You ship a few cartons to a US warehouse so you can deliver in 2 days instead of 8.

Sales start to climb. Reviews improve. Returns drop.

Then you get an email from your 3PL: “We moved part of your inventory to a new facility to improve delivery speed.”

You do not think much of it. You did not sign a lease. You did not open an office. You did not hire staff.

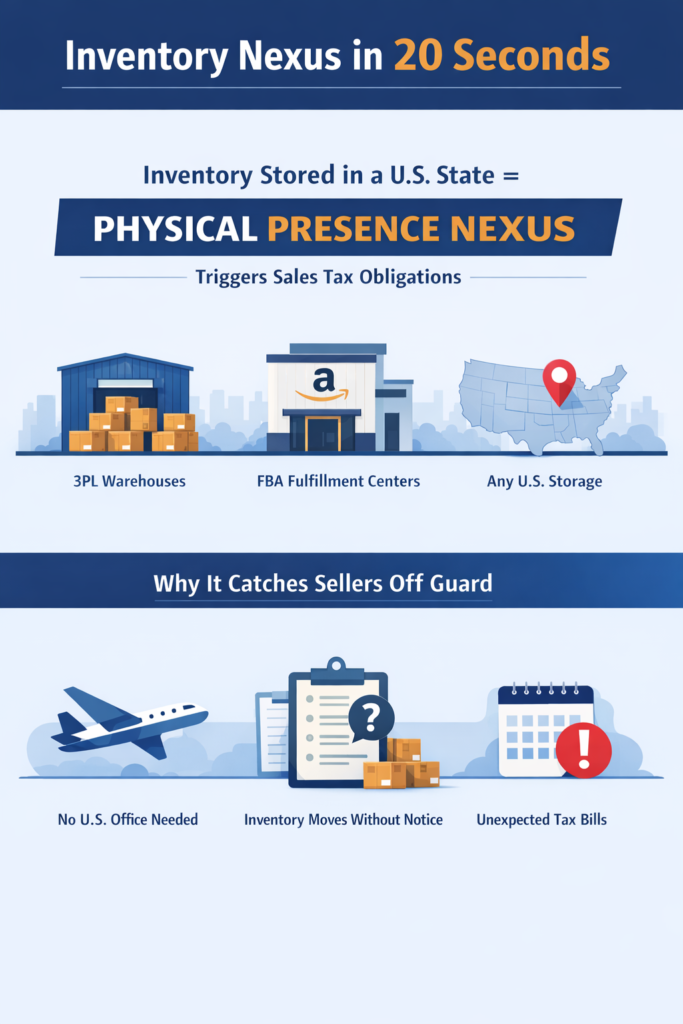

But from a sales tax point of view, one fact matters more than all of that:

Your inventory sat inside a US state.

That single detail can trigger sales tax nexus in many states. It can force sales tax registration, tax collection, and filing duties. It can also create backdated exposure if you discover it late.

This catches foreign sellers and remote brands all the time because it feels unfair. The warehouse is not yours. The staff is not yours. The building is not yours.

States often do not care.

Most states treat in-state inventory as physical presence nexus. Avalara summarizes the rule clearly: most states conclude that any inventory stored in their state creates a tax obligation (nexus).

This guide breaks it down in plain terms:

- What inventory nexus means for e-commerce sellers

- Why 3PL warehouses can create nexus (not just Amazon FBA)

- The myths that keep sellers exposed

- Practical steps to track inventory locations, spot new-state risk fast, and plan shipments with fewer surprises

If you store goods in the US through ShipBob, Amazon FBA, Flexport, Deliverr, or any 3PL, you need this logic nailed down before a notice shows up.

What Is Sales Tax Nexus and Why Warehouse Inventory Triggers It?

Sales tax nexus is the legal link that lets a US state require you to follow its sales tax rules.

When you have nexus in a state, that state can require you to:

- register for sales tax

- collect sales tax on taxable sales

- file returns and remit tax

Charging sales tax on invoices and worried you are doing it wrong? This guide shows when you should charge sales tax and when you should not.

The key is sales tax nexus; the legal connection between a business and a taxing authority that creates an obligation to register, collect, and remit tax. Avalara

Sales Tax Nexus Definition for E-commerce Sellers

E-commerce sellers usually create nexus in two ways.

1) Economic nexus

You trigger nexus by crossing a sales threshold in a state. States set their own thresholds and measurement rules. Economic nexus thresholds are established at the state level and outline when a seller’s sales activity creates a sales tax obligation. Avalara

2) Physical presence nexus

You trigger nexus by having a physical footprint in a state. Inventory stored in a state is a common trigger under physical presence rules. In most states, storing inventory in-state creates a physical nexus, even when a third-party warehouse holds the stock. Avalara

Not sure which states you already have nexus in? Use our nexus checklist for foreign sellers, then compare it to your inventory states.

Inventory Nexus Meaning: Why States Treat Stored Goods as Physical Presence

Inventory nexus means this:

Your products are physically located inside a state, so the state treats you as present in that state.

This applies even when a third party stores the inventory. That includes:

- Amazon FBA warehouses

- ShipBob facilities

- Flexport fulfillment

- any 3PL or regional warehouse network

In plain terms: most states treat any in-state inventory as a nexus trigger, meaning storing even a small amount of inventory can create a sales tax obligation. Avalara

This is the key point foreign sellers miss.

You do not need to own the building.

You do not need to visit the state.

The state focuses on where your property sits.

Third-Party Warehouses (3PL) That Can Create Inventory Nexus

If a 3PL stores your products in a US state, that state can treat you as having physical presence nexus. You can trigger sales tax obligations without an office, staff, or lease.

The general rule is clear: most states treat in-state inventory as creating a tax obligation, also known as nexus.

3PL Inventory Nexus: ShipBob, Flexport, Deliverr, and Regional Fulfillment Networks

A 3PL model looks simple. You ship units to a warehouse. The 3PL picks, packs, and ships orders.

The tax risk starts the moment your inventory sits in-state.

States often treat these facts as nexus triggers:

- You store property for sale in the state

- Your inventory sits in a warehouse you do not own

- A fulfillment center holds your goods and ships to customers

Physical presence nexus guidance consistently lists in-state inventory as a nexus trigger and explains that storing property for sale can establish a nexus. Avalara

This applies to any fulfillment partner, not just Amazon. The building owner does not change the core fact. Your goods sit inside the state. Avalara

Amazon FBA Inventory Nexus vs 3PL Inventory Nexus

Amazon FBA is a type of third-party fulfillment. The same nexus logic applies.

The difference is control.

Amazon can move inventory across its network to speed delivery. That can place your inventory in states you did not plan for. A 3PL can do the same if it runs multi-state facilities. Avalara

The risk is simple: fulfillment networks can relocate your inventory to another state without notice. That move can create a physical presence nexus in a state where you are not registered. Grant Thornton

So treat FBA and 3PL networks the same way:

- assume inventory can move

- track where it lands

- log dates for every state

Why States Treat 3PL Inventory as Physical Presence Nexus

States look for a physical tie.

Inventory creates that tie because your property sits in the state and supports sales into the state. In general, in-state inventory can establish a nexus, which can require a seller to register, collect, and remit sales tax. Avalara

Here is the key seller takeaway.

If you store inventory in a state, act as if you may have a nexus in that state until you confirm otherwise.

Common Myths About Warehouse Inventory and Sales Tax Obligations

Bad assumptions create expensive tax exposure. Most sellers repeat the same three myths.

Myth 1: “It is not my building, so it is not my nexus”

A state does not need you to own the warehouse.

A state looks at where your property sits.

If your inventory sits in a state, the state can treat that as physical presence nexus. In simple terms, most states treat in-state inventory as creating a tax obligation called nexus. Avalara

What this means for you:

- A 3PL warehouse can create nexus

- Amazon FBA inventory can create nexus

- You can trigger nexus without staff or office space. Avalara

Myth 2: “I can avoid nexus by sending small batches”

Inventory nexus does not work like economic nexus.

Economic nexus uses thresholds.

Inventory nexus often starts with presence.

If you store inventory in a state, the state can treat that as a nexus even if you store a small quantity.

What this means for you:

- A test shipment can still create exposure

- A low-volume SKU can still create exposure

- You should log the first date inventory entered the state. Avalara

Myth 3: “My 3PL moved inventory without asking, so I am not responsible”

3PL networks move inventory to speed delivery.

FBA does this at scale.

Amazon can relocate inventory between facilities without the seller’s knowledge. That relocation can give the seller physical presence in a state where the seller is not registered to collect sales tax. Grant Thornton

What this means for you:

- You cannot rely on memory

- You need facility-level inventory history

- You need dates for every state where inventory sat. Grant Thornton

Myth 4: “Amazon collects sales tax, so I can ignore nexus”

Marketplace rules can reduce your collection workload on marketplace sales.

They do not erase all obligations in every state.

Pennsylvania makes a key point explicit. A business must collect Pennsylvania sales tax when it maintains inventory in Pennsylvania and makes direct sales to Pennsylvania customers. Pennsylvania Government

Texas also shows why marketplace logic does not solve everything. A seller with physical presence in Texas must have an active sales and use tax permit, even if the seller sells through a marketplace that collects and remits. Texas Comptroller

What this means for you:

- Separate marketplace sales from direct sales in your reports

- Treat inventory states as high-priority review states

- Do not assume marketplace collection ends your compliance work Pennsylvania Government

The Real Risk: Your 3PL Can Move Inventory Across States Without Asking

Fulfillment networks optimize for delivery speed.

They rebalance inventory across warehouses.

You may not control where your stock ends up.

This can create a silent nexus. Your inventory enters a new state, and you do not notice it.

Amazon can relocate inventory between distribution or fulfillment centers without the seller’s knowledge. That move can give the retailer physical presence in a state where the retailer is not registered to collect sales tax. Grant Thornton

Inventory location matters because most states treat in-state inventory as creating a tax obligation, known as nexus. Avalara

Inventory Rebalancing Creates Silent Nexus

Silent nexus happens when:

- your inventory moves into a new state

- you keep selling as normal

- you do not register because you do not know inventory is there

States focus on a simple fact.

Your property sat in the state.

That can establish physical presence nexus. Avalara

Why You Cannot Defend What You Do Not Track

If a state questions your compliance, it will ask for evidence.

Dates matter. Locations matter. Facility history matters.

If you cannot prove when inventory entered a state, you lose control of the timeline.

This is why your first operational fix is simple.

Track where inventory sits and when it moved. Avalara

What Tax Obligations Inventory Nexus Can Trigger

Inventory nexus can trigger real compliance duties. Not theory. Not best practice.

Sales Tax Registration Requirements After Inventory Creates Nexus

When you have physical presence in a state, a state may require you to register for a sales tax permit.

Pennsylvania makes the trigger explicit. A business must collect Pennsylvania sales tax when it maintains inventory in Pennsylvania and makes direct sales to Pennsylvania customers. Pennsylvania Government

Texas shows a similar compliance expectation for sellers with presence. Texas guidance for marketplace sellers states you are still responsible for having a Texas tax permit and filing returns, even if your only sales are through a marketplace provider. Texas Comptroller

Sales Tax Collection and Filing Duties After Nexus

After you register, states expect you to:

- collect sales tax on taxable sales

- file returns on the required schedule

- remit tax on time

Pennsylvania’s guidance lists collection duties tied to inventory plus direct sales and also calls out cases where a marketplace facilitator does not collect or remit. Pennsylvania Government

Back Taxes, Interest, and Penalties From Late Action

Late discovery is where sellers get hurt.

If a state determines that nexus existed earlier than your registration date, the state may assess tax for earlier periods.

That is why controlling the timeline matters. Tracking inventory location and movement reduces surprise exposure because most states treat stored inventory as a nexus. Avalara

Florida vs Texas vs Pennsylvania: Inventory Nexus Table and Seller Takeaways

If your inventory sits in one of these states, treat it as a nexus trigger until you confirm your exact fact pattern. Physical presence nexus guidance commonly lists in-state inventory as a nexus trigger. For example, inventory stored in Texas through FBA or any fulfillment warehouse can establish Texas nexus. Avalara

Inventory nexus table (Florida, Texas, Pennsylvania)

| State | What triggers the sales tax problem | What the state says | What you should do first |

| Florida | Inventory stored in Florida plus taxable Florida sales | Florida DOR says you must register as a sales and use tax dealer before you begin conducting business in Florida if you will sell taxable goods or services. floridarevenue.com | Log the first date inventory entered Florida. Check if your products are taxable. Prepare registration if you have taxable Florida sales. floridarevenue.com |

| Texas | Inventory stored in Texas is a physical presence signal; marketplace selling does not remove permit duties for Texas sellers | Texas Comptroller says marketplace sellers are still responsible for having a Texas tax permit and filing returns, even if all sales go through a marketplace provider. Texas Comptroller | Pull your inventory location history. If Texas shows up, treat it as a compliance review event. Confirm your selling model and permit needs. Texas Comptroller |

| Pennsylvania | Inventory in Pennsylvania plus direct sales to PA customers | PA DOR says you must collect PA sales tax when you maintain inventory in Pennsylvania and make direct sales to Pennsylvania customers. Pennsylvania Government | Separate direct sales from marketplace sales. If you have PA inventory and direct sales, treat it as high urgency. Pennsylvania Government |

Key takeaways you should apply

- Inventory creates physical presence facts. Many states treat stored inventory as a nexus even when a third party owns the facility. Avalara

- Texas is strict on permit and filing expectations for marketplace sellers who are Texas sellers. Do not assume marketplace collection ends your admin work. Texas Comptroller

- Pennsylvania draws a clear line for inventory plus direct sales. If you sell direct into PA and keep inventory there, expect a sales tax duty. Pennsylvania Government

- Do not write absolute claims for PA marketplace only sellers. PA guidance also shows other conditions and nuances. Track your facts and document your channel mix. Pennsylvania Government

Inventory Tracking System: Ledger, Reports, and Review Cadence

If you want control, you need an inventory trail you can prove. Inventory is a common physical presence nexus trigger. Physical presence nexus does not usually depend on revenue thresholds. If your inventory sits in a state, registration and collection duties may start right away. Avalara+1

Inventory location ledger (what to track)

Create one sheet. One row per facility per SKU per date range.

Track these fields:

- Warehouse provider (FBA, ShipBob, 3PL name)

- Facility name or code

- State

- First date inventory arrived

- Last date inventory left (or “still stored”)

- SKU

- Average units on hand (monthly)

- Channel tag: marketplace only, direct only, mixed

- Who moved it: you, auto rebalancing, 3PL transfer

- Source proof link: export file name, report ID, screenshot

This ledger supports the core question auditors ask. When did inventory first sit in the state. Avalara

Tracking is hard, but do you know what happens when you miss filings? Read what “missed compliance” can trigger, then set a simple monthly routine.

Reports to pull

Pull reports that show location history, not just totals.

Minimum set:

- Inventory by location report (state and facility)

- Inventory event history (transfers, relocations, check-ins)

- Fulfillment center list used in the last 12 months

- Orders by destination state split by channel (direct vs marketplace)

Your goal is simple. Match inventory states to sales states. Then decide where you have obligations. Avalara

Cadence that works

- Weekly: check if inventory entered a new state

- Monthly: reconcile the ledger to your provider exports

- Quarterly: run a nexus review for new states and new channels

Treat a new inventory state as a trigger event. Most states treat in-state inventory as nexus. That is why speed matters. Avalara

Step by Step Playbook: What to Do When Inventory Enters a New State

Treat a new inventory state like a compliance trigger. Inventory stored in-state can establish physical presence nexus in many states. Avalara

- Confirm the state and facility

Pull the exact facility name or code. Save the export or screenshot as proof. Choosing an LLC state and trying to avoid future compliance mess? This guide helps you choose a state based on fees, rules, and long-term burden.

- Log the first in-state date

Write the earliest date inventory arrived in that state. This date often becomes your nexus start point. Avalara

- Check how inventory got there

Mark the movement type:

- you shipped it

- 3PL transfer

- auto rebalancing

FBA can move inventory across facilities without the seller’s knowledge. Grant Thornton

- Split sales by channel right now

Create two numbers for that state:

- direct sales (Shopify, WooCommerce, invoices)

- marketplace sales (Amazon, Walmart, eBay)

Pennsylvania ties collection duty to inventory plus direct sales in its published guidance. Pennsylvania Government

- Decide if you must register

Use this logic:

- inventory in state and taxable direct sales often means you should review registration fast

- marketplace sales alone can still create obligations in some cases, so do not guess

Texas states marketplace sellers still need a permit and must file returns if they are Texas sellers selling through a marketplace. Texas Comptroller

- Set a filing owner and calendar

If you register, assign a person and a recurring filing routine. Texas reminds permit holders they must still file returns even with zero tax due. Texas Comptroller

Owning a US LLC from abroad and unsure what you must file? Use this filing guide to understand what keeps your LLC compliant.

- Store your proof in one folder

Keep: inventory logs, facility history, and state sales reports. This protects you if the state questions your start date.

Final Thoughts

Warehouse inventory creates real tax exposure because it creates physical presence facts. You do not need an office. You do not need staff. Your goods sitting in a state can be enough to trigger nexus in many states.

If you want to stay safe, do three things:

- Track every state where your inventory sits, with dates and facilities

- Separate direct sales from marketplace sales in your reporting

- Treat every new inventory state as a compliance trigger

This is not about fear. It is about control. When you control the inventory trail, you control your compliance timeline.

Want to avoid surprise US sales tax notices from 3PL inventory moves?

Scounts.pk helps you register your company, manage taxes, and handle compliance in Pakistan and the USA.

Need help? Chat with us on WhatsApp or visit our Contact Us page.

FAQs: Warehouse Inventory Nexus and Sales Tax Obligations

Does inventory in a 3PL warehouse create sales tax nexus?

Yes, it can. Many states treat inventory stored in-state as physical presence nexus, even when a third party owns the facility.

Does Amazon FBA inventory create sales tax nexus in every state?

Inventory stored in a state can establish nexus in many jurisdictions, though enforcement and specifics differ. Many states treat inventory held in third-party fulfillment warehouses, including Amazon FBA facilities, as physical presence nexus.

If Amazon moves my inventory without asking, can that still create nexus?

Yes, it can. Under FBA-style fulfillment, inventory may be relocated to another state without the seller’s knowledge. That move can create physical presence nexus in a state where the seller is not registered.

If a marketplace collects sales tax, do I still need to register?

Do not assume you are done. States differ. Pennsylvania says you must collect PA sales tax when you maintain inventory in Pennsylvania and make direct sales to PA customers. Pennsylvania also notes cases where a marketplace facilitator does not collect or remit. Pennsylvania Government

Texas says Texas sellers selling through a marketplace are still responsible for having a Texas tax permit and filing returns. Texas Comptroller

What if I only have inventory in Pennsylvania through FBA and no direct sales?

Pennsylvania’s published rule is clear for inventory plus direct sales. Pennsylvania Government

In Online Merchants Guild v. Hassell (Pennsylvania Commonwealth Court, September 9, 2022), the court held that FBA inventory stored in Pennsylvania, by itself, was not enough in that case to require certain out-of-state sellers to collect and remit Pennsylvania sales tax. Treat outcomes like this as state-specific legal territory that can turn on the exact facts and the state’s due process analysis. pacourts.us

Do small inventory quantities avoid nexus?

Do not rely on that outcome. Inventory-based nexus often starts from physical presence, not revenue thresholds. If your inventory sits in another state, obligations can begin immediately, sometimes from the first sale.

How do I know which states my inventory was stored in?

Use your 3PL or FBA inventory location and inventory event history exports. Track facility and date. This matters because inventory in-state is a physical presence trigger in many states. Avalara

What is the fastest way to reduce surprise nexus while scaling fulfillment?

Control what you can. Track every inventory state weekly. Treat any new state as a review event. Inventory location drives physical presence nexus risk in many states. AvalaraYou ship a few cartons to a US warehouse so you can deliver in 2 days instead of 8.

Sales start to climb. Reviews improve. Returns drop.

Then you get an email from your 3PL: “We moved part of your inventory to a new facility to improve delivery speed.”

You do not think much of it. You did not sign a lease. You did not open an office. You did not hire staff.

But from a sales tax point of view, one fact matters more than all of that:

Your inventory sat inside a US state.

That single detail can trigger sales tax nexus in many states. It can force sales tax registration, tax collection, and filing duties. It can also create backdated exposure if you discover it late.

This catches foreign sellers and remote brands all the time because it feels unfair. The warehouse is not yours. The staff is not yours. The building is not yours.

States often do not care.

Most states treat in-state inventory as physical presence nexus. Avalara summarizes the rule clearly: most states conclude that any inventory stored in their state creates a tax obligation (nexus).

This guide breaks it down in plain terms:

- What inventory nexus means for e-commerce sellers

- Why 3PL warehouses can create nexus (not just Amazon FBA)

- The myths that keep sellers exposed

- Practical steps to track inventory locations, spot new-state risk fast, and plan shipments with fewer surprises

If you store goods in the US through ShipBob, Amazon FBA, Flexport, Deliverr, or any 3PL, you need this logic nailed down before a notice shows up.

What Is Sales Tax Nexus and Why Warehouse Inventory Triggers It?

Sales tax nexus is the legal link that lets a US state require you to follow its sales tax rules.

When you have nexus in a state, that state can require you to:

- register for sales tax

- collect sales tax on taxable sales

- file returns and remit tax

Charging sales tax on invoices and worried you are doing it wrong? This guide shows when you should charge sales tax and when you should not.

The key is sales tax nexus; the legal connection between a business and a taxing authority that creates an obligation to register, collect, and remit tax. Avalara

Sales Tax Nexus Definition for E-commerce Sellers

E-commerce sellers usually create nexus in two ways.

1) Economic nexus

You trigger nexus by crossing a sales threshold in a state. States set their own thresholds and measurement rules. Economic nexus thresholds are established at the state level and outline when a seller’s sales activity creates a sales tax obligation. Avalara

2) Physical presence nexus

You trigger nexus by having a physical footprint in a state. Inventory stored in a state is a common trigger under physical presence rules. In most states, storing inventory in-state creates a physical nexus, even when a third-party warehouse holds the stock. Avalara

Not sure which states you already have nexus in? Use our nexus checklist for foreign sellers, then compare it to your inventory states.

Inventory Nexus Meaning: Why States Treat Stored Goods as Physical Presence

Inventory nexus means this:

Your products are physically located inside a state, so the state treats you as present in that state.

This applies even when a third party stores the inventory. That includes:

- Amazon FBA warehouses

- ShipBob facilities

- Flexport fulfillment

- any 3PL or regional warehouse network

In plain terms: most states treat any in-state inventory as a nexus trigger, meaning storing even a small amount of inventory can create a sales tax obligation. Avalara

This is the key point foreign sellers miss.

You do not need to own the building.

You do not need to visit the state.

The state focuses on where your property sits.

Third-Party Warehouses (3PL) That Can Create Inventory Nexus

If a 3PL stores your products in a US state, that state can treat you as having physical presence nexus. You can trigger sales tax obligations without an office, staff, or lease.

The general rule is clear: most states treat in-state inventory as creating a tax obligation, also known as nexus.

3PL Inventory Nexus: ShipBob, Flexport, Deliverr, and Regional Fulfillment Networks

A 3PL model looks simple. You ship units to a warehouse. The 3PL picks, packs, and ships orders.

The tax risk starts the moment your inventory sits in-state.

States often treat these facts as nexus triggers:

- You store property for sale in the state

- Your inventory sits in a warehouse you do not own

- A fulfillment center holds your goods and ships to customers

Physical presence nexus guidance consistently lists in-state inventory as a nexus trigger and explains that storing property for sale can establish a nexus. Avalara

This applies to any fulfillment partner, not just Amazon. The building owner does not change the core fact. Your goods sit inside the state. Avalara

Amazon FBA Inventory Nexus vs 3PL Inventory Nexus

Amazon FBA is a type of third-party fulfillment. The same nexus logic applies.

The difference is control.

Amazon can move inventory across its network to speed delivery. That can place your inventory in states you did not plan for. A 3PL can do the same if it runs multi-state facilities. Avalara

The risk is simple: fulfillment networks can relocate your inventory to another state without notice. That move can create a physical presence nexus in a state where you are not registered. Grant Thornton

So treat FBA and 3PL networks the same way:

- assume inventory can move

- track where it lands

- log dates for every state

Why States Treat 3PL Inventory as Physical Presence Nexus

States look for a physical tie.

Inventory creates that tie because your property sits in the state and supports sales into the state. In general, in-state inventory can establish a nexus, which can require a seller to register, collect, and remit sales tax. Avalara

Here is the key seller takeaway.

If you store inventory in a state, act as if you may have a nexus in that state until you confirm otherwise.

Common Myths About Warehouse Inventory and Sales Tax Obligations

Bad assumptions create expensive tax exposure. Most sellers repeat the same three myths.

Myth 1: “It is not my building, so it is not my nexus”

A state does not need you to own the warehouse.

A state looks at where your property sits.

If your inventory sits in a state, the state can treat that as physical presence nexus. In simple terms, most states treat in-state inventory as creating a tax obligation called nexus. Avalara

What this means for you:

- A 3PL warehouse can create nexus

- Amazon FBA inventory can create nexus

- You can trigger nexus without staff or office space. Avalara

Myth 2: “I can avoid nexus by sending small batches”

Inventory nexus does not work like economic nexus.

Economic nexus uses thresholds.

Inventory nexus often starts with presence.

If you store inventory in a state, the state can treat that as a nexus even if you store a small quantity.

What this means for you:

- A test shipment can still create exposure

- A low-volume SKU can still create exposure

- You should log the first date inventory entered the state. Avalara

Myth 3: “My 3PL moved inventory without asking, so I am not responsible”

3PL networks move inventory to speed delivery.

FBA does this at scale.

Amazon can relocate inventory between facilities without the seller’s knowledge. That relocation can give the seller physical presence in a state where the seller is not registered to collect sales tax. Grant Thornton

What this means for you:

- You cannot rely on memory

- You need facility-level inventory history

- You need dates for every state where inventory sat. Grant Thornton

Myth 4: “Amazon collects sales tax, so I can ignore nexus”

Marketplace rules can reduce your collection workload on marketplace sales.

They do not erase all obligations in every state.

Pennsylvania makes a key point explicit. A business must collect Pennsylvania sales tax when it maintains inventory in Pennsylvania and makes direct sales to Pennsylvania customers. Pennsylvania Government

Texas also shows why marketplace logic does not solve everything. A seller with physical presence in Texas must have an active sales and use tax permit, even if the seller sells through a marketplace that collects and remits. Texas Comptroller

What this means for you:

- Separate marketplace sales from direct sales in your reports

- Treat inventory states as high-priority review states

- Do not assume marketplace collection ends your compliance work Pennsylvania Government

The Real Risk: Your 3PL Can Move Inventory Across States Without Asking

Fulfillment networks optimize for delivery speed.

They rebalance inventory across warehouses.

You may not control where your stock ends up.

This can create a silent nexus. Your inventory enters a new state, and you do not notice it.

Amazon can relocate inventory between distribution or fulfillment centers without the seller’s knowledge. That move can give the retailer physical presence in a state where the retailer is not registered to collect sales tax. Grant Thornton

Inventory location matters because most states treat in-state inventory as creating a tax obligation, known as nexus. Avalara

Inventory Rebalancing Creates Silent Nexus

Silent nexus happens when:

- your inventory moves into a new state

- you keep selling as normal

- you do not register because you do not know inventory is there

States focus on a simple fact.

Your property sat in the state.

That can establish physical presence nexus. Avalara

Why You Cannot Defend What You Do Not Track

If a state questions your compliance, it will ask for evidence.

Dates matter. Locations matter. Facility history matters.

If you cannot prove when inventory entered a state, you lose control of the timeline.

This is why your first operational fix is simple.

Track where inventory sits and when it moved. Avalara

What Tax Obligations Inventory Nexus Can Trigger

Inventory nexus can trigger real compliance duties. Not theory. Not best practice.

Sales Tax Registration Requirements After Inventory Creates Nexus

When you have physical presence in a state, a state may require you to register for a sales tax permit.

Pennsylvania makes the trigger explicit. A business must collect Pennsylvania sales tax when it maintains inventory in Pennsylvania and makes direct sales to Pennsylvania customers. Pennsylvania Government

Texas shows a similar compliance expectation for sellers with presence. Texas guidance for marketplace sellers states you are still responsible for having a Texas tax permit and filing returns, even if your only sales are through a marketplace provider. Texas Comptroller

Sales Tax Collection and Filing Duties After Nexus

After you register, states expect you to:

- collect sales tax on taxable sales

- file returns on the required schedule

- remit tax on time

Pennsylvania’s guidance lists collection duties tied to inventory plus direct sales and also calls out cases where a marketplace facilitator does not collect or remit. Pennsylvania Government

Back Taxes, Interest, and Penalties From Late Action

Late discovery is where sellers get hurt.

If a state determines that nexus existed earlier than your registration date, the state may assess tax for earlier periods.

That is why controlling the timeline matters. Tracking inventory location and movement reduces surprise exposure because most states treat stored inventory as a nexus. Avalara

Florida vs Texas vs Pennsylvania: Inventory Nexus Table and Seller Takeaways

If your inventory sits in one of these states, treat it as a nexus trigger until you confirm your exact fact pattern. Physical presence nexus guidance commonly lists in-state inventory as a nexus trigger. For example, inventory stored in Texas through FBA or any fulfillment warehouse can establish Texas nexus. Avalara

Inventory nexus table (Florida, Texas, Pennsylvania)

| State | What triggers the sales tax problem | What the state says | What you should do first |

| Florida | Inventory stored in Florida plus taxable Florida sales | Florida DOR says you must register as a sales and use tax dealer before you begin conducting business in Florida if you will sell taxable goods or services. floridarevenue.com | Log the first date inventory entered Florida. Check if your products are taxable. Prepare registration if you have taxable Florida sales. floridarevenue.com |

| Texas | Inventory stored in Texas is a physical presence signal; marketplace selling does not remove permit duties for Texas sellers | Texas Comptroller says marketplace sellers are still responsible for having a Texas tax permit and filing returns, even if all sales go through a marketplace provider. Texas Comptroller | Pull your inventory location history. If Texas shows up, treat it as a compliance review event. Confirm your selling model and permit needs. Texas Comptroller |

| Pennsylvania | Inventory in Pennsylvania plus direct sales to PA customers | PA DOR says you must collect PA sales tax when you maintain inventory in Pennsylvania and make direct sales to Pennsylvania customers. Pennsylvania Government | Separate direct sales from marketplace sales. If you have PA inventory and direct sales, treat it as high urgency. Pennsylvania Government |

Key takeaways you should apply

- Inventory creates physical presence facts. Many states treat stored inventory as a nexus even when a third party owns the facility. Avalara

- Texas is strict on permit and filing expectations for marketplace sellers who are Texas sellers. Do not assume marketplace collection ends your admin work. Texas Comptroller

- Pennsylvania draws a clear line for inventory plus direct sales. If you sell direct into PA and keep inventory there, expect a sales tax duty. Pennsylvania Government

- Do not write absolute claims for PA marketplace only sellers. PA guidance also shows other conditions and nuances. Track your facts and document your channel mix. Pennsylvania Government

Inventory Tracking System: Ledger, Reports, and Review Cadence

If you want control, you need an inventory trail you can prove. Inventory is a common physical presence nexus trigger. Physical presence nexus does not usually depend on revenue thresholds. If your inventory sits in a state, registration and collection duties may start right away. Avalara+1

Inventory location ledger (what to track)

Create one sheet. One row per facility per SKU per date range.

Track these fields:

- Warehouse provider (FBA, ShipBob, 3PL name)

- Facility name or code

- State

- First date inventory arrived

- Last date inventory left (or “still stored”)

- SKU

- Average units on hand (monthly)

- Channel tag: marketplace only, direct only, mixed

- Who moved it: you, auto rebalancing, 3PL transfer

- Source proof link: export file name, report ID, screenshot

This ledger supports the core question auditors ask. When did inventory first sit in the state. Avalara

Tracking is hard, but do you know what happens when you miss filings? Read what “missed compliance” can trigger, then set a simple monthly routine.

Reports to pull

Pull reports that show location history, not just totals.

Minimum set:

- Inventory by location report (state and facility)

- Inventory event history (transfers, relocations, check-ins)

- Fulfillment center list used in the last 12 months

- Orders by destination state split by channel (direct vs marketplace)

Your goal is simple. Match inventory states to sales states. Then decide where you have obligations. Avalara

Cadence that works

- Weekly: check if inventory entered a new state

- Monthly: reconcile the ledger to your provider exports

- Quarterly: run a nexus review for new states and new channels

Treat a new inventory state as a trigger event. Most states treat in-state inventory as nexus. That is why speed matters. Avalara

Step by Step Playbook: What to Do When Inventory Enters a New State

Treat a new inventory state like a compliance trigger. Inventory stored in-state can establish physical presence nexus in many states. Avalara

- Confirm the state and facility

Pull the exact facility name or code. Save the export or screenshot as proof. Choosing an LLC state and trying to avoid future compliance mess? This guide helps you choose a state based on fees, rules, and long-term burden.

- Log the first in-state date

Write the earliest date inventory arrived in that state. This date often becomes your nexus start point. Avalara

- Check how inventory got there

Mark the movement type:

- you shipped it

- 3PL transfer

- auto rebalancing

FBA can move inventory across facilities without the seller’s knowledge. Grant Thornton

- Split sales by channel right now

Create two numbers for that state:

- direct sales (Shopify, WooCommerce, invoices)

- marketplace sales (Amazon, Walmart, eBay)

Pennsylvania ties collection duty to inventory plus direct sales in its published guidance. Pennsylvania Government

- Decide if you must register

Use this logic:

- inventory in state and taxable direct sales often means you should review registration fast

- marketplace sales alone can still create obligations in some cases, so do not guess

Texas states marketplace sellers still need a permit and must file returns if they are Texas sellers selling through a marketplace. Texas Comptroller

- Set a filing owner and calendar

If you register, assign a person and a recurring filing routine. Texas reminds permit holders they must still file returns even with zero tax due. Texas Comptroller

Owning a US LLC from abroad and unsure what you must file? Use this filing guide to understand what keeps your LLC compliant.

- Store your proof in one folder

Keep: inventory logs, facility history, and state sales reports. This protects you if the state questions your start date.

Final Thoughts

Warehouse inventory creates real tax exposure because it creates physical presence facts. You do not need an office. You do not need staff. Your goods sitting in a state can be enough to trigger nexus in many states.

If you want to stay safe, do three things:

- Track every state where your inventory sits, with dates and facilities

- Separate direct sales from marketplace sales in your reporting

- Treat every new inventory state as a compliance trigger

This is not about fear. It is about control. When you control the inventory trail, you control your compliance timeline.

Want to avoid surprise US sales tax notices from 3PL inventory moves?

Scounts.pk helps you register your company, manage taxes, and handle compliance in Pakistan and the USA.

Need help? Chat with us on WhatsApp or visit our Contact Us page.

FAQs: Warehouse Inventory Nexus and Sales Tax Obligations

Does inventory in a 3PL warehouse create sales tax nexus?

Yes, it can. Many states treat inventory stored in-state as physical presence nexus, even when a third party owns the facility.

Does Amazon FBA inventory create sales tax nexus in every state?

Inventory stored in a state can establish nexus in many jurisdictions, though enforcement and specifics differ. Many states treat inventory held in third-party fulfillment warehouses, including Amazon FBA facilities, as physical presence nexus.

If Amazon moves my inventory without asking, can that still create nexus?

Yes, it can. Under FBA-style fulfillment, inventory may be relocated to another state without the seller’s knowledge. That move can create physical presence nexus in a state where the seller is not registered.

If a marketplace collects sales tax, do I still need to register?

Do not assume you are done. States differ. Pennsylvania says you must collect PA sales tax when you maintain inventory in Pennsylvania and make direct sales to PA customers. Pennsylvania also notes cases where a marketplace facilitator does not collect or remit. Pennsylvania Government

Texas says Texas sellers selling through a marketplace are still responsible for having a Texas tax permit and filing returns. Texas Comptroller

What if I only have inventory in Pennsylvania through FBA and no direct sales?

Pennsylvania’s published rule is clear for inventory plus direct sales. Pennsylvania Government

In Online Merchants Guild v. Hassell (Pennsylvania Commonwealth Court, September 9, 2022), the court held that FBA inventory stored in Pennsylvania, by itself, was not enough in that case to require certain out-of-state sellers to collect and remit Pennsylvania sales tax. Treat outcomes like this as state-specific legal territory that can turn on the exact facts and the state’s due process analysis. pacourts.us

Do small inventory quantities avoid nexus?

Do not rely on that outcome. Inventory-based nexus often starts from physical presence, not revenue thresholds. If your inventory sits in another state, obligations can begin immediately, sometimes from the first sale.

How do I know which states my inventory was stored in?

Use your 3PL or FBA inventory location and inventory event history exports. Track facility and date. This matters because inventory in-state is a physical presence trigger in many states. Avalara

Sources:

https://www.pacourts.us/assets/opinions/commonwealth/out/179md21_9-9-22.pdf

https://floridarevenue.com/taxes/eservices/Pages/registration.aspx

https://comptroller.texas.gov/taxes/sales/marketplace-providers-sellers.php

https://comptroller.texas.gov/taxes/sales/remote-sellers-marketplace-faq.php

https://sell.amazon.com/blog/amazon-fba-for-beginners

https://www.avalara.com/us/en/learn/whitepapers/know-your-nexus-ebook.html

https://www.avalara.com/us/en/learn/guides/state-by-state-guide-economic-nexus-laws.html

Disclaimer: This article is authored by a writer at Scounts Private Limited. Please note that the fees mentioned are subject to change and may not be accurate at the time of reading. The content has not yet reviewed by any of our LLC taxation experts. For expert advice or services, feel free to contact us.