You can legally owe zero tax to the IRS and still owe tax in the United States.

This is where many foreign founders get caught. Blogs and videos focus almost entirely on federal tax. They explain when a non-resident owner does not have U.S. effectively connected income. Then they stop. What they do not explain is that federal tax rules do not control state taxes.

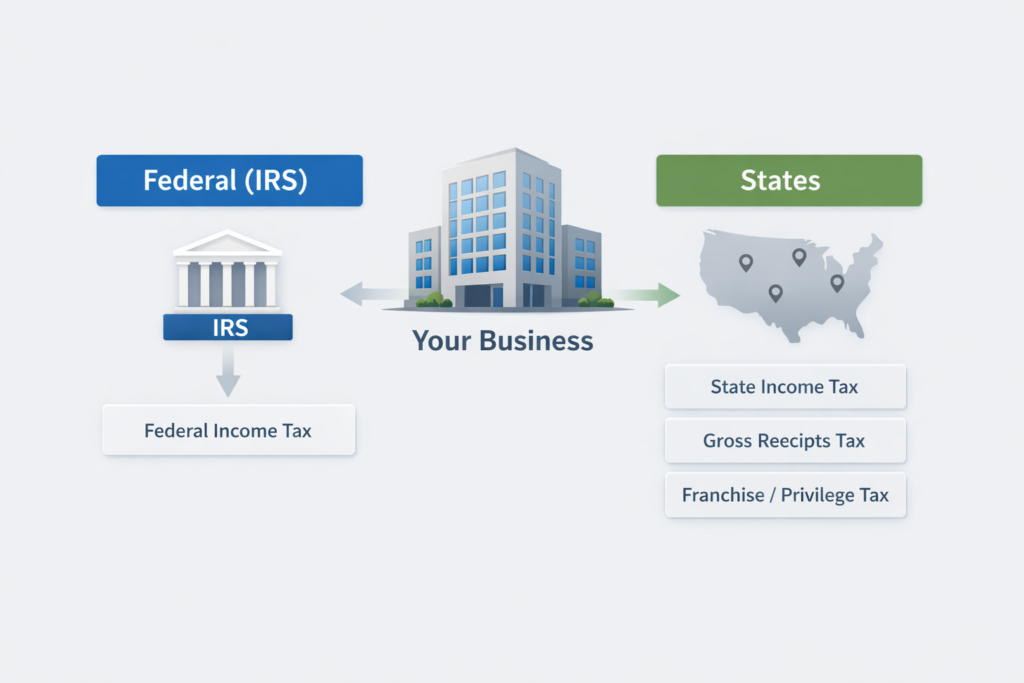

The IRS only administers federal income tax. U.S. states operate under their own taxing authority. A state does not care that the IRS considers your income non-taxable. If a state’s rules say your business activity creates tax exposure, that rule applies on its own.

This misunderstanding is often reinforced by treaty discussions. U.S. income tax treaties limit federal taxation. They generally do not bind U.S. states. The IRS states this clearly in its official treaty guidance. Income tax treaties apply to federal income tax and do not prevent states from imposing their own taxes. IRS

States also tax businesses differently than the IRS. Some states do not tax profit at all. They tax gross receipts. Washington is the most common example. Washington has no corporate income tax, but it imposes the Business & Occupation tax on revenue earned from Washington customers, even if the business is foreign-owned and even if it makes no profit. Washington State Department of Revenue

This is the gap most foreign-owner guides ignore. You can be fully compliant with the IRS and still have state tax filings you never knew existed. That gap is where penalties and back filings usually begin.

Who This Article Is For?

If you are a non-resident founder with a U.S. LLC

This article is written for founders who live outside the United States and own or plan to form a U.S. company. This includes Pakistan-based, GCC-based, UK, or EU founders who run their business remotely and do not have a U.S. office or employees.

Many founders in this position are told they owe no U.S. tax because they have no effectively connected income. That conclusion usually refers only to federal income tax under IRS rules. Internal Revenue Service (IRS)

If you rely on “zero tax” advice focused only on the IRS

This article is for you if your understanding of U.S. tax is based on guides that discuss:

- Form 5472 filing

- No federal income tax for foreign owners

- No U.S. permanent establishment

Those topics are real, but they describe federal tax only. U.S. states do not follow IRS classifications when applying their own taxes. Multistate Tax Commission

If you sell to U.S. customers from outside the U.S.

This includes founders who:

- Sell SaaS or digital services to U.S. customers

- Run ecommerce brands with U.S. buyers

- Use Stripe, PayPal, or U.S. marketplaces

States can apply their own nexus rules to these activities, even when the seller is foreign and owes no IRS income tax.

If you believe tax treaties protect you from all U.S. taxes

Many foreign founders rely on U.S. income tax treaties for peace of mind. Treaties can limit federal income tax, but they generally do not restrict U.S. states from imposing their own business taxes. The IRS states this explicitly in its treaty guidance. Internal Revenue Service (IRS)

If you think you are already compliant

This article is also for founders who:

- File Form 5472 correctly

- Have no federal tax due

- Believe their compliance obligations are complete

Many founders meet all IRS requirements and still miss state-level filing obligations because those rules sit outside the federal tax system.

The Blind Spot in Most Foreign Owner Tax Guides

What these guides focus on?

Most foreign owner tax guides stop at federal income tax. They explain why a non-resident owner may have no effectively connected income and therefore no IRS tax due. That analysis is real, but it is incomplete.

The IRS itself limits its role to federal taxation. It does not administer state taxes and does not decide whether a business owes tax at the state level. Internal Revenue Service (IRS)

What they leave out entirely

These guides usually skip three critical facts:

- States tax independently of the IRS

A clean federal position does not block state tax obligations. - Some states tax revenue, not profit

A business can owe state tax even when it makes no money. - Foreign status does not exempt you

States apply their own nexus rules to foreign companies.

States coordinate these rules through their own frameworks, not IRS definitions. The Multistate Tax Commission makes it clear that states determine nexus and tax liability under state law, regardless of federal income tax outcomes. Multistate Tax Commission

How do founders actually get misled?

A Pakistan-based founder with a Wyoming single-member LLC may file Form 5472 correctly and owe zero IRS tax. Most guides would call this “fully compliant.” What they do not explain is that the same company can still trigger state taxes once sales cross a state’s economic nexus threshold.

Washington is a common example. The state imposes Business & Occupation tax on gross receipts earned from Washington customers, even if the business is foreign owned and unprofitable. Washington State Department of Revenue

This omission is the blind spot. It is not illegal advice. It is incomplete advice, and that gap is where state tax problems begin.

Federal Tax vs State Tax — Two Separate Legal Systems

The IRS only controls federal income tax

The Internal Revenue Service administers federal income tax only. Its role is limited to deciding whether income is taxable under U.S. federal law and whether a foreign business has effectively connected income.

If the IRS concludes you owe no federal income tax, that decision ends only at the federal level. Internal Revenue Service (IRS)

U.S. states operate under their own taxing authority

Each U.S. state has the constitutional power to impose and enforce its own taxes. States do not rely on IRS classifications to decide whether tax applies. They write their own statutes, define their own nexus standards, and enforce their own filing rules.

State tax systems are coordinated through state-level frameworks, not the IRS. The Multistate Tax Commission confirms that nexus and tax liability are determined under state law, independent of federal income tax outcomes. Multistate Tax Commission

Tax treaties do not protect against state taxes

Many foreign founders assume tax treaties shield them from all U.S. taxes. That assumption is incorrect.

U.S. income tax treaties apply to federal income tax. They generally do not bind U.S. states. The IRS explicitly states that treaties do not prevent states from imposing their own taxes on income or business activity within the state. Internal Revenue Service (IRS)

A real example of how this plays out

A Pakistan-based founder operates a Wyoming single-member LLC and sells software to U.S. customers. The IRS determines there is no effectively connected income. Federal tax due is zero.

Washington State reaches a different conclusion. Once sales to Washington customers cross the state’s economic nexus threshold, the business may owe Business & Occupation tax on gross receipts, even with no profit and no federal tax liability. Washington State Department of Revenue

This is not a contradiction. It is the result of two separate legal systems applying different rules to the same business activity.

The Three State Tax Types Foreign Founders Commonly Miss

| Tax Type | Example State | What Is Taxed | Applies Even If No Profit? | Common Founder Mistake | Official Source |

| Gross Receipts Tax | Washington (B&O) | Revenue from in-state customers | Yes | Assuming no profit means no tax | Washington State Department of Revenue https://dor.wa.gov/taxes-rates/business-occupation-tax |

| Franchise / Privilege Tax | Delaware | Right to exist or remain incorporated | Yes | Assuming a dormant company owes nothing | Delaware Division of Corporations https://corp.delaware.gov/frtaxcalc/ |

| Income / Margin Tax | Texas | Profit or modified margin | Usually | Assuming foreign companies are exempt | Texas Comptroller of Public Accounts https://comptroller.texas.gov/taxes/franchise/ |

| Nexus Standards (applies to all) | Multiple states | Determines when state tax applies | Not profit-based | Relying on IRS rules | Multistate Tax Commission https://www.mtc.gov/uniformity/model-statutes/nexus/ |

If your business sells into Washington or Texas and you have already researched sales tax nexus, that same activity may also create income or gross-receipts tax exposure at the state level. To understand where foreign founders usually stop too early, read our guide on State Economic Nexus (WA/TX Taxes) for foreign sellers.

Real Example #1: Washington B&O Tax (SaaS Founder)

A Pakistan-based founder runs a SaaS company through a Wyoming single-member LLC. All development and support happen outside the United States. There are no U.S. employees and no U.S. office. The IRS position is clear. There is no effectively connected income, so federal income tax due is zero.

The problem starts at the state level.

Washington does not impose a corporate income tax. Instead, it applies the Business and Occupation tax to gross receipts earned from Washington customers. Once economic nexus thresholds are crossed, the tax applies to revenue, not profit. Operating at a loss does not remove the obligation.

Washington states explicitly that B&O tax applies based on business activity and receipts sourced to Washington, regardless of where the business is located or whether it owes federal income tax. Washington State Department of Revenue

This is how a SaaS founder can be fully compliant with the IRS and still owe Washington state tax on subscription revenue.

Real Example #2: Delaware Franchise Tax (Dormant Entity)

A foreign founder incorporates a Delaware C-Corporation to raise funds later. The company never launches. There are no customers, no revenue, and no operations. Because there is no activity, the founder assumes there is no tax exposure anywhere.

That assumption is wrong.

Delaware imposes an annual franchise tax on corporations for the privilege of being incorporated in the state. The tax applies even if the company is dormant. It does not depend on income, customers, or physical presence.

Delaware makes this clear through its official franchise tax guidance and calculator.Delaware Division of Corporations

Many foreign founders first discover this obligation after penalties have already accrued, simply because no one explained that franchise tax exists independently of income tax.

Real Example #3: Non-SaaS Contrast Case (Texas Margin Tax)

A non-U.S. ecommerce brand sells physical products to U.S. customers from abroad. There is no U.S. warehouse and no U.S. staff. Federal income tax analysis shows no effectively connected income.

Texas applies a different framework.

Texas imposes a franchise tax, often referred to as a margin tax, once economic nexus thresholds are met. The tax is based on a modified margin calculation, not federal taxable income. Foreign companies are not exempt. Sales into Texas alone can create filing obligations.

Texas explains this nexus standard and tax structure through its official Comptroller guidance. Texas Comptroller of Public Accounts

This example matters because it shows the issue is not limited to Washington or digital businesses. Different states use different tax bases, but the underlying rule is the same. State tax exposure can exist even when federal tax is zero.

Myths vs Reality

Myth: If I owe zero tax to the IRS, I owe zero tax in the U.S.

Reality: Federal income tax and state taxes are separate systems. A clean IRS position does not block state taxes based on state law. Internal Revenue Service (IRS)

Myth: No U.S. office or employees means no state tax.

Reality: Many states apply economic nexus rules based on sales or receipts alone. Physical presence is not required. Multistate Tax Commission

Myth: Tax treaties protect me from all U.S. taxes.

Reality: U.S. income tax treaties apply to federal income tax. They generally do not bind states. The IRS states this explicitly. Internal Revenue Service (IRS)

Myth: No profit means no state tax.

Reality: Some states tax gross receipts, not profit. Washington’s Business and Occupation tax applies even when a business operates at a loss. Washington State Department of Revenue

Myth: Marketplaces or payment processors handle all state taxes for me.

Reality: Marketplace sales tax collection does not eliminate a seller’s exposure to income, margin, or gross-receipts taxes imposed directly on the business.

High-Risk Situations Foreign Founders Fall Into

Selling into the U.S. without checking non-income taxes

Founders often research the sales tax nexus and stop there. The same activity can also trigger gross-receipts, franchise, or income taxes at the state level.

Running SaaS or digital services from abroad

Subscription revenue sourced to specific states can create a nexus even when all development and support occur outside the U.S.

Using Delaware or Wyoming entities and assuming ongoing compliance is zero

Dormant entities can still owe annual franchise taxes and filing obligations that continue until formal dissolution.

Relying only on federal compliance

Filing Form 5472 correctly does not confirm state compliance. Many founders meet all IRS requirements and still miss state filings governed by different rules.

Discovering nexus retroactively

States can assess tax and penalties once nexus is identified, even if the business was unaware at the time.

If you want to see how these risks appear across multiple states and business models, including common mistakes foreign founders make, read our guide on Common States and Compliance Risks for Foreign-Owned U.S. LLCs.

What Happens If You Ignore State Taxes?

Ignoring state tax obligations does not make them disappear. In most states, exposure grows quietly until it becomes expensive to fix.

Back taxes accumulate automatically.

Once a state determines you had nexus, it can assess tax for prior years, even if you never registered. This applies to gross receipts taxes, franchise taxes, and income or margin taxes.

Penalties and interest apply on top of tax.

States impose late-filing penalties and interest from the original due date. These amounts often exceed the original tax owed. States are not required to warn you before penalties start accruing

Source: Washington State Department of Revenue

https://dor.wa.gov/taxes-rates/penalties-and-interest

Loss of good standing creates secondary problems.

Unpaid franchise taxes or missing returns can cause an entity to lose good standing. This can block fundraising, banking, payment processors, or future dissolution.

Compliance becomes harder later.

Once exposure spans multiple years, cleanup often requires amended filings, voluntary disclosure applications, or professional intervention. States are less flexible once they initiate contact.

When Does This Become Urgent? (Timing and Deadlines)

Registration triggers

Urgency starts when you cross a state nexus threshold. This can happen through:

- Sales volume into a state

- Customer concentration

- Economic presence rules defined by the state

Nexus standards are defined under state law, not IRS rules. Multistate Tax Commission

Filing deadlines

Once registered, states impose recurring filing deadlines, even if tax due is zero. Missing these deadlines triggers penalties automatically. For example, Washington requires regular B&O filings based on assigned frequency. Washington State Department of Revenue

Retroactive exposure risk

If nexus existed in prior years and was missed, states can assess tax retroactively. Many foreign founders discover this only after receiving a notice or during a compliance review. At that stage, options are more limited and more costly.

How to Check Your State Tax Exposure (Decision Framework)

If you are unsure how to evaluate nexus across multiple states or how to correct missed filings safely, this is the point where professional review matters.Need help assessing or fixing state tax exposure? Explore US LLC Tax Filing Services for foreign-owned LLCs..

When Professional Help Is No Longer Optional

Professional help becomes necessary when state tax exposure is no longer theoretical.

You should not rely on self-research alone if:

- You sell into multiple U.S. states and have never reviewed non-income taxes

- You discovered missed filings from prior years

- Your entity is registered in Delaware and franchise tax filings are unclear

- You need to correct exposure before a state contacts you

At this stage, the goal is no longer learning. It is risk control.

If you already have a U.S. entity and need help with compliance, corrections, or ongoing filings, review our Income Tax Registration and Income Tax Return Filing services.

Unsure Where Your State Tax Risk Actually Starts?

Scounts.pk helps non-resident founders move beyond assumptions. We support U.S. company registration, state and federal tax compliance, and cross-border income tax matters in both Pakistan and the United States. This way, your decisions are based on current law and official rules, not forum guesses or incomplete guides.

If you want clarity on your structure, filings, or past exposure, you can chat with us on WhatsApp or visit our Contact Us page to discuss your situation before it becomes a compliance issue.

FAQs (People Also Ask)

Does a tax treaty protect me from U.S. state taxes?

No. U.S. income tax treaties apply to federal income tax only. They generally do not bind U.S. states. The IRS states this clearly in its treaty guidance

If Amazon or a marketplace collects sales tax, am I covered for state taxes?

No. Marketplace collection typically covers sales tax only. It does not eliminate a seller’s exposure to state income, margin, or gross-receipts taxes imposed directly on the business. These taxes are assessed under separate state laws.

Can U.S. states tax foreign-owned companies with no U.S. presence?

Yes. Many states apply economic nexus rules based on sales or receipts alone. Physical presence is not required

Do I need to file state returns if the tax due is zero?

Often, yes. Many states require registration and periodic filings once nexus exists, even if no tax is ultimately owed for a period. Missing these filings can still trigger penalties.

How do I know which states I should check first?

Start with states where you have the most customers or revenue. States like Washington, Texas, Ohio, and Delaware frequently appear in audits and compliance reviews because of non-income taxes and franchise obligations.

Sources:

https://www.irs.gov/businesses/international-businesses

https://corp.delaware.gov/frtaxcalc

https://dor.wa.gov/taxes-rates/business-occupation-tax

https://comptroller.texas.gov/taxes/franchise

https://www.mtc.gov/uniformity/model-statutes/nexus

https://www.irs.gov/businesses/international-businesses/united-states-income-tax-treaties

https://www.irs.gov/businesses/international-businesses

Disclaimer: This article is authored by a writer at Scounts Private Limited. Please note that the fees mentioned are subject to change and may not be accurate at the time of reading. The content has not yet reviewed by any of our LLC taxation experts. For expert advice or services, feel free to contact us.