Planning to grow your business in the U.S.?

The first step is opening a U.S. bank account for your foreign LLC.

It makes transactions easy and boosts your credibility!

Opening a U.S. bank account as a non-resident can be a bit challenging due to strict rules and security requirements. Most banks require you to visit a branch in person to open an account, although some do offer remote options.

It’s important to understand the differences between full-service banks like Bank of America, financial platforms like Mercury and Relay, and electronic money institutions (EMIs) like Payoneer and Wise. Full-service banks provide traditional banking features like checks, deposit services, and enhanced security. Mercury and Relay, on the other hand, are not banks themselves but fintech companies that partner with U.S. banks to offer online business banking. EMIs like Payoneer and Wise focus on digital wallets and international money transfers but don’t provide the full services of a bank.

If you’re unsure where to start, we can help you open accounts with PayPal, Wise, or platforms like Mercury and Relay. This guide will cover all aspects of the process, with a primary focus on opening a U.S. bank account and understanding the key factors you need to consider.

If you’re interested in our LLC services, including help with bank account setup, feel free to request a proposal by clicking here.

I’ll walk you through all the basics—important documents, choosing a bank, and dealing with common challenges.

Let’s dive in!

Importance of Bank Account for Foreign LLC

Opening a U.S. bank account for a foreign LLC is an important step if you’re looking to expand your business internationally. It makes managing money easier, avoids the hassle of currency exchange, and gives you access to the benefits of the U.S. market.

With deposit insurance from the FDIC for up to $250,000, you’ll also have peace of mind knowing your money is secure. A separate U.S. account helps you stay compliant with IRS rules and keeps your cash flow organized.

Plus, platforms like Payoneer, PayPal, and Stripe work smoothly with U.S. bank accounts, making payments and transactions simple. Overall, it’s a smart move to support your business growth.

What are the Prerequisites for Opening a US Bank Account for a Foreign LLC

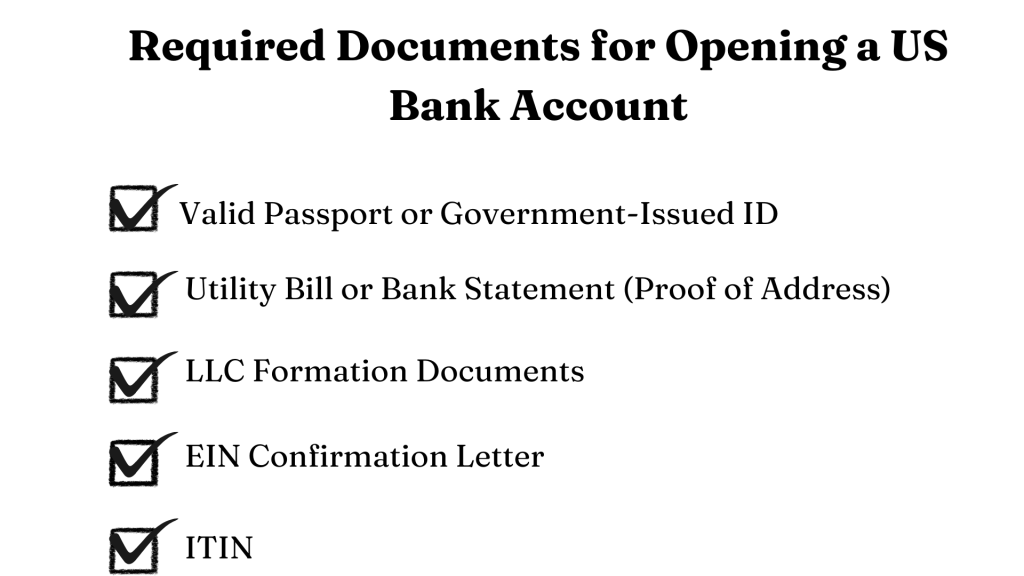

The requirements for opening a U.S. bank account for a foreign LLC can vary depending on the bank, but here are the general prerequisites you’ll need to meet:

- Firstly, you must have a valid passport and/or other government-issued photo ID.

- Next, you need utility bills or foreign bank account statements for personal proof of address.

- For the LLC you need to have articles of incorporation or the organization.

- Moreover, you should have a confirmation letter for the LLC’s employee identification number (EIN).

- Lastly, you will need an Individual Taxpayer Identification Number (ITIN) for the tax identification purposes.

How to Choose the Right Bank for a Foreign LLC

Choosing the wrong bank can lead to unnecessary fees, inefficient processes, and hindered growth. To avoid such inconveniences, investing time in selecting the right bank can yield significant long-term benefits.

As promised easy guidance, we have categorized banks into three different sections.

US Banks: The big names like Bank of America, Wells Fargo, Chase, and Citibank are top choices for U.S. banking, offering a wide range of services. But smaller banks can also be a great option, often providing personalized service and lower fees.

However, keep in mind that most U.S. banks, whether big or small, will require you to visit a branch in person to open your account. While you can usually start the process online, you’ll need to go in person to complete it, especially for business accounts or if you’re not a U.S. resident.

Offshore US Banking: There are also some great options like Mercury and Relay for non-residents who need U.S. banking. While they’re not traditional banks, they’re fintech companies that partner with U.S. banks to offer online banking services with an easy-to-use interface. This means you get all the benefits of a U.S. bank account without having to deal with a big, traditional bank. It’s a great solution if you want to manage your business or personal finances in the U.S. from anywhere in the world.

Non-bank EMIs (Electronic Money Institutions): Payoneer, Wise, Revolut, and PayPal are examples of electronic money institutions (EMIs). These services let you send, receive, and store money online without needing a regular bank. They’re especially useful for international transactions, offering features like multiple currencies, low fees, and fast transfers. Whether you’re a freelancer, business owner, or just traveling, EMIs make handling money easy and convenient from anywhere in the world.

Among the different options, choosing the best option based on your convenience is of the utmost importance. Knowing the convenient option based on its ease of use, use of that account for which purposes, features offered, and safety while making the transactions will help you choose the best.

Step-by-Step Guide to Open a US Bank Account for a Pakistani LLC

1. First, You Need To Prepare The Required Documents

The documentation requirements can vary from bank to bank, but as a non-resident looking for how to open a US bank account for a foreign LLC, you will need to prepare the following documents:

- Your Certificate of Formation or Articles of Organization, which establish your LLC in the US.

- Verifying your LLC’s EIN from the IRS is necessary for tax and banking purposes.

- A passport and/or a driver’s license, to confirm your identity.

- Outlining the ownership and management structure of your LLC.

- Lease agreement or utility bill, to show your LLC’s registered address. Some banks will allow you to use a non-resident address while others will require a US Address

- While not always required, a US phone number can help banks feel more comfortable with foreign LLCs.

As a non-resident, obtaining an EIN can be challenging without a Social Security Number (SSN). If this applies, check with potential banks on their policies regarding foreign applicants without an SSN or EIN.

2. Choose Which Bank You Want

One thing to keep at your fingertips, none of the big US banks have great customer service. Each one of them has its hurdles in store for you. However, research your options and confirm that the bank is open to foreign LLCs. Select a bank with favorable terms and remote account setup if necessary.

In-Person Setup:

If you plan to visit the US, you can directly reach out to the branch of your chosen bank. To do so, you must schedule an appointment with a bank representative. During this appointment, you ought to present all the necessary documentation to the bank officer. This includes your passport, visa, LLC formation documents, EIN, and proof of address. The bank officer will guide you through the application process and answer any questions you might have in your mind.

Remote Setup:

If you cannot visit the US, you can open a bank account remotely. Some US banks offer online banking services that allow you to open an account remotely. However, the specific process may vary depending on the bank and your circumstances.

You might need to use a third-party service or a trusted intermediary to help you with the application process, especially for verification purposes. It’s advisable to research the bank’s specific requirements and procedures for remote account opening.

You can also set up an account with EMIs like Payoneer or Wise, or with fintech services like Mercury or Relay. The choice depends on your business needs, so it’s important to pick what works best for you. If you’re unsure, our team is here to help you set up an account with any of the options we’ve discussed!

3. Initial Funding of the Account

To open a US bank account, you’ll typically need to meet a minimum deposit requirement. Depending on the bank and account type, this initial deposit can range from a few dollors to a few thousand US dollars.

You can usually make this deposit via wire transfer, check, or in person at a branch (if you’re visiting the US). While most US banks prefer deposits in US dollars, some may accept foreign currency. However, currency conversion fees can significantly impact your initial deposit.

To minimize these costs, consider using reputable currency exchange services to convert your funds to US dollars before transferring them to your US bank account.

EMIs like Payoneer usually don’t require an initial deposit, but this can vary. For example, Wise currently asks for a small deposit of under $50. It’s always a good idea to check the specific requirements on their individual websites before signing up.

4. Setting Up Online Banking Access

Once your bank account is activated, you’ll want to set up online and mobile banking for convenient access.

This typically involves creating a strong, unique password and enabling two-factor authentication (2FA) for added security. Security should be on your top priority list. Protecting your account is paramount. Familiarize yourself with the bank’s security features, such as fraud alerts and account monitoring tools. Be cautious of phishing attempts and avoid sharing sensitive information with anyone.

5. Obtaining a Debit Card

You may be able to request a debit card as part of your account setup. If you’re not physically present in the US, the bank might be able to mail the card to your international address. However, there may be restrictions or additional fees associated with this. When using your debit card internationally, be aware of potential fees such as foreign transaction fees and currency conversion charges.

These fees can vary depending on your bank and the specific transaction. It’s advisable to check with your bank to understand their international transaction policies and any applicable limits.

6. Understanding Charges

Many US banks impose monthly maintenance fees on business accounts, especially for non-resident accounts. These fees can vary based on the bank and the specific account type. Additionally, be prepared for fees associated with wire transfers, international transactions, and currency exchanges.

To minimize costs, consider using ACH (Automated Clearing House) transfers for domestic transactions within the US. ACH transfers are generally more cost-effective than wire transfers.

If you need to make international transfers, research the best exchange rates and lowest fees offered by different banks and financial institutions.

Learn about ITIN, and how to get the one from the detailed video by Ashfaq Khattak

8. Tax and Financial Implications

As a foreign-owned LLC with a US bank account, you’ll have specific tax obligations. These include filing annual tax returns, paying corporate income tax, and potentially withholding taxes on payments to non-US residents.

It’s crucial to understand these obligations to avoid penalties and ensure compliance. Given the complexities of US tax laws, especially for foreign-owned entities, it’s highly recommended to consult with a US-based tax advisor.

They can provide tailored advice based on your specific circumstances, help you navigate the tax system, and ensure you’re meeting all your tax obligations.

Excited to open your U.S. bank account? At Scounts, we’re here to help you set up your LLC and guide you through the bank account process.

Reach out to us anytime, and we’ll help you get started on your U.S. business journey.