Freelancing and remote work are no longer side hustles in Pakistan. Millions of professionals now earn foreign income through platforms like Upwork, Fiverr, Freelancer, and direct contracts with overseas clients. At the same time, a growing number of Pakistanis work remotely as employees for foreign companies while living locally.

With this growth comes an unavoidable reality: freelancers and remote workers are fully taxable under Pakistani law.

Many people still assume that foreign income is “outside FBR’s reach” or that small online earnings do not matter. This assumption is risky. The Federal Board of Revenue now actively tracks foreign remittances, bank inflows, platform payments, and filer status. Understanding how freelancer tax in Pakistan works in 2025 is no longer optional — it is essential for staying compliant and tax-efficient.

Why Freelancers and Remote Workers Must Take Tax Seriously:

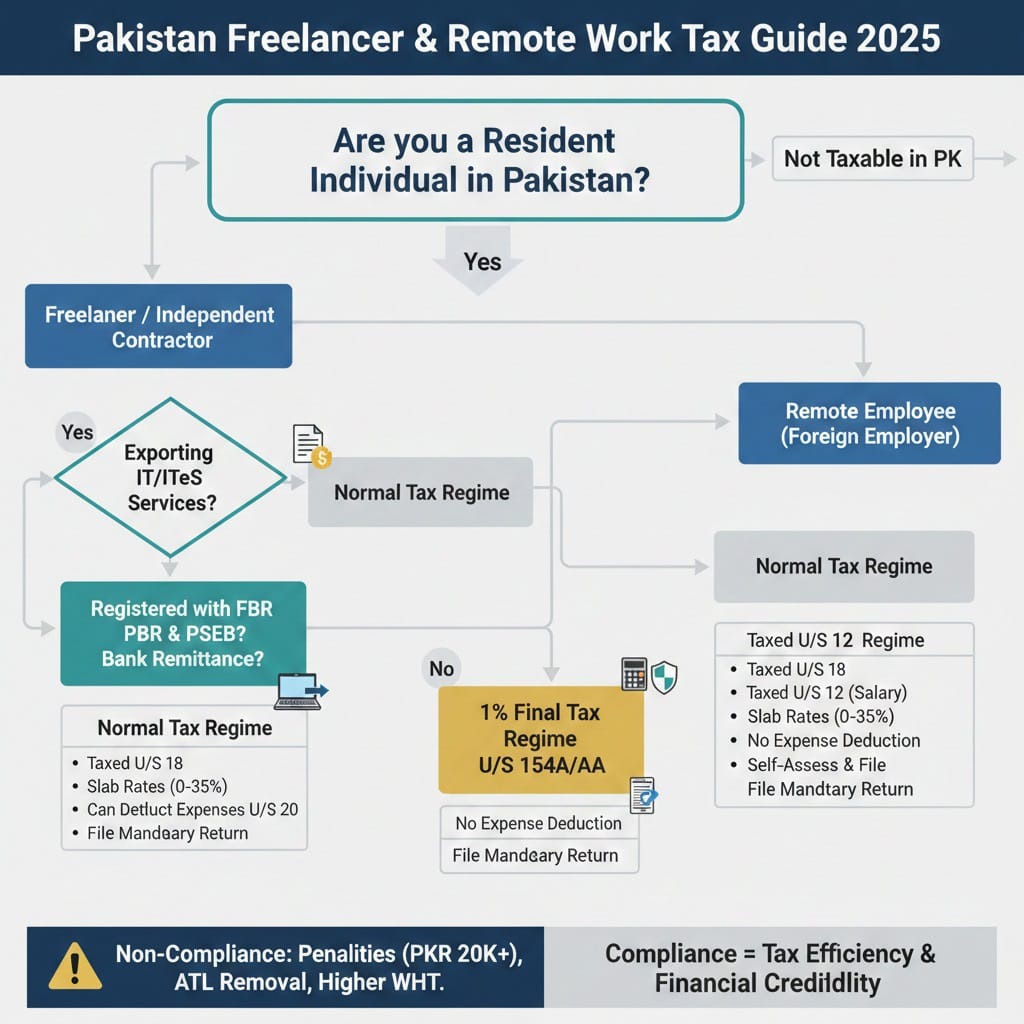

Freelance income is taxable in Pakistan even if it is earned from foreign clients and received through online platforms. The source of payment does not override tax residency. If you are a resident individual under Pakistani tax law, your global income falls within the tax net unless specifically exempt.

Filing tax returns is not just about avoiding penalties. Becoming a filer reduces taxes on banking transactions, vehicle registration, property transfers, and improves your financial credibility. Non-filers face higher withholding taxes, possible FBR notices, and difficulty conducting basic financial activities.

Freelancer vs Remote Employee: Why Classification Matters:

Before calculating tax, the law asks a basic question: are you a freelancer or a remote employee? The answer changes everything.

A freelancer is an independent service provider who issues invoices, bears business expenses, and receives payments directly through banking channels or platforms like Payoneer or Wise. A remote employee, on the other hand, works under an employment contract, receives a fixed salary, and operates under employer control — even if that employer is abroad.

This distinction determines whether income is taxed as business income U/S 18 or salary income U/S 12 of the Income Tax Ordinance, 2001.

Legal Classification at a Glance:

| Aspect | Freelancer / Independent Contractor | Remote Employee |

| Head of income | Income from Business | Salary |

| Governing section | Section 18 | Section 12 |

| Nature of relationship | Independent service provider | Employer–employee |

| Invoicing | Self-issued | Not applicable |

| Expense deduction | Allowed (Section 20) | Not allowed |

| Eligibility for 1% IT export regime | Yes (if conditions met) | No |

Tax on Freelancers Exporting IT & IT-Enabled Services:

Pakistan actively encourages the export of IT and digital services. To support this sector, the law provides a concessional final tax regime for freelancers exporting qualifying services.

U/Ss 154A and 154AA, read with Part I of the Second Schedule, income from export of IT and IT-enabled services is taxed at a flat 1% rate, which is final tax. This means no further tax is payable on that income.

Eligible services include software development, website and app development, digital marketing, graphic design, data analytics, cloud services, technical consulting, and advanced fields such as AI, machine learning, and blockchain services.

To qualify, the freelancer must be registered with the Federal Board of Revenue, registered with the Pakistan Software Export Board (PSEB), and must receive foreign remittances through proper banking channels.

Tax Rates Applicable to Freelancers in Pakistan:

Not all freelancers qualify for the final tax regime. Those providing non-IT services or failing to meet registration conditions are taxed under the normal slab system.

Individual Income Tax Rates (Normal Regime – Tax Year 2025)

| Taxable Income (PKR) | Applicable Rate |

| Up to 600,000 | 0% |

| 600,001 – 1,200,000 | 5% |

| 1,200,001 – 2,200,000 | 15% |

| 2,200,001 – 3,200,000 | 25% |

| Above 3,200,000 | 35% |

These rates apply to non-IT freelancers and to all remote employees.

Withholding Tax on Foreign Remittances:

When IT export proceeds are received in Pakistan, banks are required to deduct 1% withholding tax U/S 154A. This deduction is final and discharges the entire tax liability.

If, for any reason, tax is not deducted by the bank, the freelancer must still declare the income and pay the 1% tax voluntarily while filing the return. Non-deduction does not mean non-taxability.

Expense Deductions for Freelancers Under Normal Regime:

Freelancers taxed under the normal regime can claim legitimate business expenses U/S 20, such as:

· Internet and utility bills

· Depreciation on laptops and equipment (section 22)

· Software subscriptions and professional courses

· Bank charges and platform commissions

· Proportionate home-office expenses

· Expenses must be wholly and exclusively for business purposes and properly documented.

Tax Treatment of Remote Employees:

Remote employees working for foreign companies are taxed as salaried individuals U/S 12. Since foreign employers usually do not deduct Pakistani tax, self-assessment applies.

Remote employees cannot claim business expense deductions. They are taxed strictly according to salary slabs, although limited tax credits under Chapter IIIA may be available.

Sales Tax Position for Freelancers:

Export of services is zero-rated for federal sales tax purposes, meaning no output tax is payable and registration is generally not required if services are exported only.

However, providing services to local Pakistani clients may trigger provincial sales tax obligations depending on the province and nature of services.

Filing Requirements and Documentation:

Every freelancer and remote worker must file an annual income tax return U/S 114, even if tax deducted is final. Where applicable, a wealth statement U/S 116 is also mandatory.

Key documents include bank PRCs, platform earning statements, invoices, and expense records. Proper documentation protects against FBR notices and future disputes.

Penalties for Non-Compliance:

Failure to file returns attracts minimum penalties starting from PKR 20,000 and removal from the Active Taxpayers List. Mis-declaration or concealment can result in penalties equal to 100% of the tax involved, along with default surcharge and enforcement action U/Ss 182, 191, and 114B.

A Simple Practical Example:

A registered IT freelancer earns PKR 5,000,000 in 2025 through banking channels. Bank deducts 1% tax = PKR 50,000.

Tax is final.

Filing a return is mandatory.

No further income tax is payable.

Compliance Is the New Advantage:

Pakistan’s tax system no longer ignores freelancers. It actively rewards compliant ones. The 1% final tax regime for IT exports is among the most generous globally, but it only applies to documented and registered taxpayers.

Freelancing without registration is risky.

Freelancing with compliance is highly tax-efficient.

How Scounts Digital Tax Services Can Assist:

At Scounts Digital Tax Services, we specialize in providing structured tax and compliance solutions for freelancers, remote professionals, and digital service exporters operating in Pakistan. Our advisory approach is grounded in the Income Tax Ordinance, 2001 and its latest amendments, with a focus on ensuring lawful compliance while achieving optimal tax efficiency.

We assist clients in correctly classifying their income as business income or salary income, a determination that directly impacts applicable tax rates, deductibility of expenses, and eligibility for concessional regimes. For freelancers exporting IT and IT-enabled services, we advise on qualification for the final tax regime U/Ss 154A and 154AA, including registration with the Federal Board of Revenue and the Pakistan Software Export Board, and proper documentation of foreign remittances.

Our services include NTN registration, income tax return filing, wealth statement preparation, and advance tax planning for individuals and sole proprietors. We also provide guidance on expense deductibility, record-keeping requirements, and reconciliation of platform earnings with banking records to ensure consistency and audit readiness. For remote employees working with foreign employers, we offer support in salary tax computation, self-assessment, and annual compliance obligations.

In addition to routine compliance, Scounts Digital Tax Services represents clients before tax authorities in matters involving notices, audits, penalty proceedings, and related correspondence with the Federal Board of Revenue. Our objective is to proactively manage tax risk, minimize exposure to penalties, and provide clients with clarity and confidence in their tax affairs.

Whether you are an independent freelancer, a remote professional, or a growing digital services provider, Scounts Digital Tax Services offers practical, compliant, and forward-looking tax solutions tailored to the realities of Pakistan’s evolving digital economy.

FAQs: Freelancer & Remote Work Tax in Pakistan:

Q1: Is income from foreign clients taxable in Pakistan?

Yes. If you are a tax resident of Pakistan, global income is taxable unless specifically exempt.

Q2: How do I know if I am a freelancer or a remote employee?

- Freelancer: Independent service provider, invoices clients, bears business expenses.

- Remote employee: Works under a contract, fixed salary, employer-controlled.

Q3: What is the 1% final tax regime?

Eligible IT freelancers exporting qualifying services pay 1% of income as final tax U/S 154A and 154AA. No further tax is due.

Q4: Can I deduct expenses from my freelancing income?

- Freelancers under normal regime: Yes, legitimate business expenses U/S 20.

- Remote employees: No, only salary slabs apply.

Q5: Do I have to file a tax return if my bank deducts 1% final tax?

Yes, filing is mandatory even if tax is final.

Q6: What happens if I don’t register or file?

Penalties start at PKR 20,000, possible removal from Active Taxpayers List, and higher tax rates on banking transactions.

Q7: Are sales taxes applicable on freelance services?

- Exports: zero-rated, no output tax.

- Local clients: may trigger provincial sales tax depending on service and location.

Q8: What documents do I need for compliance?

Bank PRCs, platform earning statements, invoices, expense receipts, and any other business documentation.

References:

https://www.brecorder.com/news/40393871/opinion-services-export-boom-the-tax-anomaly

https://taxationpk.com/insights/freelance-income-tax-rates/

https://abhconsultants.pk/applicable-taxes-for-freelancers-in-pakistan-in-2025/

https://legalversity.com/freelancer-tax-calculator https://taxcalculatorpakistan.pk/pakistan-budget-2025-26-latest-income-tax-slabs-freelancer-tax-explained/

https://taxcalculatorpakistan.pk/pakistan-freelancer-tax-calculator/

https://taxgoshwaraa.com/freelancers-income-tax-guide-everything-you-need-to-know/

https://bloompakistan.com/freelancers-tax-in-pakistan-what-you-need-to-know-in-2025

https://www.dawn.com/news/1927927/fbr-exempts-online-foreign-services-from-5pc-levy