The Corporate Transparency Act (CTA) is a U.S. federal compliance law that requires certain companies to report Beneficial Ownership Information (BOI) to FinCEN (Financial Crimes Enforcement Network), a bureau of the U.S. Treasury. BOI refers to personal identification details of individuals who own or control a company.

The purpose of the CTA is to increase transparency and prevent misuse of companies for money laundering and other financial crimes. In 2025, key rule changes and exemptions have made CTA compliance especially relevant for foreign-owned businesses.

Foreign Owner

↓

Foreign-Formed Company

↓

Registered in a U.S. State

↓

BOI Report Required

↓

Filed with FinCEN (Not IRS)

This article is intended for foreign entrepreneurs, including Pakistani founders, who own or plan to form U.S. LLCs or corporations. It is particularly useful for freelancers, consultants, SaaS founders, and e-commerce operators using U.S. entities for international business. The article assumes no prior legal or U.S. compliance knowledge and explains all concepts in simple terms.

Importance of CTA Compliance for Foreign-Owned U.S. Businesses:

CTA compliance is a new and often misunderstood obligation for foreign owners. Many founders believe that U.S. compliance only involves tax filings, which is no longer accurate. The CTA introduces a separate federal reporting requirement, even for companies with no income or tax liability. Because FinCEN issued major updates and exemptions in 2024–2025, older online guidance is frequently outdated. Clear, updated, and practical explanations are therefore essential.

Understanding the Corporate Transparency Act (CTA) – A Federal Transparency Law for Business Ownership Disclosure:

The Corporate Transparency Act is a U.S. law that requires certain companies to disclose who ultimately owns or controls them. These disclosures are made to FinCEN, not to the IRS. The CTA does not impose a tax and does not calculate profit or loss. Instead, it focuses on transparency by identifying the real people behind legal entities.

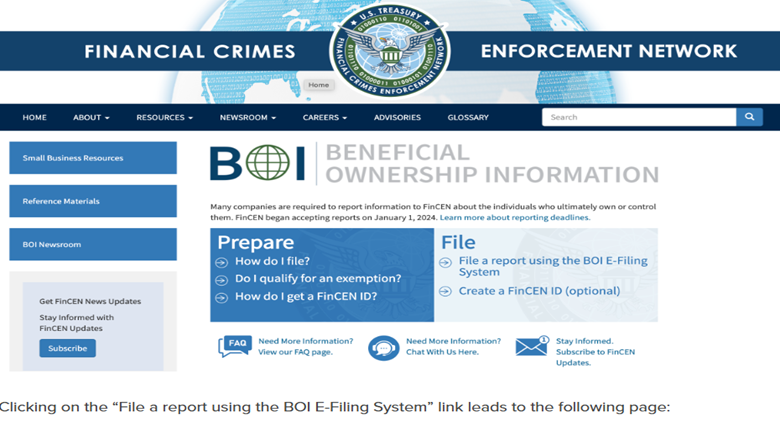

More information is available on FinCEN’s official website:

https://www.fincen.gov/boi

Beneficial Ownership Information (BOI) Explained – Who Is Considered an Owner or Controller Under CTA:

Beneficial Ownership Information (BOI) means information about individuals who:

- Own 25% or more of the company, or

- Exercise substantial control over the company’s decisions

BOI includes the individual’s full legal name, date of birth, residential address, and government-issued identification (such as a passport). This information is stored securely by FinCEN and is not publicly accessible.

For further clarification and official FAQs, readers can visit:

https://www.fincen.gov/boi-faqs

CTA Filing Requirements in 2025 – Which Companies Are Legally Required to Submit BOI Reports:

Under current rules, foreign reporting companies are required to file BOI reports.

A foreign reporting company is defined as:

- A company formed outside the United States, and

- Registered to do business in any U.S. state

| Company type | Place of formation | Registered in US | BOI filing required in 2025 |

| Domestic reporting company | United States | Yes | Mostly exempt |

| Foreign reporting company | Outside US (e.g., Pakistan) | Yes | Yes – must file |

Example:

A company incorporated in Pakistan that registers in Delaware or Texas is considered a foreign reporting company and must file a BOI report.

Key 2025 Regulatory Update – Domestic Company Exemption and Its Impact on Foreign Entities:

In 2025, FinCEN issued an Interim Final Rule (IFR) that exempted most domestic U.S.-formed companies from BOI reporting. However, this exemption does not apply to foreign-formed companies registered in the U.S.

This means:

- A U.S.-formed LLC (even if 100% foreign-owned) may be exempt

- A non-U.S. company registered in the U.S. is still required to file

This distinction is critical and frequently misunderstood.

BOI Reporting Deadlines for 2025 – Statutory Timelines Based on Registration Date:

Filing deadlines depend on when the foreign company was registered in the U.S.

BOI filing deadlines for 2025

| Registration timing | Filing deadline |

| Registered before 2024 | By April 25, 2025 |

| Registered in 2024 or later | Within 30 days |

Penalties and Legal Consequences of CTA Non-Compliance – Civil and Criminal Exposure Explained:

Failure to file a BOI report, or filing incorrect information, can result in:

- Civil penalties of $500 per day

- Maximum fines of up to $10,000

- Criminal penalties including up to two years imprisonment

Although FinCEN has temporarily paused enforcement while final rules are implemented, the legal obligation to comply remains in place.

Practical Illustration – CTA Applicability for a Pakistani Founder with a U.S.-Registered Business:

A Pakistani entrepreneur forms a company in Pakistan and registers it in Delaware to open a U.S. bank account and payment gateway. The company earns no revenue in its first year. Despite having no income, the company qualifies as a foreign reporting company and must file a BOI report with FinCEN. Failure to do so exposes the owner to CTA penalties.

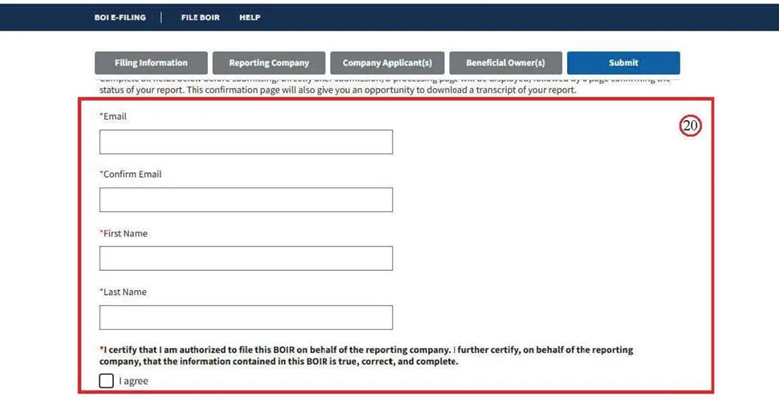

Information Required for BOI Filing – Personal and Company Details Required by FinCEN:

To complete the BOI report, the company must provide:

- Legal name and U.S. registration details of the company

- Beneficial owner details (name, date of birth, address, ID)

- Company applicant details (for newly registered entities)

No financial statements or tax returns are required.

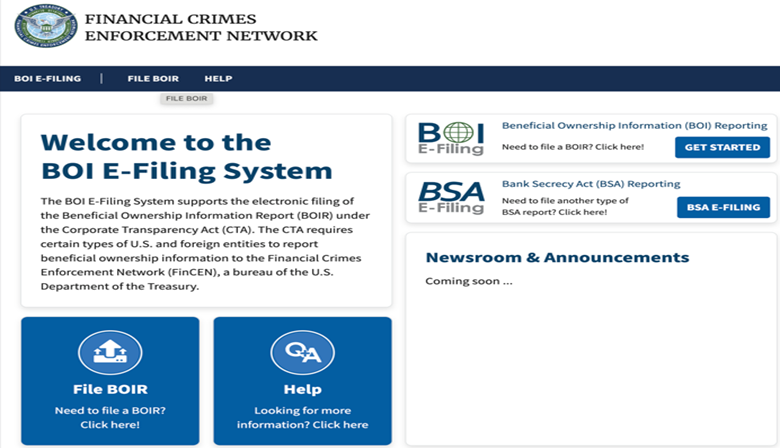

High-Level Overview of the BOI Filing Process – How CTA Reporting Is Submitted to FinCEN:

- Access FinCEN’s online BOI filing system

- Enter company identification details

- Enter beneficial owner information

- Review and submit electronically

The process is fully online and does not require a U.S. address.

For step-by-step filing guidance and system access, refer to:

https://www.fincen.gov/beneficial-ownership-information-reporting

Step 1: Access FinCEN’s online BOI filing system

Step 2: Enter company identification details

Step 3: Enter beneficial owner information

Step 4: Review and submit electronically

Ongoing CTA Compliance Obligations – Updating BOI Information After Ownership or Control Changes:

CTA compliance is not a one-time requirement. Any change in ownership, control, address, or identification details must be reported to FinCEN within 30 days. Failure to update information can lead to penalties.

CTA Compliance Outlook for 2026 – Expected Enforcement Trends and Regulatory Direction:

Looking ahead to 2026, CTA compliance is expected to become more strictly enforced. FinCEN has indicated that transitional relief periods will end, and automated enforcement and data-sharing with other regulators may increase. Foreign-owned entities should expect greater scrutiny, particularly where BOI information is missing, outdated, or inconsistent. Companies that establish proper reporting processes in 2025 will be better positioned to avoid penalties in 2026 and beyond.

Professional Opinion – Why Early and Accurate CTA Compliance Is Strategically Important:

From a compliance perspective, the Corporate Transparency Act represents a long-term shift toward increased regulatory transparency in the United States. Foreign owners who treat CTA as a one-time formality risk future penalties when ownership or control details change. Early and accurate compliance reduces legal exposure, improves credibility with banks and payment processors, and aligns the business with evolving U.S. regulatory expectations.

Common myths clarified:

“CTA only applies to U.S. citizens.”

This is incorrect. CTA applies based on the company’s legal status, not the owner’s nationality.

“If my company has no income, I don’t need to file.”

Incorrect. BOI reporting is required even if the company is inactive or earns zero revenue.

“U.S. compliance laws don’t matter if I live in Pakistan.”

Incorrect. CTA is a U.S. federal law and applies regardless of where the owner resides.

Official Guidance and Reference Sources:

For official and up-to-date information on CTA and BOI reporting requirements, readers are encouraged to consult primary U.S. government sources:

• FinCEN – Beneficial Ownership Information: https://www.fincen.gov/boi

• FinCEN BOI FAQs: https://www.fincen.gov/boi-faqs

• U.S. Treasury – Corporate Transparency Act Overview: https://home.treasury.gov

These sources provide authoritative guidance, filing instructions, and regulatory updates.

Scounts.pk assists foreign-owned U.S. businesses with accurate CTA assessment, BOI filing, and ongoing update requirements. Proper compliance through experienced professionals helps reduce regulatory risk and supports smoother banking and payment processes.