If you own an LLC from abroad, answer this honestly.

If your state changed your status tomorrow, would you even know?

Most founders would not. They assume no revenue means no filings. They assume their formation agent handles everything. They assume they can clean it up later.

Most states do not work like that.

Missing state filings can trigger status changes, and in some cases, forfeiture or loss of good standing. Once that happens, your business can lose key legal protections, and personal risk can increase if you keep operating during that period. In Texas, the stakes can be even higher because Texas law can make directors and officers personally liable for certain debts created while the company is forfeited.

The good news is you can prevent it with a simple system. Let’s break it down step by step.

Why State Compliance Matters More Than You Think?

Most founders treat state filings like boring paperwork. That mistake gets expensive.

States do not “forget” about missing reports. They track deadlines automatically. If you do not file, your LLC can lose good standing (your business is no longer officially compliant). If the problem continues, Texas can move toward forfeiture (the state removes your company’s right to operate and weakens key legal protections).

Three critical misconceptions

Myth #1: “Nobody enforces these requirements.”

Reality: Enforcement is systematic. States use automated tracking. Texas sends delinquency notices and can escalate status if filings remain missing. Always assume the system is watching.

Myth #2: “Only big companies face serious consequences.”

Reality: Size does not protect you. A single-member LLC can face the same compliance actions as a larger company, including loss of good standing and forfeiture.

Myth #3: “I can reinstate later and it will erase the damage.”

Reality: Reinstatement (restoring your company’s active status) can fix the entity’s status going forward, but it may not wipe out personal exposure for certain debts created while the LLC was forfeited. That is why timing matters.

Required Filings: What You Must Submit

If you want your LLC protection to stay “on,” you have to file what the state and IRS expect. Most foreign founders miss filings for one simple reason. Nobody explains them clearly.

Let’s cover the two filings that cause the most damage when ignored.

State-level: Texas Public Information Report (PIR)

The Public Information Report (PIR) is part of Texas franchise tax compliance. It confirms who controls the company and where official notices go.

Texas PIR basics

Critical point (most people get this wrong)

Even if your Texas LLC owes no franchise tax, Texas may still require you to file the PIR to stay compliant and fix “not in good standing” issues.

Federal: IRS Form 5472 for foreign-owned LLCs

This is the big one that blindsides foreign founders.

Form 5472 is an information return (a disclosure form, not a “tax bill”) used to report transactions between a U.S. entity and its foreign owner or related parties.

Who needs to care about Form 5472

- Form 5472 applies to a “reporting corporation,” including a 25% foreign-owned U.S. corporation.

- It also commonly affects foreign founders who own a U.S. LLC that is a disregarded entity (an LLC treated as part of its owner for income tax) because IRS rules treat certain foreign-owned disregarded entities as corporations for these reporting rules.

Filing basics

| Requirement | Details |

| Filing name | Form 5472 |

| Due date | Filed with the applicable income tax return. Commonly April 15 for calendar-year filers, or the 15th day of the 4th month after year-end. |

| Associated form | Often filed with a pro forma Form 1120 in foreign-owned disregarded entity situations. |

| Penalty | $25,000 per failure to file a complete and correct Form 5472 by the due date. |

| Continuation penalty | If not filed within 90 days after IRS notice, an additional $25,000 per 30-day period may apply. |

What gets reported (simple list)

Reportable transactions often include:

- Capital contributions (money you put into the LLC)

- Distributions (money the LLC sends back to you)

- Loans between you and the LLC

- Rent or service payments either direction

- Buying or selling property between you and the LLC.

Important (the part that surprises people)

Form 5472 may still be required even if:

- Your LLC had no income

- You owe no U.S. federal tax

- The only activity was funding the company (capital contribution)

- The business is dormant or inactive.

Understanding Personal Liability Under Texas Law

When Texas forfeits your company’s corporate privileges (your legal right to operate as an active entity), your LLC shield can weaken in a very specific way.

Under Texas Tax Code § 171.255, if forfeiture happens because the company failed to file a required report or failed to pay a tax or penalty, each director or officer can become personally liable for certain company debts.

This is not “everything forever.” It is a defined rule with a time window.

What debts can trigger personal liability?

The statute focuses on debts “created or incurred” during the forfeiture window. (“Created or incurred” means when the events happened that gave rise to the debt, not when someone sues you later.)

That can include things like:

- contracts you sign while forfeited

- vendor bills you approve

- obligations created while operating during that period

When does personal liability begin?

This is the part the founders misunderstand.

Texas law ties liability to debts created or incurred after the date a report, tax, or penalty is due and before corporate privileges are revived (restored).

So the risk can begin earlier than many people expect. It is not always only “after the forfeiture date.”

Example (simple):

Your report was due May 15. You keep operating after May 15. If your LLC later becomes forfeited and you created new business debts in that window, those debts can create personal exposure for directors or officers.

What courts look at

Courts often focus on when the debt was actually created. In cases citing Texas law, courts look at the underlying events that created the obligation, not just the later paperwork dates.

Important safety note (keep you accurate)

Texas law also includes defenses in some situations, and courts apply facts differently depending on the case. So your safest wording is “can become personally liable,” not “always becomes liable.”

Real-World Consequences: Court-Documented Cases

Forfeiture is not just a warning on a government website. Courts have repeatedly shown that it creates real legal and financial damage for business owners.

Loss of the right to sue

In Price v. Upper Chesapeake Health Ventures (192 Md. App. 695, 2010), a Maryland LLC lost its good standing and later tried to sue a customer for unpaid bills. The court refused.

Why?

Because a forfeited entity lacks legal standing (the legal right to bring a lawsuit). The company could still defend itself if sued, but it could not go to court to collect money it was owed.

In simple terms, the business could be sued, but it could not enforce its own contracts.

Long periods of personal exposure

A Texas case shows how dangerous long-term forfeiture can become.

In Stoneleigh on Turtle Creek Owners Association v. G Force Framing, LLC, a construction company continued operating for years after its corporate privileges were forfeited. The company was later reinstated, but that did not erase the past.

The court allowed claims that members could face personal liability for obligations created during the forfeiture period. That included contracts, liens, and other business commitments made while the LLC was not in good standing.

The key lesson is simple. Reinstatement fixes your status going forward. It does not automatically protect you from problems created while the company was forfeited.

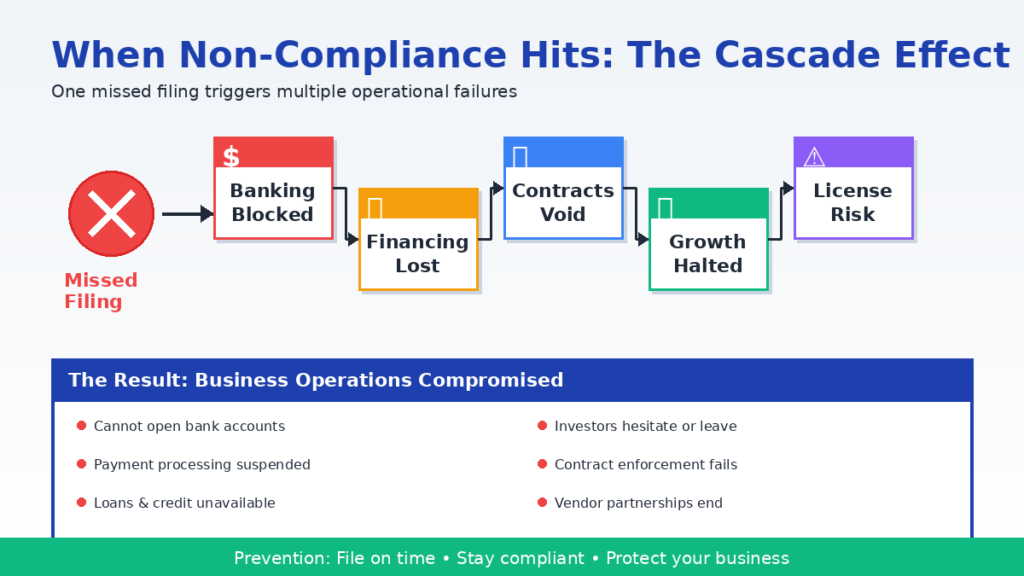

Operational Consequences of Non-Compliance

Personal liability is the long-term risk. The immediate damage is operational. When an LLC loses good standing or enters forfeiture, everyday business functions can start failing.

Banking and payments

- New bank accounts may be denied

- Existing accounts can be restricted or closed

- Payment processors may suspend services

Financing and investors

- Business loans and credit lines become unavailable

- Investors often pause or walk away

- Loan terms may be reviewed more strictly

Contracts and legal rights

- Enforcing contracts becomes difficult

- Collecting unpaid invoices is harder

- Legal disputes become more complex

Business growth

- Vendors and partners may refuse to work with you

- Certificates of good standing cannot be issued

- Government or regulated contracts may be blocked

Licensing and insurance

- Professional licenses can be questioned

- Insurance coverage may face scrutiny

Non-compliance does not always shut a business down overnight. But it quietly removes the tools you need to operate, grow, and protect yourself.

Unique Challenges for Foreign Founders

Running a US LLC while living outside the country adds extra compliance challenges that many founders underestimate.

Communication gaps

Most states send official notices by mail to your registered agent. If that agent is outdated, slow to notify you, or no longer actively monitored, important deadlines can pass without you ever seeing a warning.

Time zone and deadline confusion

US filing deadlines follow US time zones. A due date like May 15 in Texas can already be May 16 in other parts of the world. That gap alone can cause an accidental late filing if reminders are not set carefully.

Form 5472 blind spot

Form 5472 applies only to foreign-owned US entities. Because of that, it rarely appears in standard LLC guides or formation checklists. Many foreign founders learn about it only after receiving a penalty notice.

How to reduce the risk

Use a professional registered agent that sends digital alerts, not just mail. Set compliance reminders based on US time zones. Work with a US-based CPA or Enrolled Agent who regularly handles foreign-owned LLC filings and understands these edge cases.

Compliance Action Plan: 6 Essential Steps

- Verify your current status

Check your LLC status with the state’s Secretary of State. For Texas, use the Texas Comptroller Taxable Entity Search. Your status should show Active or In Good Standing. - Set a compliance calendar

Track key deadlines, including Texas franchise filings, IRS Form 5472 for foreign-owned LLCs, registered agent renewals, and any required licenses. Set reminders 60, 30, and 7 days before each deadline, based on US time zones. - Use a professional registered agent

A registered agent typically costs $100 to $300 per year. A good agent provides a reliable US address, receives official notices, sends digital alerts, and helps ensure important mail is not missed. - Work with the right tax professional

Foreign-owned LLCs should work with a US CPA or Enrolled Agent experienced in cross-border filings. Form 5472 is technical, and professional preparation can help avoid costly errors and penalties. - Keep business and personal finances separate

Do not mix personal and business funds. Paying business expenses from personal accounts can create reportable transactions and weaken your LLC protection. - Keep clear records

Maintain copies of all filings, contracts, financial records, and registered agent agreements. Keep records for at least seven years, and keep formation documents permanently.

Remediation for Non-Compliant Entities

Many founders find this guide after something has already gone wrong. The good news is that most compliance issues can be fixed if you act early and follow the right order.

Fixing missed Texas state filings

If your Texas LLC is behind on franchise filings or reports:

- File all missing franchise tax reports and required information reports

- Pay any outstanding tax, penalties, and interest

- Request tax clearance from the Texas Comptroller

- Apply for reinstatement if your entity was forfeited or dissolved

Costs vary based on how long the issue has been ignored. Short delays are usually manageable. Long gaps can become expensive and time-consuming.

Important to understand:

Reinstatement restores your company’s status going forward. It does not automatically erase personal exposure for debts created while the LLC was forfeited.

Fixing Form 5472 issues

Form 5472 problems should be handled carefully.

If you missed one or more filings:

- Contact a US CPA or Enrolled Agent with foreign-owned LLC experience

- Gather records of all transactions between you and the LLC

- File Form 5472 with a pro forma Form 1120 for each missing year

- Request penalty abatement if there is reasonable cause

Do not attempt to fix Form 5472 issues on your own. Errors here can trigger large penalties, even when no tax is owed.

Final thoughts

Your LLC protects you only when it is properly maintained. Most compliance problems do not come from bad intent. They come from missed details, unclear guidance, and silence from the state.

The good news is that staying compliant is far easier and cheaper than fixing problems later. With the right system and the right support, you can protect your business and your personal assets with confidence.

If you are unsure about your current status, or if something already went wrong, we can help.

Contact us for a quick compliance review and clear next steps tailored to your situation.

Your business deserves protection. Let’s make sure it stays that way.