Income tax file return: Everything you need to know

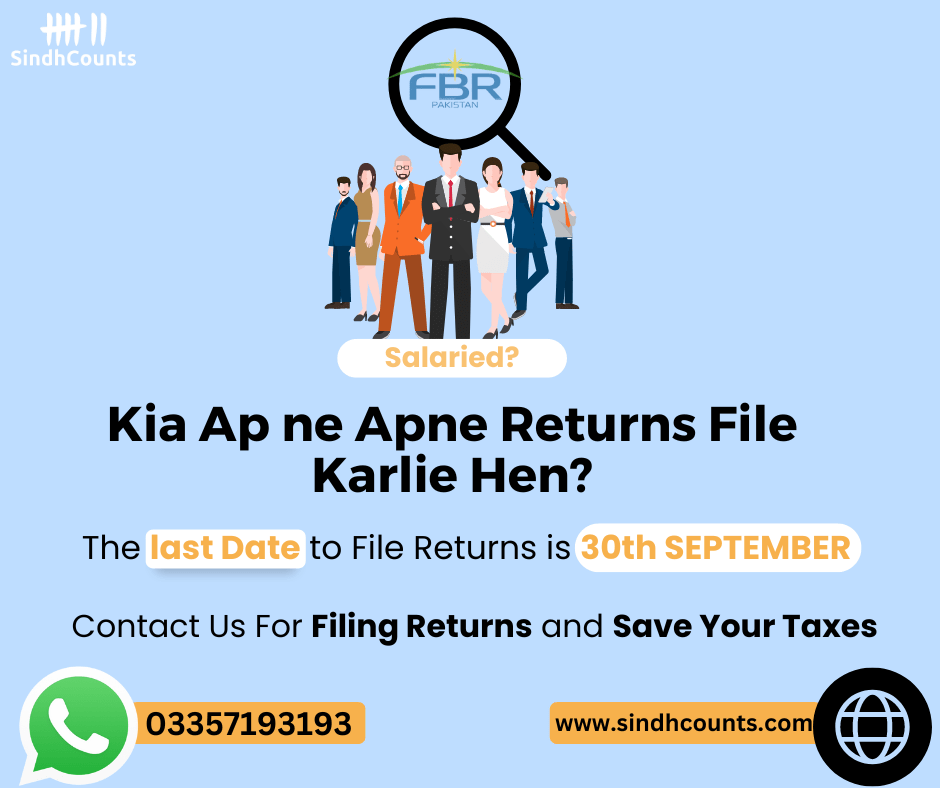

Income tax return filing in Pakistan is a process that must be completed by all individuals and businesses earning income within the country. The deadline for income tax file return is usually at the end of September, and there are certain requirements that must be met in order to complete the process. This article will walk you through the steps involved in filing a return for the year 2022.

We have answered all the questions, including How can you file a 2022 tax return, When should you file Income Tax Return, and What is the last date for a Tax Return in 2022.

What is an income tax return? When to file an income tax return?

An income tax return is a document that must be filed annually by all individuals and businesses earning income within the country. The return lists all of the individual’s or business’ income and deductions for the year and calculates the amount of taxes that must be paid to the government. The deadline for filing a return in Pakistan is usually at the end of September. However, taxpayers who are unable to file by the deadline can apply for an extension with the income tax department.

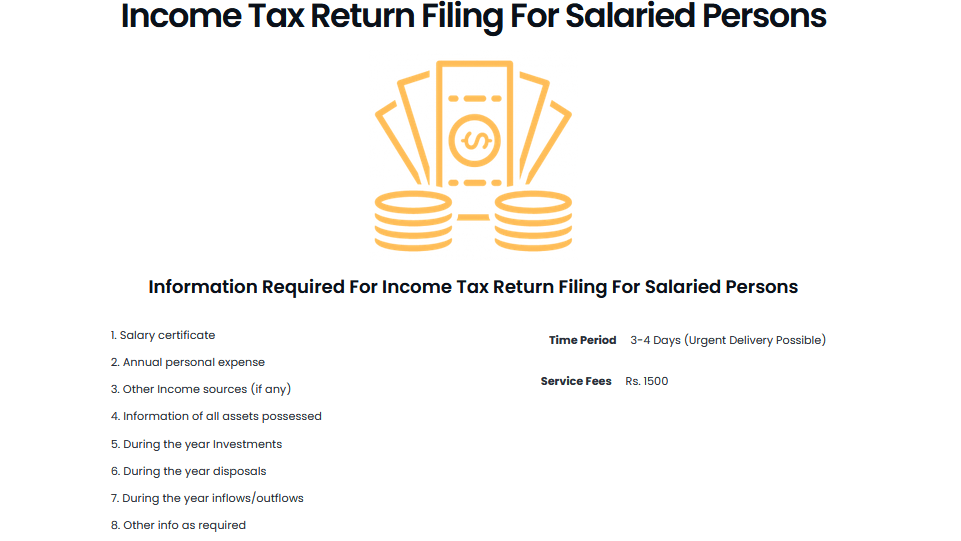

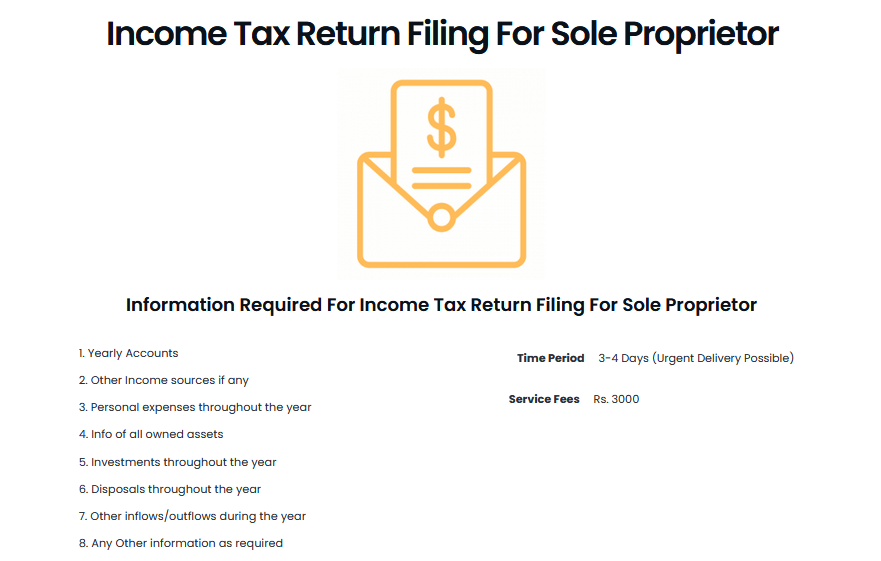

What is required to file an income tax return?

In order to file a return, you will need to have your annual salary/income statement, bank statements, investment statements, and any other documentation related to income or deductions. You will also need your national identity card or passport.

Check here to see the complete list of information required for Salaried, Businesses, and companies for filing an annual return.

The process of filing an income tax return

Once you have gathered all of the required documentation, you can begin filing your return. The process typically involves completing a form and submitting into iris on the Federal Board of Revenue (FBR) website. There are also many tax consultancy services available that can help you complete your return quickly and easily.

How you can file an income tax return?

When it comes to filing a tax return, there are a few things you need to know in order to make the process as smooth as possible. Here are the steps involved in filing an income tax return:

1. Gather all of the required documentation. This includes your annual salary/income statement, bank statements, investment statements, and any other documentation related to your income or deductions. You will also need your national identity card or passport.

2. Complete a form. This will be the main document you use for returns. It will ask for information about your income and deductions for the year.

3. Submit the form to the Federal Board of Revenue (FBR). You can do this either online or physically.

4. Pay any taxes that are owed. Once your return is processed, you will be notified of how much tax you owe and will have to pay this amount in order to complete the process.

Common mistakes made while filing tax return

There are a few mistakes that people often make while filing their tax returns. Here are the most common ones:

Individuals can file their tax returns directly on the portal by logging into their accounts. They can also check with experts available for filing returns.

1. Not filing on time. The deadline for filing the tax return is usually at the end of September, and those who miss this deadline can face penalties.

2. Not including all of the income. It is important to include all of your income on your return, or you may face penalties from the government.

3. Not including all of your deductions. Similarly, it is important to include all of your deductions on your return, or you may not get the full benefit of them.

4. Making mistakes on the form. If you make any mistakes on your form, it may cause delays in processing your return.

5. Not paying taxes owed. Once your return is processed, you will be notified of how much tax you owe and will have to pay this amount in order to complete the process. Failing to do so can result in penalties from the government.

The process of filing a return can seem daunting, but it is important to remember that it is a necessary part of being a taxpayer.

By following the steps above and ensuring that you have all of the required documentation, you can avoid making common mistakes and make the process as smooth as possible.

You can also get your returns reviewed by the team at SindhCounts. Click here to learn more about us and our tax related services.

The benefits of filing income tax return

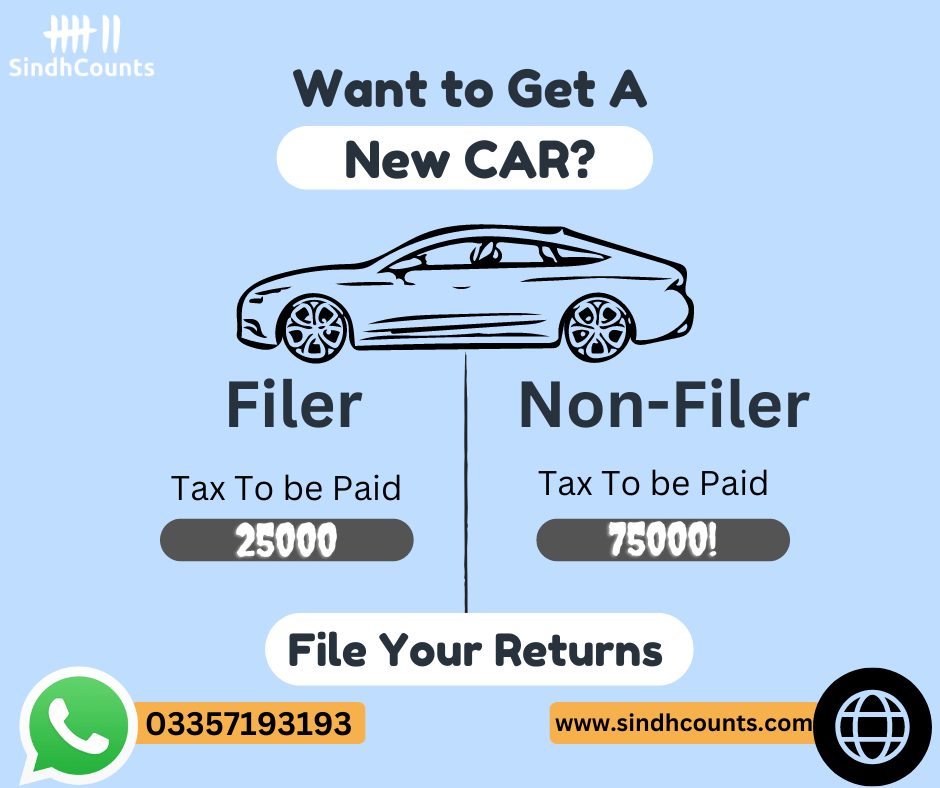

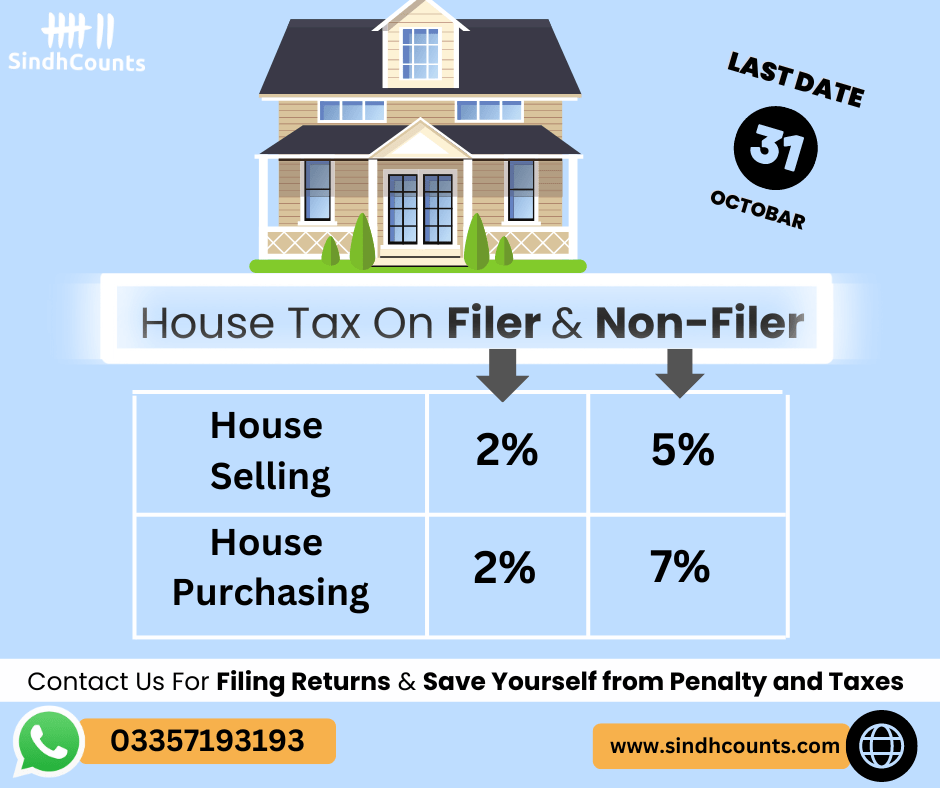

There are many benefits to filing the tax return upon successful submission of income tax, including:

1. Receiving a refund. If you have paid more taxes than you owe, you may be eligible for a refund.

2. Avoid penalties. If you do not file a return or file it late, you may face penalties from the government.

3. Getting discounts on utilities and other services. Some utility providers and other service providers offer discounts to those who file tax returns.

4. Getting a clear picture of your financial situation. Filing of income tax returns gives you a detailed overview of your income and deductions for the year, which can help you plan for the future.

How to get help with filing the income tax returns

Sindhcounts is a team of expert and trusted accountants who will help you file your tax return of income tax online and help you with the tax in Pakistan. You can contact with Sindhcounts team for returns of income tax. Our team will guide you through the process and help you file your return. You can also find helpful information on our website required to understand tax matters, including a video tutorial on filing your return online.