You’re a Pakistan-based founder. You run a Wyoming LLC (or a Pakistan company selling into the US). You want US revenue, so you hire a US-based sales rep.

You assume: “No US office = no US tax.”

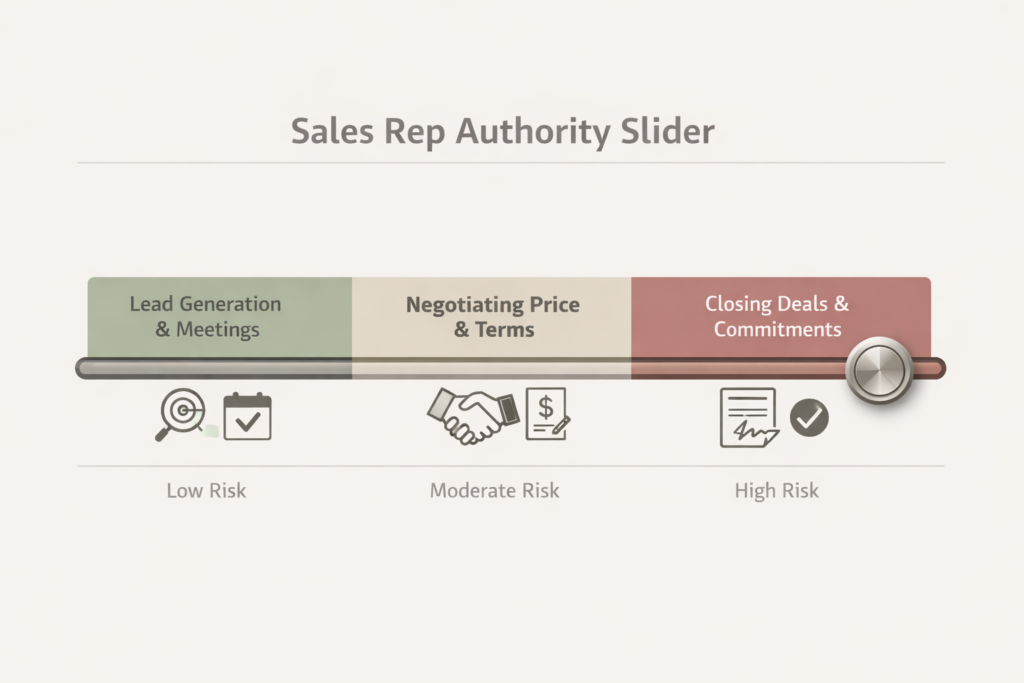

That assumption breaks when your rep starts acting like a deal-closer.

Under the US–Pakistan income tax treaty, you can create a US Permanent Establishment (PE) through an agent if that agent habitually negotiates and concludes contracts on your behalf (or fills orders from US stock). (IRS)

That’s the trap: you think you’re only “marketing in the US.”

But your structure can start looking like you are doing business in the US.

Myth vs Reality: What Non-Resident Founders Get Wrong

Most Pakistan-based founders don’t set out to create US tax exposure.

It usually happens like this:

You’re running a Wyoming LLC (or a Pakistan company selling into the US). You hire a US-based sales rep because US customers respond faster to someone in their time zone. You tell the rep, “Close deals. Move fast. Don’t let prospects go cold.”

That’s exactly where problems start.

Because under the US–Pakistan income tax treaty, PE isn’t only about renting an office in the US. A US-based agent can create a PE if they habitually negotiate and conclude contracts on your behalf (or if they regularly fill orders from US stock). (IRS treaty PDF)

Here are the myths that lead people into this trap.

Myth 1: “No US office means no US tax”

Reality: A US office is not the only trigger. A dependent agent can do it too, if they have the kind of authority that makes customers feel, “This person can commit the company.” (IRS treaty PDF)

Myth 2: “My rep doesn’t sign contracts, so I’m safe”

Reality: The signature is not the whole story.

If your rep negotiates the deal and you simply rubber-stamp it, you are still creating the facts that auditors look for. IRS treaty practice guidance focuses on agent authority and whether the enterprise is effectively being bound through the agent’s actions. (IRS Practice Unit)

Myth 3: “Treaty means I’m protected no matter what”

Reality: Treaty protection for business profits depends on whether you have a US PE. Once a PE exists, profits attributable to that PE can become taxable. (IRS treaty PDF)

Myth 4: “It’s just marketing”

Reality: Lead generation is usually fine. But closing activity isn’t “marketing.”

The moment your US rep starts committing pricing, negotiating terms, or finalizing renewals, you are no longer just “advertising into the US.” You’re operating through a person on the ground. That’s the exact pattern IRS treaty guidance flags. (IRS Practice Unit)

Before you give a US rep authority to negotiate or close deals, make sure you’re not building tax exposure by accident. Start here: Do Foreign-Owned US LLCs Really Pay Zero Tax? (2026 breakdown)

PE Risk Quick Test (60 seconds)

Before you read the deeper rules, run this fast check. It’s the quickest way to spot danger.

| Question | If “Yes” → risk | Why it matters | Fix |

| Can the US rep negotiate final price/terms? | High | Looks like contract authority (agent PE trigger). (IRS treaty PDF) | Final pricing/terms approved outside the US |

| Can they approve discounts or special terms? | High | Discount control becomes contract control. (IRS Practice Unit) | Fixed rate card + non-US approvals |

| Can they sign or otherwise bind you? | High | Treaty agent PE rule focuses on authority to conclude contracts. (IRS treaty PDF) | Remove authority in writing + in practice |

| Do they handle renewals/upsells? | Med–High | Renewals are still contracts. Habit matters. (IRS Practice Unit) | Renewals executed outside the US |

| Do you rubber-stamp their deals? | High | Substance beats paperwork. (IRS Practice Unit) | Document real approvals; sometimes say “no” |

| Does anyone in the US hold inventory and fill orders? | High | Treaty explicitly flags filling orders from US stock. (IRS treaty PDF) | Avoid US stock-to-order fulfillment |

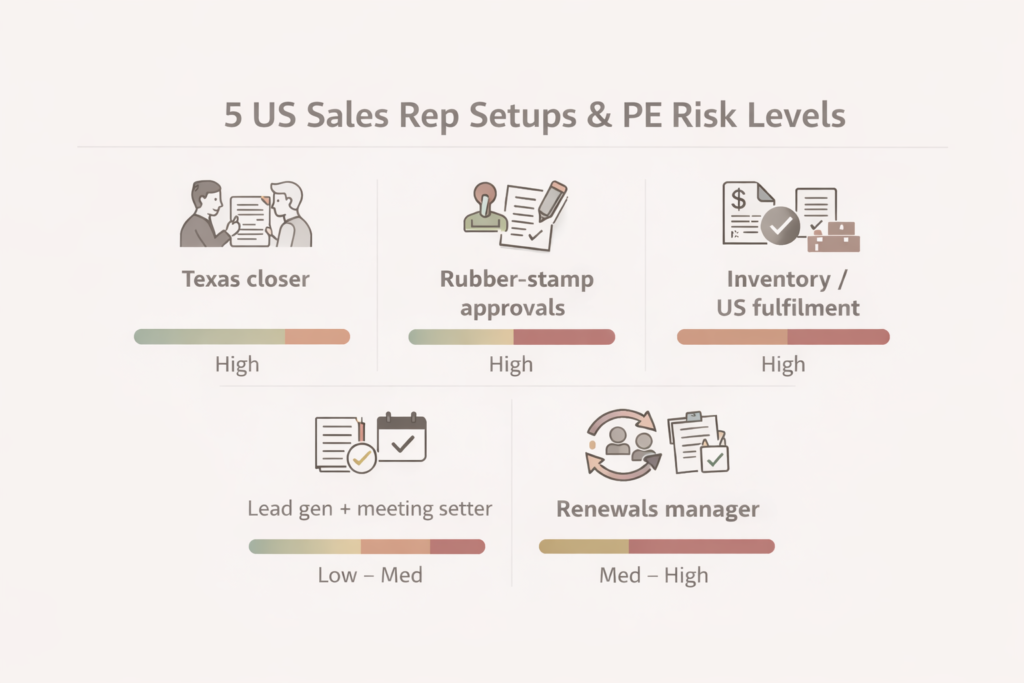

5 Common US Sales Rep Setups (Low vs Medium vs High Risk)

Most founders don’t hire a US rep thinking about “Permanent Establishment.”

They hire for one reason: speed.

But the structure you choose decides whether your US rep is:

- just a marketing layer, or

- a US deal-making engine that creates PE exposure.

Here are the most common setups I see non-resident founders use.

1) The “Texas closer” setup (High risk)

This is the classic trap.

Your US rep:

- negotiates pricing

- pushes discounts

- confirms final terms

- gets verbal commitment

- sends the “final agreement”

Even if you sign the contract from Pakistan, the rep may still look like the person who habitually concludes contracts for you. That’s the dependent-agent PE trigger in the US–Pakistan treaty. (IRS treaty PDF)

Fix it fast:

- remove discount authority

- remove term negotiation authority

- force final approval + term-setting outside the US

- keep the rep on lead + meeting + relationship only

2) The “rubber-stamp approval” setup (High risk)

This one is even more dangerous because founders don’t notice it.

Your US rep negotiates everything, and you approve every deal instantly because:

- you trust them

- you want speed

- you don’t want friction

From a risk perspective, “approval” becomes meaningless if it’s automatic.

IRS practice guidance focuses on substance: if the agent’s activity binds the enterprise commercially, the arrangement becomes a problem. (IRS Practice Unit)

Fix it properly:

- create a real approval rule (sometimes the answer must be “no”)

- require written approval for exceptions (discounts, refunds, rush delivery)

3) The “lead gen + meeting setter” setup (Low to Medium risk)

This is usually the safest structure if you want US presence without PE drama.

Your US rep:

- runs outreach

- follows up leads

- sets meetings

- qualifies prospects

But they do not:

- negotiate final pricing

- finalize terms

- sign contracts

- commit delivery or refunds

This typically stays away from the treaty’s agent-PE trigger because the rep isn’t operating with contract-concluding authority. (IRS treaty PDF)

Fix to keep it safe:

- lock role boundaries in writing

- use a non-binding proposal template

- keep final negotiations on Pakistan-side calls

4) The “renewals + upsells manager” setup (Medium to High risk)

Founders ignore this one.

They think:

“They’re not closing new deals, just managing existing accounts.”

But renewals and upsells still involve:

- contract terms

- pricing

- commitments

And when this becomes a habit, it starts to look like recurring contract authority. (IRS Practice Unit)

Fix it:

- allow relationship management

- keep renewal approvals outside the US

- centralize exception handling (discounts, special terms)

5) The “inventory / orders fulfilled in the US” setup (High risk)

This is the second treaty trigger that many founders miss.

If your US setup includes:

- storing goods in the US

- maintaining stock

- regularly filling orders from that stock

…the treaty explicitly treats that as PE-style exposure through the agent/facility pattern. (IRS treaty PDF)

Fix it:

- avoid US stock fulfillment

- fulfill from outside the US

- if you must store inventory in the US, treat it as a serious compliance structure decision (not a “quick growth hack”)

Mini takeaway (simple rule)

If your US rep can close deals or commit terms, assume PE risk until you restructure.

If your US rep can only generate leads and support relationships, risk is usually much lower.

How to Hire US Sales Without Triggering PE (Rules You Can Actually Implement)

If you want a US rep for speed, you need one thing: tight boundaries.

The US–Pakistan treaty risk shows up when your rep becomes a person who habitually negotiates and concludes contracts for you (or fills orders from US stock). (IRS treaty PDF)

So your goal is simple:

Keep the rep in “pipeline mode,” not “closing mode.”

Rule 1: Strip “contract power” from the role (in writing + reality)

Your US rep should not be allowed to:

- sign contracts

- accept contracts “on your behalf”

- finalize pricing

- approve discounts

- commit delivery dates, SLAs, refund terms, penalties

- promise custom terms outside your standard offer

This isn’t just legal wording. It’s behavior. IRS treaty guidance looks at the agent pattern and whether the agent’s actions effectively bind the enterprise commercially. (IRS Practice Unit)

Good line to include in the rep agreement:

“The representative has no authority to negotiate or conclude contracts or bind the company.”

Rule 2: Put “final negotiation” on a non-US decision maker

Your rep can:

- qualify the lead

- gather requirements

- schedule calls

- keep the prospect warm

- follow up

But when the conversation becomes:

- price

- term changes

- special discounts

- legal edits

- delivery commitments

…your process must pull it back to Pakistan-side approval and negotiation.

If you don’t do this, you recreate the “rubber-stamp” pattern that makes the rep look like the closer in substance. (IRS Practice Unit)

Rule 3: Use a “rate card” instead of negotiation

Negotiation is what turns a rep into an agent with contract power.

A cleaner setup:

- publish a fixed pricing/rate card (even if private)

- allow the rep to quote only those prices

- require non-US approval for any discount or exception

If you must discount:

Make it a formal approval step with a clear paper trail.

Rule 4: Don’t let the rep send “final” documents

This is a common mistake.

If your rep sends the “final contract,” customers perceive the rep as the person who concludes the deal.

Better:

- rep can send marketing material + non-binding summaries

- final contract is issued from your official company email by a non-US decision maker

- signature and acceptance happens through that channel

This aligns with the treaty’s focus on who has authority to conclude contracts and the IRS focus on the agent pattern. (IRS treaty PDF)

Rule 5: Don’t “accidentally” create the inventory trigger

The treaty also flags a separate risk pattern: US stock used to regularly fill orders. (IRS treaty PDF)

So if your business involves goods:

- avoid storing inventory in the US under a rep-controlled flow

- avoid “rep ships to customers” setups

- treat US fulfillment as a serious tax/compliance decision, not an operational shortcut

Rule 6: Document your reality (because reality wins)

If the IRS ever asks questions, the most useful evidence is boring evidence:

- who approved discounts

- where contracts were finalized

- where key terms were negotiated

- whether approvals were real or automatic

Keep:

- an approval matrix (who can approve what)

- exception logs (discounts, refunds, special terms)

- contract execution trail (who issued final contract, who signed)

What Happens If You Ignore This (And Let the Rep “Close Deals”)

If your US rep crosses into deal-making authority and it becomes the normal pattern, your risk isn’t theoretical.

Under the US–Pakistan treaty, once you’re considered to have a US Permanent Establishment (PE), the US can tax the profits attributable to that PE. The treaty’s protection for business profits is not automatic. It’s conditional on not having a PE. (IRS treaty PDF)

What “profits attributable to a PE” means (simple version)

Think of it like this:

If the IRS sees your US rep as the person who is effectively concluding contracts in the US, the US can argue:

- the rep isn’t “marketing support”

- the rep is a US business function

- a slice of your profit is tied to that US function

That’s the “attribution” concept in treaty terms. (IRS treaty PDF)

What usually goes wrong in real life

Non-resident founders typically get hit in one of these ways:

- The rep negotiates pricing and discounts casually on calls.

- Customers treat the rep’s word as final.

- The founder “approves everything” to keep sales fast.

- Contracts show Pakistan signatures, but the deal was already decided in the US.

IRS treaty practice guidance is designed to identify these dependent-agent patterns. (IRS Practice Unit)

The defensive move founders don’t know: “Protective” filing strategy

Sometimes you’re in a gray area.

You might not be sure whether your US rep’s role has already crossed the line. Or maybe your structure changed mid-year (lead gen → closing).

In those cases, a protective filing approach can matter, because it can preserve positions and reduce future damage if the IRS later argues you had US business exposure.

If you already have a US rep and you’re not 100% sure where you stand, don’t guess.

Read this next and then decide your next move: Protective Form 1120-F: When and How to File a Protective Return (Non-Resident Guide)

The Hidden Layer: State Compliance Can Stack Too (Keep this short)

Even if you manage the treaty/PE side carefully, a US footprint can still create state-level admin and tax complexity.

This isn’t a scare tactic. It’s just how the US works: federal rules and state rules run on different tracks.

So treat your US hiring decision as a “structure decision,” not just a “sales decision.”

If you’re hiring in the US, don’t look at federal rules only. Read this next to avoid the state-level surprises: Common States + Risks in Tax and Compliance for Foreign-Owned US LLCs

What To Do and When To Do It

| What to do | When to do it | Why it matters |

| Write the rep role as lead gen + relationship only (no closing authority) | Before hiring | Stops the dependent-agent PE pattern from forming |

| Lock rules: rep cannot approve discounts/terms | Before first US calls | Discount/terms control becomes contract control |

| Make final negotiation + contract execution happen outside the US | Before first proposal | Prevents “habitually concludes contracts” facts |

| Create a simple approval trail (exceptions must be approved in writing) | From day 1 | Evidence beats “we didn’t mean it” |

| Review 10 random deals monthly for “authority creep” | Monthly | Most PE risk happens slowly over time |

| If things already crossed the line, consider protective strategy | Immediately | Delay usually makes cleanup harder |

Once US activity starts, deadlines and compliance don’t wait for you to “figure it out later.” Use this to stay on track: Navigating U.S. Tax Deadlines 2026: A Complete Guide for Pakistani LLC Owners

FAQs: Hiring a US Sales Rep and Permanent Establishment (PE) Risk

1) What is a “Permanent Establishment (PE)” in simple terms?

A PE is a level of US presence that can allow the US to tax business profits connected to that US activity. Under the US–Pakistan treaty, PE can be created through a fixed place of business or a dependent agent who can habitually negotiate and conclude contracts for you.

2) Can hiring a US-based sales rep create US tax liability even if I have no US office?

Yes. A US office is not required if your US rep functions as a dependent agent with contract authority (or if orders are filled from US stock). The treaty specifically addresses agency as a PE trigger when the agent can negotiate and conclude contracts on your behalf.

3) Does a US sales rep create PE only if they sign contracts?

No. Signing is a strong red flag, but PE risk is about authority and behavior. If the rep routinely negotiates key terms and you approve automatically, the rep can still look like the person effectively concluding contracts. IRS treaty practice guidance focuses on dependent-agent patterns and contract-concluding authority.

4) Which sales activities are most likely to trigger PE risk?

High-risk activities typically include:

- negotiating final price/terms

- approving discounts or exceptions

- committing delivery dates, SLAs, refunds, penalties

- sending “final” agreements customers accept

- handling renewals/upsells as the normal closer

These behaviors align with “authority to negotiate and conclude contracts” concepts in treaty/IRS analysis.

5) What sales activities are usually lower risk (if structured properly)?

Lower-risk patterns usually look like:

- lead generation (outreach, follow-ups)

- meeting scheduling

- qualification and discovery

- relationship management without pricing/terms authority

The key is that the rep cannot bind you and does not habitually negotiate or conclude contracts.

6) What is the “independent agent” exception, and can I rely on it?

The treaty generally treats truly independent brokers/commission agents differently, but independence must be real (not just a label). If the agent is economically dependent on you or effectively acts like your internal closer, the exception becomes harder to rely on.

7) Can US inventory or US order fulfillment create PE risk?

Yes. The US–Pakistan treaty explicitly flags a PE-style trigger when an agent has a stock of goods and regularly fills orders from that stock on behalf of the enterprise.

8) If I form a Wyoming (or Delaware) LLC, does that automatically prevent PE issues?

No. A US LLC structure doesn’t automatically eliminate PE/USTB-style risk if your operational facts create a US business presence through people or fulfillment patterns. Entity setup helps, but authority and operations matter more than the state of formation.

9) What should I put in my sales rep agreement to reduce PE risk?

At minimum:

- “No authority to negotiate or conclude contracts.”

- “No authority to bind the company.”

- “Pricing/discounts/terms must be approved outside the US.”

- Clear process: who approves exceptions, how contracts are issued, where execution happens.

This aligns your paperwork with the treaty’s agency PE trigger rules—but you must also follow it in practice.

10) I already hired a US rep and they’ve been closing deals. What should I do first?

Start with immediate containment:

- Remove discount and term negotiation authority today.

- Move final pricing/terms and contract execution outside the US.

- Audit recent deals for “habitually concluding” patterns.

- If exposure is possible, consider whether a protective filing approach is needed.

IRS guidance on dependent agent PE patterns is exactly why you should fix the “habit” quickly.

Not Sure If Your US Rep Setup Is Creating Tax Risk?

If your US rep is negotiating price, discounts, terms, or renewals, get a quick structure review before the pattern becomes “habitual.”

Need help? Chat with us on WhatsApp or visit our Contact Us page.

Sources:

https://www.irs.gov/pub/fatca/int_practice_units/TRE9450_06_02.pdf

https://www.irs.gov/pub/fatca/int_practice_units/tre_t_016_07_02.pdf

https://www.irs.gov/pub/irs-trty/us-pakistan-income-tax-treaty.pdf

Disclaimer: This article is authored by a writer at Scounts Private Limited. Please note that the fees mentioned are subject to change and may not be accurate at the time of reading. The content has not yet reviewed by any of our LLC taxation experts. For expert advice or services, feel free to contact us.