Introduction

If you own a foreign-owned U.S. company, BOI Filing Deadlines, Penalties, and Exemptions in 2025 directly affect your business. These rules are no longer optional guidance. They are legal requirements under the Corporate Transparency Act (CTA) (a U.S. law that requires companies to disclose real owners).

Many foreign founders still believe BOI rules are only for large companies or that small overseas businesses will be ignored. That belief is risky. In this article, we explain BOI Filing Deadlines, Penalties, and Exemptions in 2025 using clear language, real timelines, and practical examples, so foreign-owned U.S. companies can comply with confidence.

What Is BOI Reporting Under the Corporate Transparency Act?

BOI stands for Beneficial Ownership Information (details about the real people who own or control a company). The report is filed with FinCEN (the U.S. government office that fights financial crimes).

The Corporate Transparency Act requires many U.S. and foreign-owned companies to tell FinCEN:

- Who owns the company

- Who controls it

- How those people can be identified

This rule exists to reduce money laundering, fraud, and hidden ownership structures.

FinCEN provides official explanations and ongoing updates through its Frequently Asked Questions section on BOI reporting, which foreign owners should rely on instead of informal advice.

Why BOI Filing Matters for Foreign-Owned U.S. Companies

Foreign-owned companies receive extra attention because they often:

- Operate remotely

- Use registered agents

- Have no physical U.S. presence

- Assume small size equals low risk

BOI rules do not work that way.

If your company is registered in any U.S. state, BOI filing usually applies. BOI Filing Deadlines, Penalties, and Exemptions in 2025 are based on registration status, not nationality or company size.

Who Must File a BOI Report?

You must file if your company is considered a reporting company (a company required to submit ownership information).

This includes:

- U.S. LLCs and corporations

- Foreign companies registered to do business in a U.S. state

- Single-member LLCs

- E-commerce and Amazon FBA businesses

- SaaS and consulting companies

- Holding companies with no active operations

If your company exists because you filed documents with a Secretary of State, BOI likely applies.

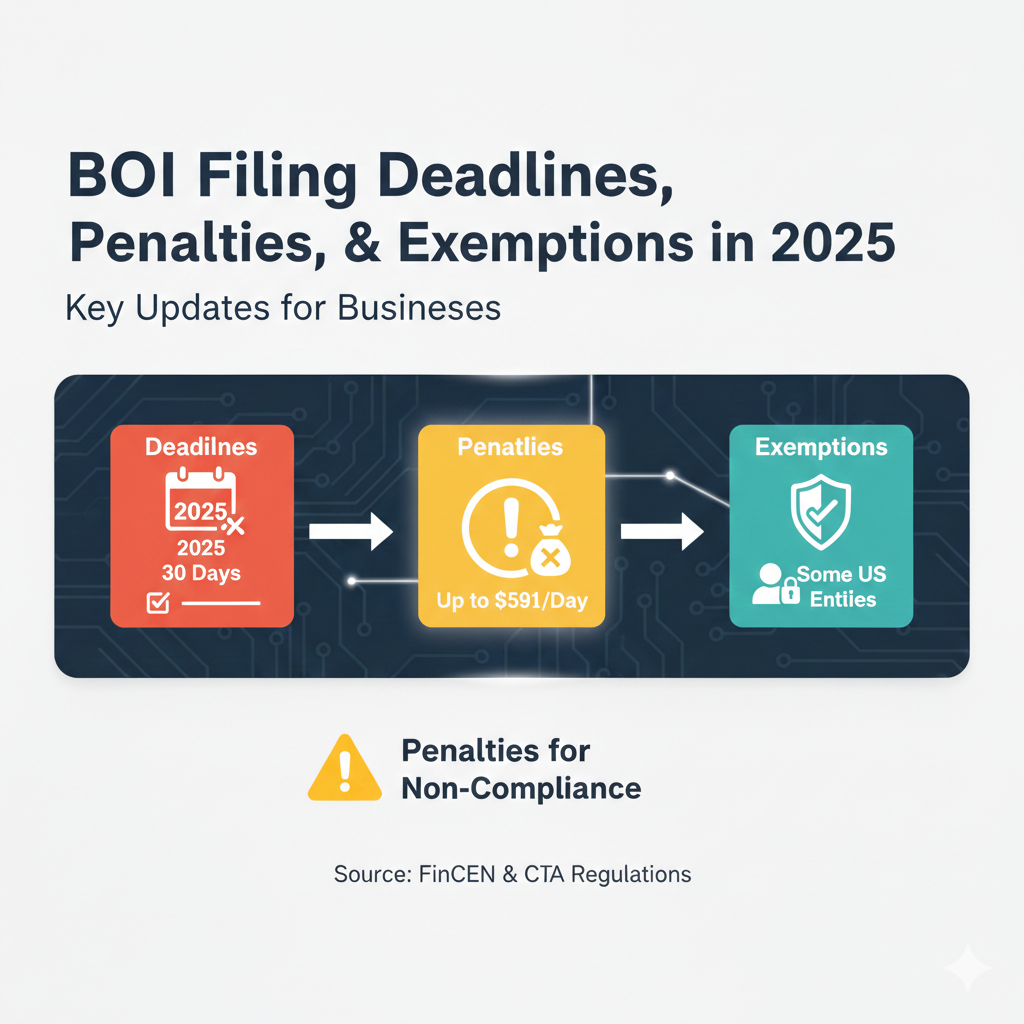

BOI Filing Deadlines, Penalties, and Exemptions in 2025: Filing Timeline Explained

This section causes the most confusion.

Many foreign founders believe:

“BOI reports were due January 1, 2025, so I already missed it.”

That statement is not fully correct.

BOI Filing Deadlines Table

| Company Type | Formation or Registration Date | BOI Filing Deadline |

|---|---|---|

| U.S. company | Formed before Jan 1, 2024 | January 1, 2025 |

| U.S. company | Formed during 2024 | 90 days from formation |

| U.S. company | Formed in 2025 or later | 30 days from formation |

| Foreign company | Registered in U.S. before 2024 | April 25, 2025 |

| Foreign company | Registered in 2024 or later | 30 days from registration |

Foreign-owned companies were given extra time, which is why April 25, 2025 is a critical date for many non-U.S. founders.

What Information Is Required in a BOI Report?

A BOI report is short but very specific.

You must provide information about:

- The company

- Each beneficial owner (a real person who owns or controls the company)

- Each company applicant (the person who filed formation documents, for newer companies)

A beneficial owner is anyone who:

- Owns 25% or more, or

- Exercises substantial control (power to make major decisions)

For each person, FinCEN requires:

- Full legal name

- Date of birth

- Address

- Passport or government ID number

- Image of the ID

FinCEN outlines these requirements clearly in its official Beneficial Ownership Information Reporting Rule Fact Sheet.

BOI Filing Deadlines, Penalties, and Exemptions in 2025: Penalties Explained Clearly

The law allows serious penalties.

Official penalties include:

- $500 per day

- Up to $10,000

- Possible criminal penalties for willful violations (knowingly ignoring the law)

However, context matters.

FinCEN has publicly stated that it is temporarily suspending enforcement of penalties while rule updates are finalized. Legal firms have confirmed this position after reviewing FinCEN announcements, including this detailed explanation.

This does not mean BOI filing can be ignored. Once enforcement begins, late filings may still be penalized.

Small companies are not protected simply because they are small.

BOI Filing Deadlines, Penalties, and Exemptions in 2025: Exemptions That Actually Matter

There are 23 exemptions under the CTA, but most foreign-owned companies do not qualify.

The Large Operating Company Exemption

To qualify, all three conditions must be met:

| Requirement | Rule |

|---|---|

| Employees | More than 20 full-time U.S. employees |

| Physical office | Active U.S. office location |

| Revenue | Over $5 million in U.S. gross receipts |

Most foreign-owned startups, online businesses, and holding companies fail at least one of these tests.

Legal analysis of this exemption is explained in detail by Clark Hill:

https://www.clarkhill.com/news-events/news/corporate-transparency-act-understanding-the-large-operating-companyexemption/

Common Real-World Scenarios

BOI rules become much easier when you see how they apply to real businesses. Below are common situations faced by foreign-owned U.S. companies, explained in simple terms.

Single-Member Foreign-Owned LLC

This is one of the most common setups for foreign founders.

In this case, the company:

- Has only one owner

- Has no employees

- Is often registered in states like Delaware or Wyoming

- Operates remotely from outside the U.S.

Even though the business is small and simple, it must file a BOI report. The Corporate Transparency Act does not exempt companies just because they have one owner or no staff. The owner is considered the beneficial owner (the real person who owns or controls the company), and their details must be reported to FinCEN.

There is also no applicable exemption here because:

- The company does not have more than 20 U.S. employees

- It does not have a physical U.S. office

- It does not earn over $5 million in U.S. revenue

As a result, BOI filing is required even if the LLC has no activity or income.

Foreign Company Registered in Delaware

This scenario applies to non-U.S. companies that register to do business in the United States.

In this case:

- The company was formed outside the U.S.

- It later registered in Delaware (or another U.S. state)

- The registration happened before January 1, 2024

FinCEN treats this as a foreign reporting company (a non-U.S. company registered in a U.S. state). For these companies, FinCEN provided extra time to comply. The BOI filing deadline is April 25, 2025, not January 1, 2025.

This is important because many foreign founders mistakenly believe they already missed the deadline. In reality, FinCEN intentionally allowed more time because foreign ownership structures are often more complex and require additional documentation.

SaaS Startup Using Only Contractors

This is common for early-stage startups.

In this case, the company:

- Has no full-time employees

- Uses freelancers or contractors instead

- May generate revenue but operates with a lean team

Under BOI rules, contractors do not count as employees. Only full-time employees on payroll are counted when determining exemptions. Because of this, the company does not qualify for the large operating company exemption.

Even if the startup is growing, BOI filing is still required unless:

- It has more than 20 full-time U.S. employees, and

- It has a physical office in the U.S., and

- It earns over $5 million in U.S. gross receipts

Until all three conditions are met, the company remains subject to BOI reporting.

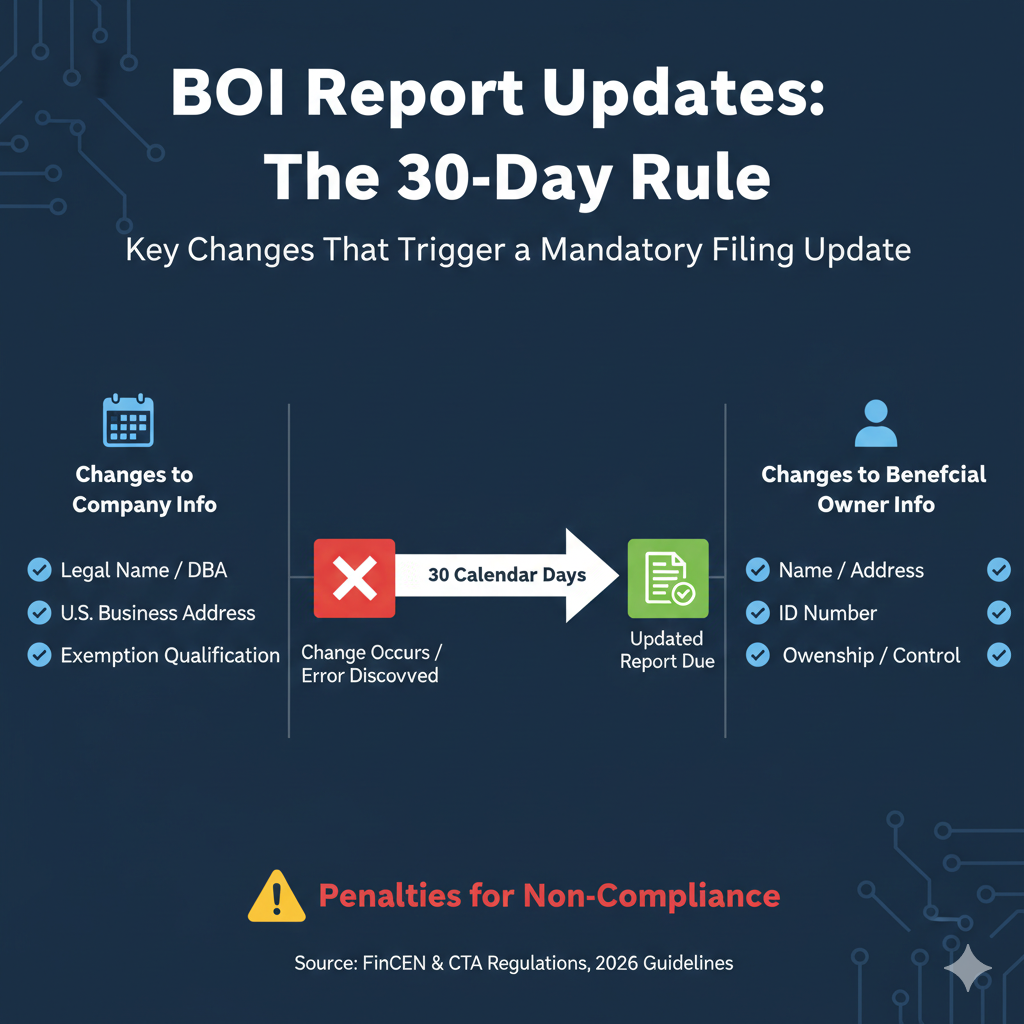

Updating or Correcting a BOI Report

BOI compliance does not end after the first filing. It is an ongoing obligation, meaning companies must keep their information accurate over time. FinCEN expects the BOI report to reflect the company’s current and correct ownership details at all times.

A BOI report must be updated within 30 days if there is any change in beneficial ownership (who owns 25% or more), management or control (such as a new director or manager), or the company’s registered or residential address. Updates are also required if an owner’s passport or government ID expires or is replaced, even if the person remains the same.

If incorrect information is discovered after filing, a correction must also be submitted within 30 days. FinCEN treats failure to update or correct a BOI report the same as failing to file, which means penalties can apply once enforcement begins.

Why BOI Compliance Affects Banking and Trust

Banks increasingly:

- Ask about BOI filings

- Match ownership records

- Flag inconsistencies

BOI compliance is becoming a basic trust requirement, not just a legal formality.

Some foreign founders choose to get a quick compliance review when timelines or ownership structures feel unclear. Firms like Scounts provide initial guidance for foreign-owned U.S. companies, which readers can explore here.

Getting Clarity Before Enforcement Tightens

Because BOI reporting connects with tax filings, banking, and ownership records, some founders prefer professional confirmation that everything is accurate. Scounts currently offers free initial consultations with discounted compliance support, which can be discussed directly via WhatsApp.

Final Thoughts

BOI Filing Deadlines, Penalties, and Exemptions in 2025 are now part of doing business in the United States. For foreign-owned companies, ignoring BOI rules creates future risk, not savings.

Filing correctly builds credibility.

Waiting increases uncertainty.

For companies managing BOI alongside taxes and annual filings, a single compliance review often prevents long-term problems. Readers who want clarity before enforcement expands may consider requesting a complimentary BOI compliance check through Scounts here.

FAQs: BOI Filing Deadlines, Penalties, and Exemptions in 2025

No. Single-member LLCs are not exempt.

April 25, 2025, applies to foreign reporting companies.

No, BOI is not filed with the IRS.

Yes, corrections are allowed within 30 days.

Yes, small size does not remove legal exposure.

Disclaimer: This article is authored by a writer at Scounts Private Limited. Please note that the fees mentioned are subject to change and may not be accurate at the time of reading. The content has not yet reviewed by any of our LLC taxation experts. For expert advice or services, feel free to contact us.