Introduction

Amazon FBA (Fulfillment by Amazon) is a powerful platform for international sellers, but it does not eliminate legal or tax responsibilities. In 2025 Compliance Strategy for FBA Sellers, compliance requirements are more complex than ever, especially for Pakistani and other non-US sellers.

This article provides a comprehensive 2025 compliance strategy for FBA sellers, explaining obligations like sales tax, the Corporate Transparency Act (CTA), IRS filings, and operational readiness. Using examples, tables, and actionable steps, the goal is to make these complex topics simple and actionable.

Why Amazon 2025 FBA Compliance Strategy Matters

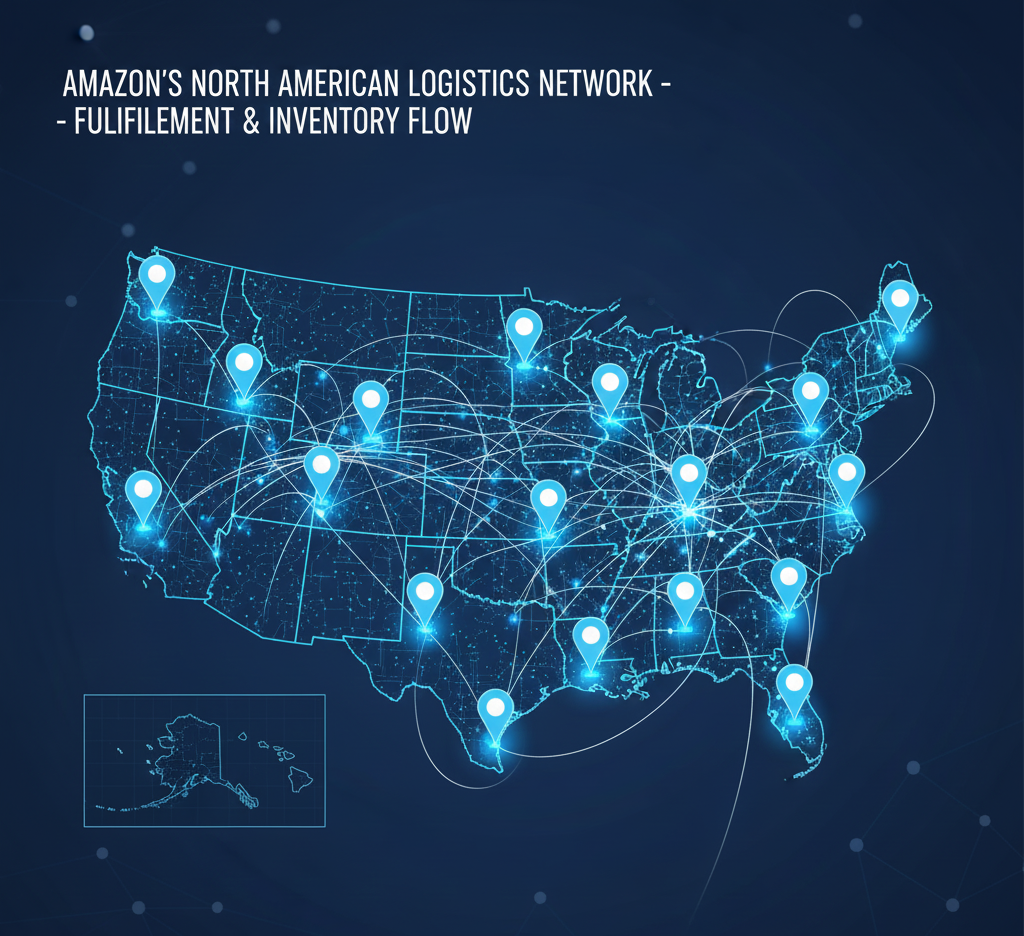

Amazon decides where your inventory is stored. Every storage location in the US can trigger 2025 compliance strategy for FBA sellers’ compliance obligations for sellers, even if the seller operates entirely from abroad.

What this means in practice:

- State-level sales tax obligations arise when inventory is in fulfillment centers

- Federal reporting rules apply even if the business is not profitable

- New transparency laws like CTA (Corporate Transparency Act, requires US companies to disclose ownership info to FinCEN) demand owner disclosure

Example scenario:

A seller in Lahore sends 1,000 units to Amazon. Amazon stores 400 units in California and later ships 200 to Texas. Without action, the seller now has nexus (a legal connection between your business and a US state that triggers tax obligations) in both states, making them liable for sales tax registration and reporting. Ignoring these rules can lead to high fines and penalties, even if sales are low.

Common Myths About Amazon 2025 FBA Compliance Strategy

Many sellers assume Amazon handles everything. This is not true. Understanding what Amazon does and does not cover is important, so I listed it below.

What Amazon Typically Handles:

Amazon acts as a marketplace facilitator in several US states. This means it automatically collects sales tax from buyers at checkout in certain jurisdictions. This can feel like “Amazon is taking care of everything,” but in reality, it only covers specific parts of the compliance puzzle.

- Sales Tax Collection

- In states with marketplace facilitator laws, Amazon calculates and collects sales tax for orders shipped to customers.

- Example: If your product is sold to a California customer, Amazon will collect the California sales tax at checkout and remit it to the state on your behalf.

- Transaction and Inventory Reports

- Amazon provides detailed records of sales, returns, and inventory movements.

- These reports help sellers track revenue, manage inventory, and identify nexus (states where they have tax obligations).

What Amazon Does NOT Handle:

Even though Amazon automates tax collection in some states, there are critical areas where compliance responsibility remains fully on the seller:

- Sales Tax Registration

- If your inventory creates nexus in a state (for example, inventory stored in Texas or New Jersey fulfillment centers), you must register your business with that state’s tax authority, even if Amazon collects tax at checkout.

- Example: A Lahore-based seller storing inventory in New York must register for New York sales tax. Amazon collecting tax does not fulfill this requirement.

- Sales Tax Filing and Reporting

- States may require sellers to submit monthly, quarterly, or annual tax returns.

- Amazon’s marketplace facilitator reporting may not cover all states or local tax rules.

- Corporate Transparency Act (CTA) Reporting

- Sellers using a US LLC must file Beneficial Ownership Information (BOI) with FinCEN.

- Amazon has no role in this federal reporting requirement.

- IRS Filings (Form 5472 / Form 1120 / 1120-F)

- Foreign-owned LLCs must file these forms to disclose foreign transactions and US activity.

- Amazon does not prepare or submit IRS forms; this is entirely the seller’s responsibility.

Source: Amazon Seller Central – Marketplace Tax Collection

Note: Treat Amazon as a service provider, not a legal shield. Compliance responsibility always lies with the seller.

The Risk of Waiting Until Sales Grow

Many FBA sellers think they can ignore compliance until their sales reach a certain threshold. For 2025 compliance strategy for FBA sellers, this is one of the most common mistakes.

Key points:

- Certain obligations apply even with zero revenue

- Penalties accumulate daily

- Ignorance does not protect you from audits

Example:

A Karachi-based entrepreneur forms a Wyoming LLC for FBA but delays CTA and IRS filings. Even without generating sales, fines for Form 5472 can reach $25,000, and CTA penalties can be $500 per day. Early action prevents backdated penalties and ensures smoother operations.

6 Steps for Understanding Nexus for Amazon FBA Sellers

Nexus (a legal connection that triggers tax duties) is created when a business has sufficient presence in a state. For FBA sellers, Amazon storage alone can create physical nexus.

How nexus is triggered:

- Inventory stored in a state’s fulfillment centers

- Automated inventory transfers between states

- Sales above certain thresholds in remote states (economic nexus)

Example:

Your Lahore-based business stores inventory in Florida. Even without employees or offices, Florida law treats you as having nexus, requiring registration and reporting.

Tip from experienced sellers:

Check inventory reports monthly to track nexus changes. This prevents surprise notices from states and avoids retroactive tax liability.

Step 1: Monitor Where Amazon Stores Your Inventory

Amazon FBA sellers must regularly review the Inventory Event Detail Report and Monthly Inventory Storage Report.

Actionable steps:

- List every US state where inventory is stored

- Mark any state exceeding thresholds for sales or units

- Prioritize states for registration based on risk of audit and penalties

Proactive planning rule: Once you know where your product is stored, research that state’s nexus rules immediately.

Example:

Inventory in Texas requires sales tax registration, even if Amazon already collects tax at checkout. Ignoring it can trigger penalties plus interest.

Step 2: Register and File Sales Tax Where Nexus Exists

Even if Amazon collects sales tax, sellers often need to register and file returns in nexus states.

Practical steps for Pakistani FBA sellers:

- Identify states where physical inventory exists

- Register for sales tax in each state

- Use platforms like TaxValet to automate filings

Example:

A seller with inventory in California, Ohio, and Illinois should register in all three states, then file monthly or quarterly returns, even if Amazon handles collection.

Tip: Keep copies of registration documents and monthly reports for audit-proof compliance.

Step 3: Track Revenue vs. Compliance Thresholds

Sales tax, CTA filings, and IRS requirements are not triggered by profit alone.

Track:

- Gross revenue per state

- Inventory levels per state

- Transactions between the LLC and owners

Example:

A Karachi-based LLC with minimal US sales still owes Form 5472 if the foreign owner funds the company. Monitoring thresholds helps prevent costly late filings and ensures timely reporting.

Step 4: File CTA BOI for US LLCs

CTA (Corporate Transparency Act – requires US companies to disclose ownership info to FinCEN) applies to most US LLCs and corporations.

BOI (Beneficial Ownership Information – details of company owners required by FinCEN) includes:

- Name of each owner

- Residential address

- Passport or government-issued ID

- Ownership percentage

Deadlines:

- New LLCs (2025): file within 30 days

- Pre-2024 LLCs: file by January 1, 2025

Example:

A Pakistani founder forming a Delaware LLC for Amazon must file BOI, even if sales are zero. CTA penalties are $500 per day until compliance is met.

Step 5: File Required IRS Forms

Foreign-owned US LLCs must file specific IRS forms.

Key filings:

- Form 5472 (for reportable transactions by foreign owners)

- Form 1120 / 1120-F (annual federal tax returns)

Disregarded entity (an LLC ignored for income tax purposes but still required to submit information returns) may still need Form 5472.

Example:

Even with no revenue, failing to submit Form 5472 results in $25,000 fines.

Step 6: Maintain Operational Readiness

Operational readiness supports compliance.

Best practices:

- Keep a US bank account active

- Maintain consistent payment methods with Amazon

- Use a valid US address for registration

- Organize and store documentation from day one

These steps minimize friction for filings and audit responses.

2025 Compliance Strategy for FBA Sellers Overview Table

| Compliance Area | Trigger | Who Must File | Frequency | Penalties |

| Sales Tax | Inventory in state | FBA sellers | Monthly / Quarterly | State-based |

| CTA BOI | US entity ownership | LLCs & Corporations | One-time + updates | $500/day |

| Form 5472 | Foreign owner | Foreign-owned LLCs | Annual | $25,000 |

| Form 1120 / 1120-F | US activity | Corporations | Annual | IRS penalties |

Federal Compliance: IRS Filings for Foreign-Owned LLCs

Pakistani FBA sellers forming U.S. LLCs must comply with federal regulations.

Form 5472

- Required for foreign-owned LLCs (≥25% ownership) with reportable transactions (capital contribution, management fees, reimbursements).

- File annually with pro-forma Form 1120.

- Penalty: $25,000 per violation.

Example: Karachi founder contributes $50k to Delaware LLC → must file 5472.

Reference: IRS Instructions for Form 5472

Form 1120-F

- Reports effectively connected income (ECI) (US-related income that must be reported to the IRS) in the U.S.

- Deadline: June 15 (calendar-year taxpayer)

- Avoids penalties even if no tax is owed.

Example: Karachi LLC earns $600k in U.S. sales with $100k deductible expenses → file 1120-F for compliance.

Corporate Transparency Act (CTA) / BOI

- Foreign-owned LLCs must submit Beneficial Ownership Information (BOI) to FinCEN.

- Report all owners with ≥25% stake or substantial control.

- Penalties: Up to $10,000 per violation.

Stepwise Action:

- Identify all beneficial owners

- Submit BOI electronically

- Update changes within 30 days

For guidance on federal filings and CTA/BOI, contact Scounts.pk.

Why Proactive Planning Matters in 2025 Compliance Strategy for FBA Sellers

Sellers who plan proactively:

- Avoid unexpected penalties

- Reduce audit risk

- Scale without disruption

Correcting compliance after Amazon distributes inventory across multiple states is costly and stressful. Treat compliance as a single integrated system, not separate tasks.

Practical Guidance for Pakistani Amazon FBA Sellers

Maintain U.S. banking and payment methods

A U.S. bank account is often required to pay sales tax and handle refunds. It also supports smoother IRS filings and reduces delays with tax authorities.

Monitor U.S. inventory locations monthly

Amazon frequently moves inventory between states. Even a small inventory shift can create physical nexus (tax obligation), so reviewing inventory reports monthly helps avoid unregistered states.

Keep a valid U.S. address for registrations

State and federal agencies require a U.S. mailing address for official notices. A registered agent or mail service ensures you don’t miss compliance communications.

Track revenue and nexus thresholds

Economic nexus depends on total sales per state. Monitoring revenue regularly helps you register on time and avoid backdated tax liabilities.

File CTA, IRS forms, and state sales tax on time

Foreign-owned LLCs must meet CTA, IRS, and state deadlines. Timely filing prevents penalties and keeps your Amazon business in good standing.

Reference: Amazon Seller Tax Help Pages

Final Thoughts

The 2025 compliance strategy for FBA sellers requires understanding, proactive planning, and regular monitoring. Treat sales tax, CTA, and IRS filings as a single integrated system. Planning early ensures:

- Smooth scaling of your Amazon FBA business

- Avoidance of penalties and fines

- Focus on growth rather than compliance crises

Compliance is not optional; it’s a foundation for sustainable success. For personalized guidance, filing assistance, and expert consultation, contact Scounts today.

Frequently Asked Questions (FAQs)

Yes, many states require registration even if Amazon collects tax at checkout.

New LLCs must file BOI with FinCEN within 30 days of formation.

No, physical inventory creates nexus regardless of employees or offices.

No, LLC formation does not remove state-level sales tax obligations.

Monthly monitoring of Amazon inventory reports is recommended to stay compliant.