactly where a protective 1120-F becomes useful: you file it to preserve your position if the IRS later argues your activity looked like a US trade or business, or that some income should be treated as effectively connected.

The point isn’t panic. The point is control.

A protective return is how you avoid getting cornered later with “you should’ve filed earlier” problems.

Many founders confuse “income tax exposure” with “sales tax exposure,” and then miss both. If you sell to US customers, read this next because it answers the most common follow-up question: How to Check Sales Tax Nexus: Step-by-Step for Foreign Sellers

(Protective 1120-F is federal income tax logic. Sales tax is state-level nexus logic. Different systems.)

Step-by-Step: How to File a Protective Form 1120-F

Step 1: Confirm you’re the right filer (foreign corporation vs individual)

Form 1120-F is the U.S. income tax return of a foreign corporation. (Internal Revenue Service)

So protective 1120-F applies when the taxpayer is a foreign corporation (including cases where a US LLC is disregarded but the owner is a foreign corporation).

Step 2: Use the correct Form 1120-F for the year you’re filing

The official IRS form changes by tax year (questions, line references, and disclosures can move). Use the IRS-published form for the correct year. (Internal Revenue Service)

Step 3: Page 1 — complete your details and clearly mark it as a protective return

The IRS Instructions for Form 1120-F explain protective returns and emphasize that Form 1120-F must be filed timely, true, and accurate to preserve deductions/credits against ECI. (Internal Revenue Service)

This is the filing concept you’re using: “file now to preserve rights if the IRS later disputes your ‘no ECI’ conclusion.” (Internal Revenue Service)

Step 4: If you don’t have an EIN yet, handle it the IRS-approved way (“Applied For”)

If you don’t have an EIN by the time a return is due, IRS EIN instructions say to write “Applied For” and the date you applied in the EIN space. (Internal Revenue Service)

Practical warning: if you plan to e-file, many systems require an EIN at the time of filing. (So if the EIN is delayed, paper filing is often the realistic path to meet the deadline.) (Internal Revenue Service)

Step 5: Don’t submit a “blank” protective return — complete the required info sections

A protective filing still needs to be properly completed (identity + required disclosures). The IRS instructions stress “true and accurate” filing as part of preserving deductions/credits. (Internal Revenue Service)

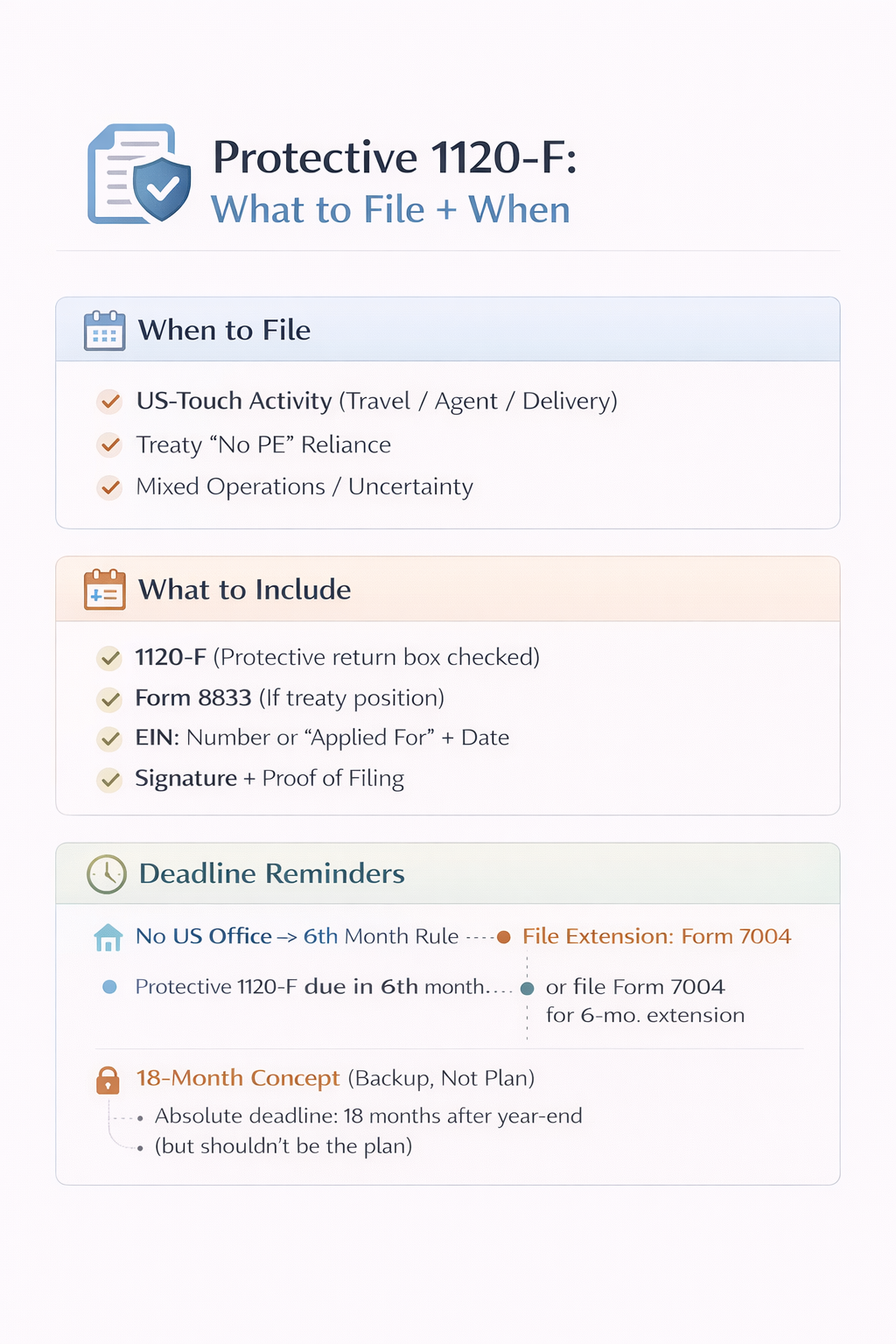

Step 6: Treaty-based protective return? Attach Form 8833 when required

The Form 1120-F itself asks whether the corporation is taking a treaty position that overrules/modifies U.S. tax law and reduces tax, and it states the corporation is generally required to attach Form 8833 (with exceptions). (Internal Revenue Service)

The IRS Form 8833 page also confirms Form 8833 is used to make the treaty-based return position disclosure required by law. (Internal Revenue Service)

Step 7: File on time (or as close as possible) — the 18-month concept matters

The IRS 1120-F instructions explain that to preserve deductions/credits against ECI, Form 1120-F must be filed timely, and it is generally treated as timely for that purpose if filed no later than 18 months after the due date (with limited waivers in some cases). (Internal Revenue Service)

Plain English: don’t “wait and see.” Protective returns are valuable specifically because they create a clean, early filing record. (Internal Revenue Service)

Deadlines That Matter (and Why Waiting Can Hurt You)

A protective 1120-F only helps you if you file it on time (or close to on time).

If you delay too long, you can lose the main benefit:

✅ the ability to preserve deductions/credits, and

✅ the ability to defend your “no ECI / treaty exemption” position cleanly.

The IRS puts real weight on timely filing when it comes to foreign corporations claiming deductions and credits against effectively connected income (ECI). (Internal Revenue Service)

1) The main due date rule (foreign corporations)

The IRS instructions explain this clearly:

✅ If a foreign corporation does NOT maintain an office or place of business in the US, it generally must file Form 1120-F by the 15th day of the 6th month after the end of its tax year.

Example (calendar-year):

Tax year ends Dec 31 → due date is typically June 15.

If the due date falls on a weekend or legal holiday, it moves to the next business day. (Internal Revenue Service)

2) Can you extend the deadline? Yes — use Form 7004

If you need more time, you can request an automatic extension using Form 7004. (Internal Revenue Service)

The IRS confirms Form 7004 gives an automatic extension, and the maximum extension period is generally 6 months. (Internal Revenue Service)

Important: an extension gives more time to file, not unlimited time to “figure it out.”

3) The 18-month rule (this is the part no one tells foreigners)

Here’s the real nuance.

The IRS and Treasury rules treat a Form 1120-F as “timely” for deductions/credits purposes if it is filed within an 18-month window after the original due date (with extra conditions in some cases). (Internal Revenue Service)

The IRS has also published a formal guidance sheet explaining this “Allowance of Deductions and Credits” rule and referencing the underlying regulation. (Internal Revenue Service)

Plain English:

Even if you owe $0, a protective 1120-F is about protecting your ability to claim deductions/credits later if the IRS changes its mind about your situation.

So filing late can destroy the point of filing at all.

4) What happens if you do NOT file?

If you skip filing completely and the IRS later decides you had ECI, you can run into these outcomes:

- You lose leverage to claim deductions and credits properly, because timely filing rules become a fight. (Internal Revenue Service)

- Your treaty position becomes harder to defend cleanly because you didn’t establish a filing trail early (especially if treaty disclosure via Form 8833 was relevant). (Internal Revenue Service)

- You end up paying professionals later to do damage control filings, instead of doing it correctly the first time.

Quick deadline takeaway (save this)

- If you’re a foreign corporation with no US office, Form 1120-F is generally due by the 15th day of the 6th month after year-end. (Internal Revenue Service)

- Form 7004 gives an automatic extension (generally 6 months). (Internal Revenue Service)

- If you want protective benefits, don’t “wait and see.” The 18-month window exists, but you should treat it as a backup—not your plan. (Internal Revenue Service)

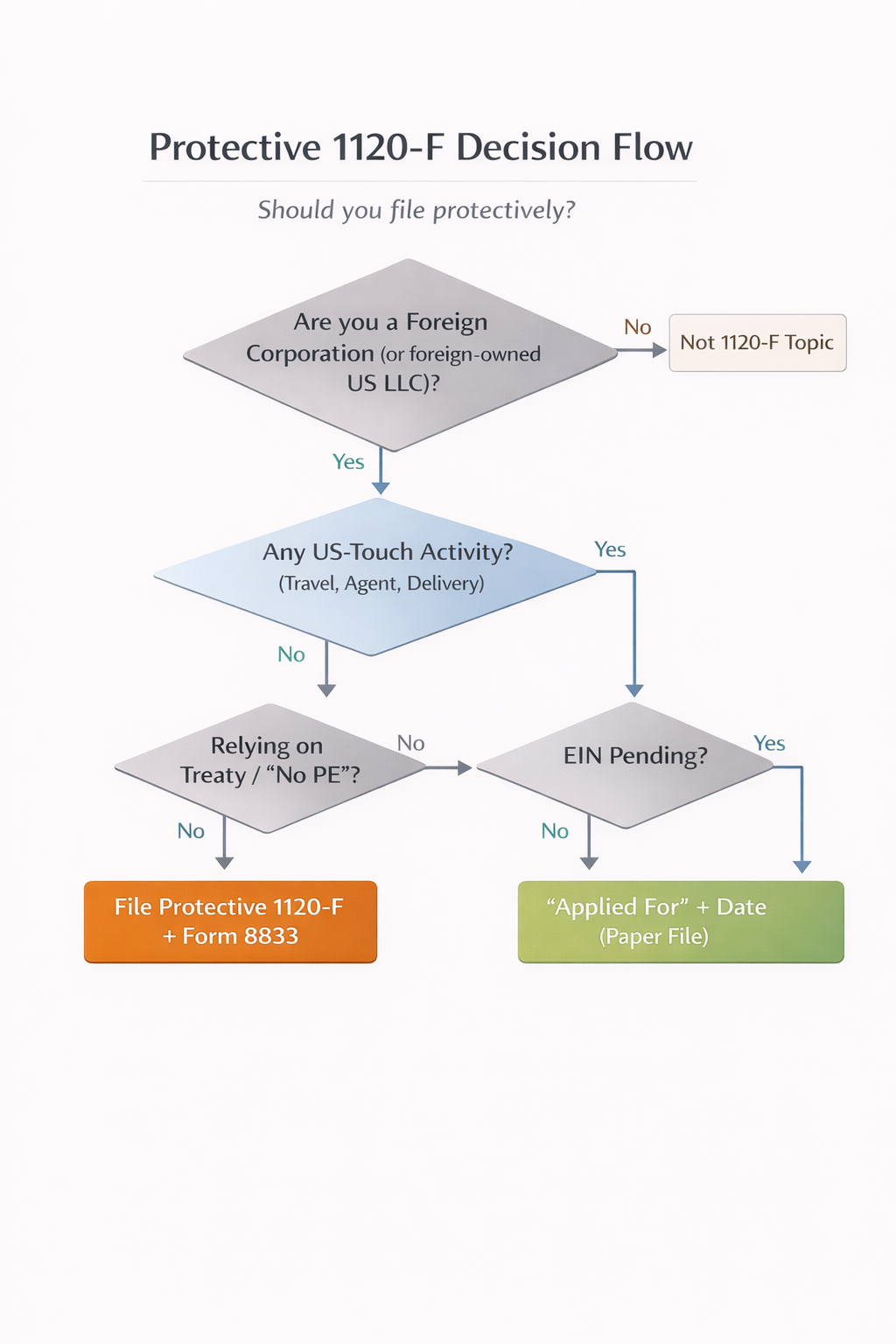

Quick Decision Table: Should You File Protective 1120-F?

| Situation | Risk level | File protective? | Notes (Form 8833? EIN issue?) |

| Remote services only (no US travel, no US agent) | Low → Medium | Maybe | If you rely on a treaty position that reduces US tax, Form 1120-F points you to attach Form 8833 (exceptions exist). (Internal Revenue Service) |

| Remote services + US travel (meetings, onsite delivery, workshops) | Medium | Yes (recommended) | Travel can shift facts. A protective return exists for “we believe no ECI, but there’s uncertainty.” The IRS instructions cover protective returns and what to complete. (Internal Revenue Service) |

| US dependent agent (sales rep/negotiator who acts for you in the US) | High | Yes (strongly) | This is the classic “IRS may argue US trade/business” risk. Protective filing preserves your position if IRS later disagrees. (Internal Revenue Service) |

| Treaty “no PE” reliance (you believe treaty blocks US tax) | Medium → High | Yes (recommended) | If protective filing is due to treaty exemption, IRS instructions say attach Form 8833. (Internal Revenue Service) |

| Mixed operations / uncertain attribution (US contractors, US sales activity, unclear sourcing) | High | Yes (strongly) | This is exactly the “file now to lock rights” use case described in IRS protective-return instructions. (Internal Revenue Service) |

EIN note (applies to every row): If your return is due and you’re still waiting for an EIN, IRS guidance says you can write “Applied For” and the date you applied in the EIN space. (Internal Revenue Service)

Final thoughts

A protective Form 1120-F is not about paying tax. It’s about protecting your position when your US exposure sits in a gray zone. If the IRS later disagrees with your “no ECI” or “treaty exemption” conclusion, a clean protective filing helps you avoid getting boxed in with fewer options.

Treat this like a safety move:

- File early when facts are uncertain

- Attach Form 8833 when you rely on a treaty position

- Don’t delay just because you’re waiting for an EIN

FAQs

1) Do I need protective 1120-F if my LLC made $0?

If you are a foreign corporation, a protective 1120-F can still matter even when tax is $0—because the purpose is preserving rights if IRS later argues you had ECI or a US trade/business. The IRS instructions explicitly describe filing a protective return in “no ECI” situations with uncertainty. (Internal Revenue Service)

2) I’m in Pakistan but have US clients—does that create ECI?

Not automatically. “US clients” alone doesn’t guarantee ECI. The risk appears when facts move toward US trade/business—US travel, dependent agents, US-based negotiation/delivery, etc. Protective filing exists for exactly this “we believe no ECI, but IRS could disagree later” situation. (Internal Revenue Service)

3) What is ECI in simple terms?

ECI (effectively connected income) is business income the IRS treats as connected to conducting a US trade or business. If IRS decides income is ECI, it can pull you into a full 1120-F reporting/deductions framework. (Internal Revenue Service)

4) When do I attach Form 8833?

Attach Form 8833 when you’re taking a treaty-based return position that reduces US tax (with exceptions). Form 1120-F explicitly says that if you answer “Yes” to the treaty position question, you are generally required to attach Form 8833. (Internal Revenue Service)

Also, the 1120-F instructions say: if your protective return is filed due to a treaty exemption, attach Form 8833. (Internal Revenue Service)

5) Can I file without an EIN?

If your return is due and you haven’t received your EIN, IRS guidance says you can write “Applied For” and the date you applied in the EIN field. (Internal Revenue Service)

6) Is protective filing the same as reporting taxable income?

No. A protective return is usually filed when you believe you have no ECI or are treaty-exempt, but you want to preserve rights if your conclusion is later challenged. (Internal Revenue Service)

7) What if I start hiring US people later?

That can change your facts fast (more US-touch activities, possible agency issues, operational footprint). If you already filed protectively, you have a cleaner record that you treated your situation seriously and preserved rights from earlier years. (Internal Revenue Service)

8) What if IRS later says I had ECI—what changes?

Two big things:

- You may need to report ECI under 1120-F rules (and deductions/credits become a major issue).

- Timely filing matters because the IRS ties deductions/credits to a timely, true, accurate return framework. (Internal Revenue Service)

9) Is this for foreign individuals too or only foreign corporations?

Form 1120-F is for foreign corporations. The IRS Form 1120-F page states a foreign corporation files it to report income, deductions, credits, and calculate US income tax liability. (Internal Revenue Service)

10) What’s the difference between 1120-F and Form 5472 responsibilities?

- 1120-F (protective or regular) deals with foreign corporation US income tax exposure (ECI/treaty). (Internal Revenue Service)

- Form 5472 is a separate compliance area that can create major penalties when missed (commonly tied to foreign-owned US entities and reportable transactions).

Need help with a Protective 1120-F or treaty filing decision?

Scounts.pk helps you register your company, manage taxes, and handle compliance in Pakistan and the USA—so you don’t rely on guesses or outdated forum advice.

Need help? Chat with us on WhatsApp or visit our Contact Us page.

Sources:

https://www.irs.gov/pub/fatca/allowance-deductions-credits-1120f.pdf

https://www.irs.gov/forms-pubs/about-form-7004

https://www.irs.gov/forms-pubs/about-form-8833

https://www.irs.gov/instructions/iss4

https://www.irs.gov/forms-pubs/about-form-1120-f

https://www.irs.gov/pub/irs-pdf/f1120f.pdf

Disclaimer: This article is authored by a writer at Scounts Private Limited. Please note that the fees mentioned are subject to change and may not be accurate at the time of reading. The content has not yet reviewed by any of our LLC taxation experts. For expert advice or services, feel free to contact us.