Get EIN Online – Hassle-Free EIN Registration Service for Non-US Residents

✅ Why You Must Get an EIN (Only Possible With Employer Identification Number!)

- Open US Bank Account

- Use Stripe, Payoneer, Wise

- Sell on Amazon & eBay

- Access Zyla, Payoneer

- File US Taxes Legally

- Run a US-Based Business

- Build Business Credit

- Get Business Loans

- Hire Employees in USA

- Appear as Legit Business

Documents & Time Period (EIN Registration Service)

- Passport or National ID for identity.

- Business Address (can be outside the US).

- Business Type (whether you’re an LLC, sole proprietorship, etc.).

- Reason for EIN (e.g., starting a business, opening a bank account).

- Responsible Person’s Name (the one applying for EIN).

- Start Date of Business and Business Activity.

Time Period

Online Application Time: Immediate or within 1-2 business days (Only available for ITIN/SSN Holders)

Fax Application Time: 4-7 business days (30-Day Est Arrival time)

Mail Application Time: 4-6 weeks.

Service Fee

$30 flat fee

Scammed by a Fake EIN Registration Service? Watch This

Common Questions Related to EIN registration Service

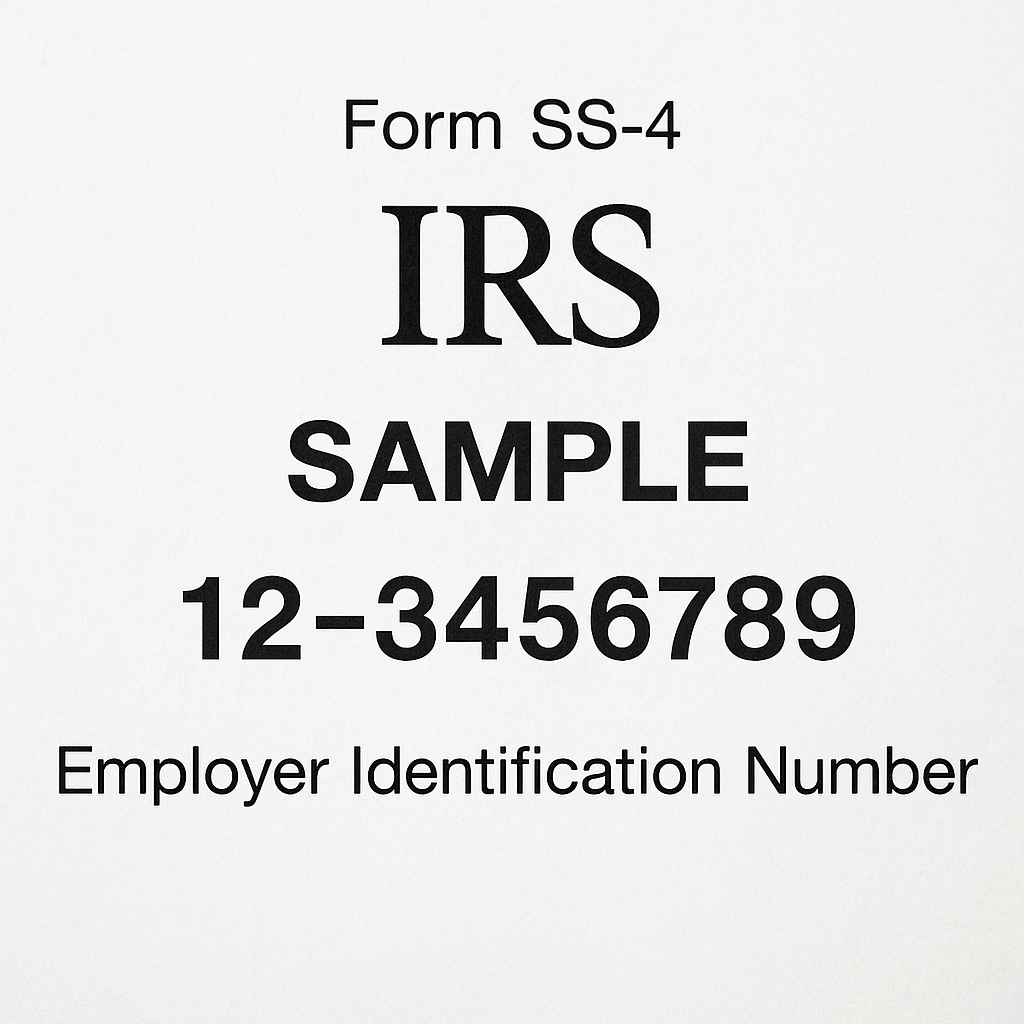

An Employer Identification Number (EIN) is a unique 9-digit number issued by the IRS to identify your business for tax purposes. It's essential for opening a business bank account, hiring employees, and filing taxes.

Businesses like LLCs, corporations, partnerships, and those hiring employees or opening business bank accounts typically require an EIN.

Our service assists you in completing and submitting the required IRS Form, ensuring accuracy and compliance, so you receive your EIN promptly.

Yes, most LLCs and corporations need an EIN for tax reporting, hiring employees, and opening business bank accounts.

While you can apply directly through the IRS, using our service ensures correct filing and saves you time.

Yes, especially if you plan to hire employees or open a business bank account.

Not always, but it's recommended if you hire employees or want to separate personal and business finances.

Yes, foreign-owned LLCs must obtain an EIN to operate legally in the U.S.

You'll need details like your business name, address. Please check the above section for exact list of information/documents needed

Yes, the IRS offers an online application tool for eligible applicants.

It's the application form to obtain an EIN from the IRS.

Yes, an EIN is a type of Tax Identification Number (TIN) used for business entities.

Most banks require an EIN to open a business account.

No, an EIN is for businesses; an SSN is for individuals.

Contact the IRS at 800-829-4933 to retrieve your EIN.

Yes, by notifying the IRS using Form 8822-B. You can also contact us for this purpose.

No, but you must provide a mailing address where the IRS can send correspondence.

You can apply by mail or fax using Form SS-4, leaving the SSN/ITIN field blank.

Our service ensures accuracy, saves time, and provides support throughout the process.

We handle the application process, ensure compliance, and address any issues that arise.

Our EIN registration service starts at $30.

You'll receive a confirmation letter from the IRS once your EIN is assigned.

We'll review the reasons and assist you in correcting and resubmitting the application.

Yes, if your application was rejected, you can correct the issues and reapply.

You can contact the IRS or use our service to verify an EIN.

Yes, by sending a letter to the IRS requesting the closure of your business account.

We are experienced professionals specializing in EIN registration services. We are partnered with certified IRS agents to provide the best possible services for EIN, ITIN, and tax filing services.

Form Your LLC with Us – Click Here

Get smooth and trusted ITIN registration Service