US sales tax can hit your SaaS business even when you are not in the US.

That is the real risk.

You price a subscription. You deliver access. You invoice a US client. Then a state treats that access as taxable.

The problem is not one rule.

The problem is 50 different rules.

One state taxes SaaS like software.

Another tax is like a service.

Another taxes only part of the invoice because of how it classifies “data” work.

Some states tax personal-use software differently than business-use software.

If you run an IT agency, the risk gets worse. You may sell consulting, implementation, managed services, support, and hosting in one package. States do not treat those items the same way.

Bundles also change the outcome. A single taxable line can pull the full invoice into tax in some states.

This guide gives you a workflow you can follow without guessing:

- Check nexus first

- Classify what you sell

- Decide when to charge sales tax

- Know when to collect certificates

- Keep documentation that protects you later

US Sales Tax for Foreign SaaS and IT Agencies: The 2-Test Compliance Framework

US sales tax is state-based.

There is no single federal sales tax rule.

You follow one workflow in every state.

Test 1: Nexus — Do you have an obligation in that state?

Nexus decides whether a state can require you to register.

After South Dakota v. Wayfair (June 21, 2018), states can require remote sellers to collect sales tax even without physical presence. Supreme Court

Most states use economic nexus.

Economic nexus triggers when your sales into a state cross a threshold. Avalara

Two important examples:

- California uses a $500,000 remote seller threshold. cdtfa.ca.gov

- Texas uses a $500,000 remote seller safe harbor threshold and sets a timeline for when collection must begin. comptroller.texas.gov

If you do not have nexus, you do not charge tax in that state.

If you do, move to Test 2.

Test 2: Taxability — Does the state tax what you sell?

Nexus does not mean SaaS is taxable.

Taxability depends on state classification.

Example of how states classify software access:

- New York taxes prewritten software regardless of delivery method, including remote access. NY Tax Department

That is why your product type matters.

You charge sales tax only when:

- You have nexus and

- Your SaaS or IT service is taxable in that state

If you do not charge tax, you still need documentation.

You must be able to prove why you did not collect.

Want the full “charge vs don’t charge” playbook? See the exact steps foreign founders use to decide when to collect US sales tax and what to document when they don’t.

Economic Nexus Rules for SaaS and IT Services (2025)

To know whether you must register and collect sales tax in a US state, you must check the economic nexus first.

Economic nexus means you have enough business activity in a state that the state can force you to collect and remit sales tax — even if you never set foot there.

How economic nexus works

- Most states set a sales threshold (often $100,000+ in a year).

- Some also use a transaction count (like 200 transactions), though many states are removing this rule in 2025. Avalara

- Once you hit a state’s threshold, you must register for sales tax in that state. Sales Tax Institute

You must track both sales volume and transaction counts into each state where you have US customers. If either metric hits the state’s rule, you have a nexus there.

What counts toward nexus

Everything you bill into a state can count:

- SaaS subscriptions

- Implementation fees

- Managed service retainers

- Support contracts

- API usage charges

Whether a sale is taxable or exempt in that state does not matter for nexus. It still counts toward the threshold. Avalara

Examples of nexus thresholds (2025)

- Many states use $100,000 in annual sales as the trigger. Avalara

- A few states like California, New York, and Texas use $500,000 or more. RJM Tax Exemption

- Some states still combine sales and transaction tests. Avalara

Monthly monitoring is essential

Tax departments can enforce nexus retroactively. You must:

- Track your last 12 months of sales into each state

- Note when you cross a threshold

- Register before your next taxable sale

The economic nexus is not static — it changes by state and over time. Stay on top of thresholds and adjust your tracker monthly. Sales Tax Institute

Not sure if you crossed nexus yet? Follow this step-by-step nexus check so you know exactly which states require registration before your next invoice.

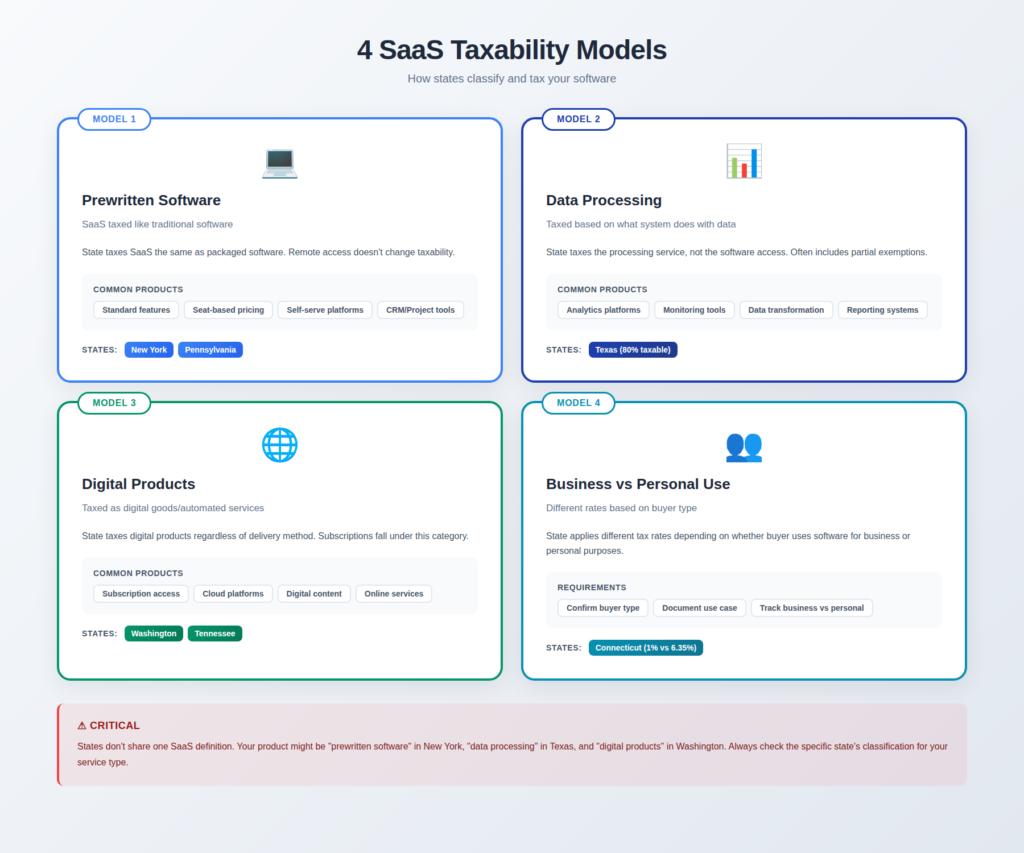

SaaS Taxability by State in 2025: The 4 Models States Use

States do not share one SaaS definition.

They classify SaaS using existing tax buckets. NY Tax Department

You will see four common models.

Model 1: SaaS treated as prewritten software

The state taxes SaaS like software.

Remote access still counts.

New York states this directly: prewritten software is taxable even by remote access. NY Tax Department

Use this model when your SaaS looks like:

- Standard features

- Seat pricing

- Self-serve access

Model 2: SaaS treated as data processing

The state taxes what your system does with customer data.

Texas taxes data processing services.

Texas exempts 20% of the charge for data processing services.

This model often covers:

- Analytics

- Monitoring

- Reporting platforms

- Data transformation tools

Model 3: SaaS treated as digital products or digital automated services

The state taxes digital products no matter how users access them.

Subscription access can fall under this structure.

Washington states sales tax applies to digital products regardless of access method, including subscription service and networking.

Model 4: SaaS taxed differently for business use vs personal use

Some states split tax treatment by buyer type or use.

Connecticut lists:

- 1% for electronically accessed canned software purchased by a business for business use

- 6.35% for personal use CT.gov

This model forces you to:

- confirm buyer type

- document business use

States That Tax SaaS in 2025: Use This Table to Stop Guessing

If your team guesses SaaS taxability, your invoices will drift.

If your invoices drift, audits get easy.

You need a table that answers one question fast:

“Do I charge sales tax in this client’s state?”

Build it in two layers:

- Layer 1: a full state list you can scan in seconds

- Layer 2: the state’s own guidance you can point to in an audit

Washington is a good example of why Layer 2 matters. Washington says sales or use tax applies to digital products no matter how accessed, including subscription service and networking. Washington Department of Revenue

New York is another. New York says prewritten software is taxable even by remote access. NY Tax Department

How to read the table

Store four fields only:

- SaaS status: Taxable / Exempt / Conditional

- Tax bucket: software / digital products / data processing

- Rate note: full rate / partial / buyer-type split

- Proof link: state DOR page or bulletin

Table template + sample rows (copy/paste structure)

| State | SaaS status | Tax bucket | Proof |

| Washington | Taxable (common) | Digital products / digital automated services | WA DOR: taxed regardless of access method, including subscription service Washington Department of Revenue |

| New York | Taxable (common) | Prewritten software | NY DTF: prewritten software taxable even by remote access NY Tax Department |

| Texas | Often taxable (common) | Data processing | TX Comptroller: data processing taxable; 20% of charge exempt Texas Comptroller |

| Connecticut | Taxable with rate split | Electronically accessed canned software | CT DRS: personal use 6.35%; business use can be 1% CT.gov |

Do not auto-mark “no sales tax” states as “no work”

Five states have no statewide sales tax. That does not always mean zero local tax work. Avalara

Need the full SaaS taxability map by state? Use this state-by-state guide to confirm whether your SaaS is taxable, conditional, or exempt before you charge tax.

Sales Tax on IT Services by State (2025): Where IT Agencies Get Caught

IT sales tax risk starts when you treat every deliverable as “consulting.”

States do not tax job titles.

They tax categories.

Most states built sales tax around tangible goods.

They must add services by law to tax them. Tax Policy Center

That is why IT service taxability varies by state. Avalara

IT service taxability follows three patterns

Pattern 1: Services are mostly exempt unless listed as taxable.

Many states work this way. Tax Policy Center

Pattern 2: Services are taxed by default, with exemptions carved out.

A small group of states taxes services broadly. Avalara

Pattern 3: States expand tax to new service lines over time.

Washington is the 2025 example you must watch. Washington Department of Revenue

High-risk IT service types once you have nexus

These lines trigger tax most often because states map them to taxable buckets:

- Managed services and ongoing administration

- Monitoring and alerting

- Helpdesk and support plans

- Hosting bundled with software

- Data processing and information handling Texas Comptroller

Texas is a clean example of the “data processing” trap.

Texas treats data processing as taxable and keeps a 20% exemption rule in the regulation and guidance. Legal Information Institute

Washington 2025: the compliance change that hits IT vendors

Washington made additional services subject to retail sales tax effective Oct. 1, 2025.

Washington’s Department of Revenue published a dedicated page listing newly taxable services and instructing sellers to start collecting sales tax on those services. Washington Department of Revenue

Washington also issued special notices for specific categories such as advertising services, with the same effective date. Washington Department of Revenue

If you sell IT-adjacent services into Washington, you must re-check taxability for every service line you invoice. Washington Department of Revenue

Bundles flip invoices from “no tax” to taxable

Bundling creates avoidable exposure.

If you bundle taxable and non-taxable items, states can treat the bundle as taxable under their bundle rules and tax base rules.

Service tax rules and digital product rules vary, so bundles raise audit risk fast. Tax Policy Center

You reduce risk when you:

- Separate line items

- Describe each line clearly

- Match the description to the state’s tax category Tax Policy Center

Is Your SaaS or IT Service Taxable? Product Classification Checklist (Use This Before You Invoice)

Before you ask “Do I charge sales tax?” you must answer one thing:

What exactly am I selling, line by line?

States tax products and services, not contracts.

Classification decides the outcome.

Use this checklist for each invoice line, not once per client.

Step 1: Identify the delivery model

Check what the customer actually receives:

- Login-based access to a standardized platform

- API access billed by usage

- Ongoing monitoring or administration

- One-time consulting or advisory work

- Custom development with ownership transfer

States look at delivery and function, not your label.

Step 2: Match the item to a tax bucket

Map each line item to a common state tax category:

- Prewritten software / remote access software

- Digital products or automated services

- Data processing or information services

- Repair, maintenance, or support services

- Professional or consulting services

States publish taxability by category, not by industry name.

Step 3: Check high-risk flags

These signals increase the chance of tax:

- Subscription or recurring billing

- Automated output with minimal human effort

- Data storage, transformation, or reporting

- Hosting bundled with software or support

- “Managed” or “fully handled” service language

If one line item is taxable, some states can tax the entire bundle.

Step 4: Apply state-specific treatment

Now check the state’s rule for that category:

- Some states tax remote software access

- Some tax data processing

- Some split rates by buyer type

- Some exempt pure consulting only

This is why a state-by-state table matters.

Step 5: Document your decision

If you charge tax:

- Keep the classification note

- Apply the correct rate

If you do not charge tax:

- Store a short taxability memo

- Link it to the state guidance

No documentation means no defense.

Resale Certificates and Exemption Certificates for SaaS & IT Agencies

You do not “accept exemption” by email.

You accept exemption with a valid certificate you keep on file. Sales Tax Institute

When you need a certificate

Collect a certificate when the buyer says any of these:

- “We are tax-exempt.”

- “This is for resale.”

- “Do not charge sales tax.”

If you do not collect it, the state can treat the sale as taxable and bill you. Sales Tax Institute

Resale vs exemption (quick rule)

- Resale certificate: buyer plans to resell what they buy. Sales Tax Institute

- Exemption certificate: buyer qualifies as exempt (government, nonprofit, etc.), or the use is exempt. Sales Tax Institute

Multi-state options that reduce friction

Two common multi-state forms exist:

- Streamlined Sales Tax (SST) Exemption Certificate (accepted by SST member states) Default

- MTC Uniform Sales & Use Tax Resale Certificate (states list acceptance rules on the form) MTC

Some states still require their own form.

Texas is a clear example. Texas allows resale purchases tax-free if the seller accepts a properly completed Form 01-339 and keeps it for four years. comptroller.texas.gov

What “valid” looks like

Do this every time:

- Collect the certificate at the point of sale Sales Tax Institute

- Check it for required fields and signature Sales Tax Institute

- Store it in a folder tied to the customer and state Sales Tax Institute

- Track renewals and update missing info early Sales Tax Institute

How to Invoice US Clients for SaaS and IT Services

Invoices decide outcomes.

Invoice wording can change taxability for services.

Your invoice must separate tax or state “tax included”

Texas states it clearly:

- Your receipt or invoice must separately show the tax, or clearly indicate tax is included in the price. comptroller.texas.gov

Use the same discipline in every state.

The invoice structure that keeps you safe

Use this layout:

- Line 1: SaaS subscription (monthly or annual)

- Line 2: Implementation (one-time)

- Line 3: Support plan (monthly)

- Line 4: Managed services (monthly)

- Line 5: Hosting or infrastructure (if you resell it)

Then:

- Show the sales tax line item per state rules comptroller.texas.gov

- Keep taxable and non-taxable items on separate lines BDO

Avoid these invoice mistakes

These trigger audits and over-taxation:

- One bundled line like “Software + setup + support” BDO

- Vague labels like “IT services” Sales Tax Institute

- Changing descriptions from month to month avalara.com

What to write when you do not charge tax

Use one of these two phrases, and keep proof:

- “No sales tax charged due to no nexus in customer state.”

- “No sales tax charged. Service treated as non-taxable in customer state. Documentation on file.”

Certificates still matter when the client claims exemption. Sales Tax Institute

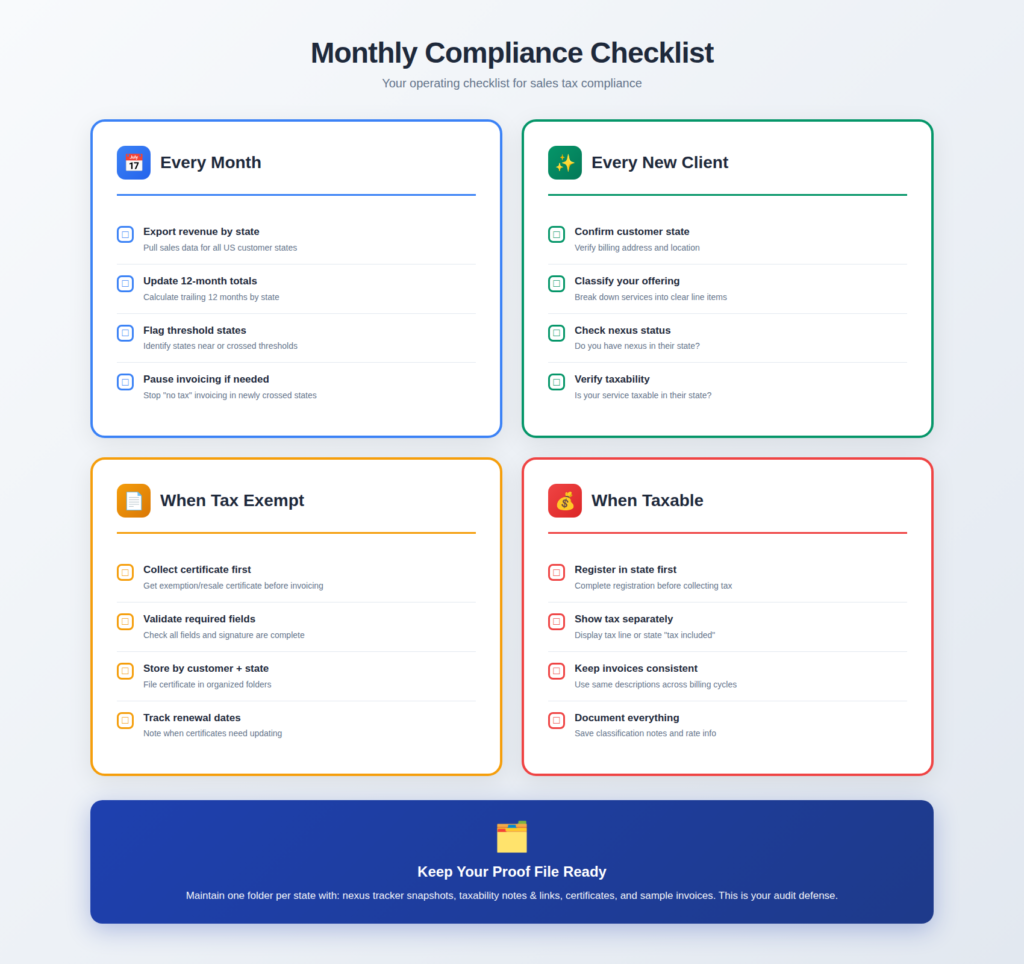

SaaS & IT Sales Tax Compliance Checklist (2025) for Foreign Sellers

Sales tax is not your only deadline risk. Use this US tax deadlines guide for Pakistani LLC owners so you don’t miss key filing dates after you register and start collecting.

Final thoughts

US sales tax will not “figure itself out.”

If you sell SaaS or IT services into the US, you need a repeatable system.

Use the same workflow every time:

- Check nexus by state

- Classify every invoice line item

- Collect only when the state taxes that category

- Collect certificates before you mark anything exempt

- Keep a proof file per state

You do not need perfection on day one.

You need consistency and documentation.

If you do that, you cut surprise tax bills, messy client disputes, and audit stress.

Want this handled end-to-end?

Scounts.pk helps you register your company, manage taxes, and handle compliance in Pakistan and the USA.

Need help? Chat with us on WhatsApp or visit our Contact Us page.

FAQs

1) Do foreign SaaS companies have to charge US sales tax?

Sometimes. You charge sales tax only when you have nexus in a state and the state taxes your SaaS category.

2) If I do not have a US office, can a state still require sales tax collection?

Yes. Many states use economic nexus based on sales volume.

3) If my SaaS is B2B only, does that mean it is exempt?

No. Some states still tax B2B SaaS. Some apply reduced rates or specific rules.

4) Do implementation and onboarding fees count toward nexus thresholds?

Often yes. Many states count gross receipts into the state. Track every billed amount by customer state.

5) Are consulting services always non-taxable?

No. Some states tax specific service categories. You must classify the service type per state.

6) What is the safest way to invoice mixed SaaS + services?

Separate each item into its own line. Use clear descriptions. Avoid one bundled “package” line.

7) When do I need an exemption or resale certificate?

When the buyer claims exemption or resale. Get the certificate before invoicing as exempt and store it.

8) What should I keep in my “proof file”?

Keep your nexus tracker, taxability notes, certificates, and sample invoices for each state.

Sources

https://www.supremecourt.gov/opinions/17pdf/17-494_j4el.pdf

https://comptroller.texas.gov/taxes/sales/remote-sellers.php

https://www.avalara.com/us/en/learn/whitepapers/service-taxability-by-state.html

https://dor.wa.gov/taxes-rates/retail-sales-tax/services-newly-subject-retail-sales-tax

https://www.law.cornell.edu/regulations/texas/34-Tex-Admin-Code-SS-3-330

https://dor.wa.gov/taxes-rates/retail-sales-tax/services-newly-subject-retail-sales-tax

https://www.streamlinedsalestax.org/Shared-Pages/exemptions

Disclaimer: This article is authored by a writer at Scounts Private Limited. Please note that the fees mentioned are subject to change and may not be accurate at the time of reading. The content has not yet reviewed by any of our LLC taxation experts. For expert advice or services, feel free to contact us.