You wake up, check Amazon Seller Central, and see normal sales.

Then a US state emails you asking why your business never registered for sales tax.

You panic.

You live in Pakistan. You do not have a US office. So how can a US state tax apply to you?

Because Amazon stored your inventory there.

If your products sit inside a US state, many states treat that as physical presence. That can trigger sales tax registration and filing duties even if you are not a US resident.

This guide is for Pakistani and other non resident Amazon FBA sellers who:

- Are planning to form a US LLC

- Already run FBA through a US LLC

- Want to avoid surprise notices and cleanup later

You will learn:

- How FBA inventory creates sales tax nexus

- Which states are highest risk

- What Amazon handles and what it does not

- How to check where your inventory is stored

- What to do next, step by step

A Real Example Most Pakistani Sellers Do Not See Coming

Ali is based in Karachi.

He forms a US LLC in Delaware through an online service. He gets his EIN and starts Amazon FBA. Sales grow. Amazon collects sales tax on orders in many states as the marketplace facilitator. Amazon

Six months later, Amazon redistributes his inventory.

Some units move to California. Some to Texas. Some to Pennsylvania.

Ali never selected those states. He never rented a warehouse there. Amazon moved the inventory automatically to speed up delivery.

One year later, Ali receives state correspondence asking why his business never registered or filed, even though inventory was stored inside the state. Pennsylvania’s own guidance says that having property or inventory in Pennsylvania can make a business subject to Pennsylvania taxes, including when inventory is stored in a fulfillment center located in Pennsylvania.

The risk appeared quietly because:

- Inventory placement is automatic

- The seller never chooses the states

- Nexus can start without any clear warning

- Compliance obligations build in the background

What “Sales Tax Nexus” Means in Simple Words

Sales tax nexus means a legal connection between your business and a US state.

If that connection exists, the state can require you to follow its sales tax rules.

For Amazon FBA sellers, a common trigger is inventory.

Inventory inside a state usually counts as physical presence. Washington’s tax agency lists “having real or tangible personal property in the state” and even “a stock of goods in Washington, including inventory held by a marketplace facilitator or another third party” as physical presence nexus creating activity. Washington Department of Revenue

Physical presence often leads to:

- Sales tax registration in that state

- Sales tax returns (sometimes even if tax was collected by a marketplace)

- Collecting tax on non-Amazon sales shipped into that state

Now the key difference.

Federal tax is handled by the IRS (income tax rules and federal filings).

State sales tax is handled separately by each state tax authority, and states can apply their own nexus standards and enforcement. For example, Pennsylvania explicitly ties in-state inventory to Pennsylvania tax obligations. pa.gov

Why Amazon FBA Creates Nexus Even If You’re in Pakistan

Amazon does not keep your inventory in one place.

It constantly redistributes products across its US fulfillment network to reduce delivery times. As of recent reporting, Amazon operates 110+ fulfillment centers across roughly 35 US states, which is why FBA sellers often end up with inventory spread across multiple states without realizing it.

Avalara explains this clearly: when Amazon moves your inventory between fulfillment centers, your business footprint moves with it, even though you never requested those locations.

That is the hidden compliance trigger.

Your product sitting on a shelf inside a state is treated as your property in that state, not Amazon’s.

And most states consider that physical presence.

Pennsylvania’s Department of Revenue explicitly says that businesses with property or inventory stored in Pennsylvania, including inventory held in fulfillment centers, can become subject to Pennsylvania tax obligations. pa.gov

Washington’s Department of Revenue states that having tangible personal property or inventory in Washington, even when stored by a third party or marketplace facilitator, creates physical presence nexus. Washington Department of Revenue

California also directly addresses fulfillment centers in its tax guidance, explaining that businesses using fulfillment warehouses may have registration and reporting responsibilities under California law. CDTFA

In simple terms:

- Amazon chooses where inventory goes

- You still own that inventory

- States treat owned inventory as business presence

So even if:

- You live in Pakistan

- Your LLC is registered in Delaware or Wyoming

- You never visited the US

Once your products are stored inside California, Texas, Pennsylvania, Washington, or any other state, many states consider that enough to establish nexus.

You do not control placement.

But you still carry the compliance responsibility.

Want the broader version of this rule beyond Amazon, including 3PL warehouses and “small batch inventory” myths? Read our deep dive on warehouse inventory creates sales tax nexus.

High-Risk States for Amazon FBA Sellers (Start Here)

Not all states create the same compliance risk.

But some states appear repeatedly in Amazon inventory reports because they combine large fulfillment footprints with active enforcement.

Start with these:

| State | Why It’s High Risk |

| California | CDTFA explicitly addresses fulfillment centers and treats in-state inventory as a compliance trigger |

| Texas | Inventory creates nexus and Texas applies additional business tax concepts |

| Washington | Physical presence includes inventory held by third parties and B&O tax applies |

| Pennsylvania | PA clearly states that inventory in fulfillment centers creates tax obligations |

| Illinois | Major Midwest logistics hub |

| New Jersey | Dense fulfillment network |

| Florida | Rapid Amazon expansion and large consumer base |

Official confirmations:

- California CDTFA explains that businesses using fulfillment centers may have California registration and reporting responsibilities:

- Texas Comptroller confirms marketplace sellers can still have Texas tax obligations when inventory is stored in Texas:

- Washington Department of Revenue states that having inventory in Washington, even when held by a marketplace facilitator or third party, creates physical presence nexus:

- Pennsylvania Department of Revenue explicitly says inventory stored in Pennsylvania fulfillment centers can subject sellers to Pennsylvania taxes:

These states show up most often when sellers export Amazon inventory location reports.

If your products were stored in any of them, they should be reviewed first.

For a deeper breakdown of how state risk affects foreign-owned entities, see our guide on high-risk US states for foreign-owned LLCs:

Amazon Collects Sales Tax — But That’s Not the End of Your Responsibility

Amazon operates as a marketplace facilitator in most US states.

That means Amazon:

- Calculates sales tax on marketplace orders

- Collects it from customers

- Remits it directly to the state

Amazon confirms this in its own marketplace tax guidance:

This helps.

But it does not automatically remove your compliance duties.

Many states still expect sellers with inventory nexus to:

- Register for a sales tax permit

- File returns (sometimes zero-dollar returns)

- Keep documentation proving Amazon collected tax

- Collect tax themselves on non-Amazon sales (Shopify, invoices, wholesale)

Washington clearly separates marketplace collection from seller responsibilities and still requires registration in many cases. Washington Department of Revenue

California also stresses recordkeeping requirements for marketplace sellers under its Marketplace Facilitator Act. CDTFA

This is where foreign sellers get trapped.

Amazon handles checkout tax.

But states care about inventory presence, registration status, filings, and records.

If you cannot show:

- where inventory was stored

- that sales were marketplace facilitated

- that tax was remitted by Amazon

states may assume non-compliance and assess retroactively.

That is how quiet FBA activity turns into expensive cleanup.

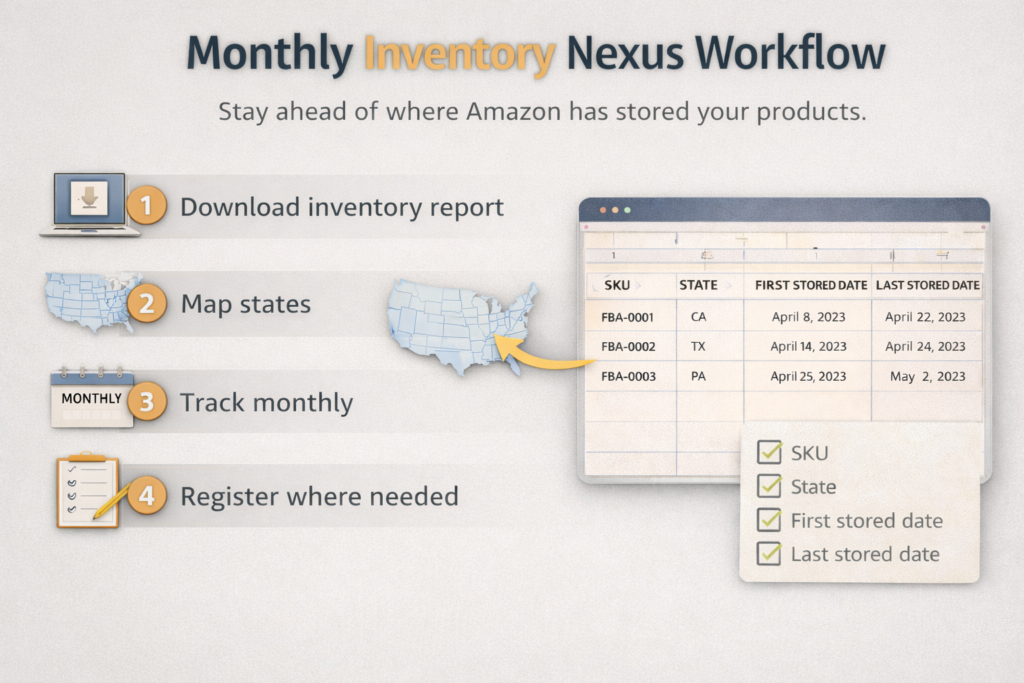

How to Check Exactly Where Amazon Stored Your Inventory

You cannot manage sales tax nexus with assumptions. You need a clean record of where your units were stored and when.

Step 1: Download an Amazon inventory movement report

Use the Inventory Ledger report. Amazon states the detailed view includes inventory events in fulfillment centers, and it includes the fulfillment center where the transaction took place.

Amazon also confirms you can download fulfillment reports as CSV for spreadsheet work.

Step 2: Map fulfillment center codes to states

Amazon explains how fulfillment center identification codes work and lists fulfillment centers by state, which helps you map codes to locations.

Step 3: Build a simple spreadsheet

Keep it simple and audit-friendly:

- SKU or ASIN

- State

- First stored date

- Last stored date

Why this protects you

If a state ever questions your nexus, this log lets you show exact dates of in-state inventory presence instead of guessing. That is the difference between a clean response and a messy, expensive cleanup.

If you want the full nexus-check workflow beyond inventory location, use this step-by-step guide on how to check sales tax nexus step-by-step.

Compliance Path for Pakistani Amazon Sellers

If you do not have a US LLC yet

- Form your US LLC

- Get your EIN

- Start inventory location tracking from Day 1 (monthly export)

- Review your inventory states every month

- Register only where inventory is actually stored and where your obligations apply

If you want Scounts to handle the setup end-to-end, start here: US LLC registration from Pakistan.

If you already have a US LLC and FBA is running

- Pull the last 12 to 24 months of inventory location history (Inventory Ledger)

- List every state where inventory was stored

- Separate Amazon marketplace sales vs off-Amazon sales (Shopify, wholesale, invoices)

- Register where required and start compliant filings

- Keep documentation showing where inventory was and what Amazon collected

For the full action plan and cleanup strategy, follow the Amazon FBA compliance action plan.

What Happens If You Ignore Inventory Nexus

Most sellers do not get fined on day one.

What usually happens is quieter.

First comes a notice from a state asking why your business never registered, even though inventory was stored there.

If you do nothing, states can move forward with:

- Backdated registration

- Forced sales tax filings

- Penalties and interest on past periods

- Estimated assessments when records are missing

- Compliance holds that can affect marketplace payouts (rare, but it happens)

- Complications during business sale or due diligence

Pennsylvania explicitly warns that businesses with inventory stored in Pennsylvania fulfillment centers may become subject to Pennsylvania taxes, even if sales happened online. pa.gov

Washington confirms that inventory held by a marketplace facilitator or third party creates physical presence nexus, which brings registration and reporting expectations. Washington Department of Revenue

California’s CDTFA also treats fulfillment-center activity as a compliance trigger and emphasizes registration and recordkeeping obligations for marketplace sellers. CDTFA

For Pakistani sellers running a single-member US LLC, there is another layer of risk.

Even if your federal income tax is zero, the IRS still requires Form 5472 + pro-forma Form 1120 every year. Missing this filing can trigger automatic penalties.

If your SMLLC compliance is not already in order, you should fix that first.

You can get help here: file Form 5472 correctly

Ignoring inventory nexus does not usually explode overnight.

It becomes expensive later.

FAQs (Based on Real Seller Confusion)

Do I owe sales tax even if Amazon collects it?

Amazon acts as a marketplace facilitator in most states and collects and remits sales tax on Amazon orders. But many states still expect sellers with inventory nexus to register, file returns, and keep documentation, especially if you sell outside Amazon.

Marketplace collection does not erase your nexus.

Do I need to register in every state Amazon touches?

No.

Only in states where your inventory was actually stored or where you otherwise created nexus.

That is why your inventory location report matters.

Can US states penalize foreign sellers?

Yes.

State sales tax laws apply based on business activity, not citizenship.

Pennsylvania and Washington both confirm that in-state inventory creates obligations regardless of where the owner lives:

How often should I check inventory locations?

At least once per month.

Amazon moves inventory automatically. Monthly reviews prevent surprises.

What if I also sell on Shopify or wholesale?

Amazon only collects tax on Amazon marketplace orders.

If you ship Shopify or wholesale orders into states where you have inventory nexus, you may need to collect and remit sales tax yourself.

This is where many sellers fall out of compliance.

Before You Close This Page, Ask Yourself

Right now, do you know:

- Which US states currently hold your inventory?

- Whether you are registered where inventory exists?

- If Amazon handled everything, or only part of it?

- Whether past months created silent exposure?

If you cannot answer those with certainty, you are not alone.

Most Pakistani Amazon sellers discover inventory nexus only when a notice arrives. By then, the conversation is about backdated filings instead of prevention.

The goal is not to panic.

The goal is to check early, fix small gaps, and stay ahead.

You can chat with us on WhatsApp or visit our Contact Us page to discuss your specific situation and get clarity before small issues turn into larger ones.

Sources

https://cdtfa.ca.gov/industry/MPFAct.htm

https://cdtfa.ca.gov/industry/fulfillment-centers

https://dor.wa.gov/education/industry-guides/physical-presence-nexus

https://dor.wa.gov/education/industry-guides/physical-presence-nexus

Disclaimer: This article is authored by a writer at Scounts Private Limited. Please note that the fees mentioned are subject to change and may not be accurate at the time of reading. The content has not yet reviewed by any of our LLC taxation experts. For expert advice or services, feel free to contact us.