What if your US LLC is already non-compliant and you simply haven’t been notified yet?

That is the reality for many non-resident founders.

US compliance does not come with reminders.

There is no warning email when a form is due.

There is no notification when a penalty starts accumulating.

Most foreign founders assume compliance begins at tax time.

In reality, some filings are triggered weeks after formation, others apply even when there is no income, and several penalties do not depend on profit at all.

This is why founders are often surprised months later by notices, fines, or blocked accounts.

This guide exists to prevent that.

It gives non-resident US LLC owners a clear, consolidated compliance checklist for 2026.

What to file. When to file it. And what happens if you do not.

No jargon.

No scattered rules.

Just the information you actually need to stay compliant.

Let’s look at how this usually goes wrong in the real world.

A Real-World Scenario: How Compliance Actually Breaks

A UK-based consultant forms a Wyoming single-member LLC in 2026 to work with US clients.

The setup is straightforward.

The LLC is registered.

An EIN is issued.

A Wise account is opened to receive payments in dollars.

For most of the year, activity is light.

There is no steady revenue.

One small invoice is issued late in the year.

An overseas contractor is paid to help with branding and admin work.

From the founder’s point of view, the business feels dormant. There is a plan to “do everything properly” at tax time once income becomes consistent.

What is not obvious is that compliance obligations have already started.

The LLC exists under US law.

It is owned by a non-resident.

Money has already moved in and out of the company.

Because of this, certain filings apply regardless of profitability.

Some of those filings have deadlines that arrive months before year-end.

State-level requirements also exist simply because the company remains active on the state register.

No reminder is sent when these deadlines pass.

Nothing breaks visibly.

Banking, invoicing, and daily operations continue as normal.

The issue usually surfaces much later. Often when preparing tax filings, opening another account, or seeking professional advice.

At that stage, the problem is not what to file.

It is why something should have been filed earlier.

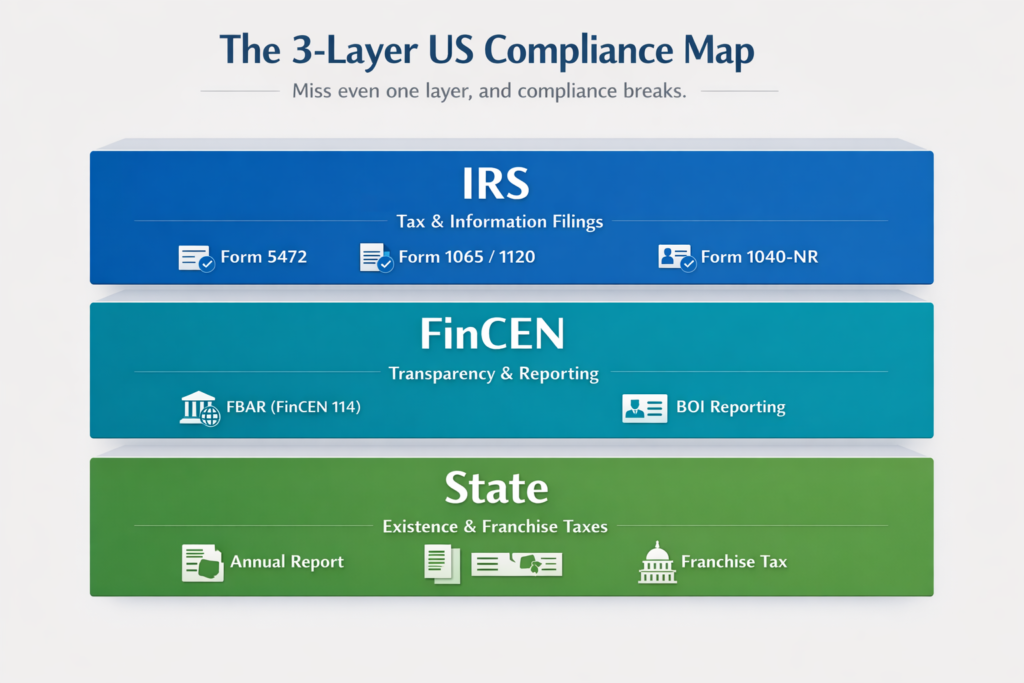

The Compliance Map: How US Obligations Are Structured

One of the biggest reasons non-resident founders struggle with US compliance is simple.

US compliance is not one system.

There is no single filing, no single deadline, and no single authority that covers everything. Instead, obligations are split across three separate layers, each operating independently. Missing even one layer can break compliance without affecting the others.

The first layer is the IRS.

The Internal Revenue Service handles income tax returns, but also a large number of information-only filings. These filings can apply even when a business has no revenue and no tax due. Ownership structure, related-party transactions, and entity classification often determine whether a filing is required, not profitability.

The second layer is FinCEN.

FinCEN is a separate US government agency focused on transparency and financial reporting, not taxation. It oversees filings related to foreign bank accounts, payment platforms, and beneficial ownership disclosures. These obligations exist outside the IRS system and have their own deadlines and penalties.

The third layer is state compliance.

Each US state regulates businesses registered within its jurisdiction. States require ongoing filings to keep an entity in good standing, such as annual reports and franchise taxes. These obligations apply even when a business is inactive and even if federal filings are up to date.

The key idea to understand is this:

If you miss even one layer, compliance breaks.

This is why a consolidated checklist matters before looking at individual forms.

The 2026 Easy Compliance Checklist

This section breaks down the actual filings non-resident US LLC owners must track in 2026. These are not theoretical requirements. These are the filings that most often trigger penalties simply because founders did not know they applied.

Federal IRS Filings (What Most Founders Miss)

Table: Key IRS Filings for Non-Resident US LLC Owners (2026)

| Filing | Who Must File | 2026 Due Date | What Happens If Missed |

| EIN | All US LLCs | Before any filing | Cannot file required IRS forms |

| Form 5472 + Pro-Forma 1120 | Foreign-owned SMLLCs and 25%+ foreign-owned entities | April 15, 2026 | Automatic penalty starting at $25,000 |

| Form 1065 | Multi-member LLCs | March 15, 2026 | Late filing penalties, K-1 issues |

| Form 1120 / 1120-F | C-Corps / foreign corporations | April 15, 2026 | Penalties, loss of deductions |

| Form 1040-NR | Non-resident individuals with US-source income | April 15, 2026 | Late filing penalties, interest |

The EIN is the foundation. Without it, the IRS cannot process any return. If your LLC exists without an EIN, compliance is already blocked. IRS

The most commonly missed filing for foreign founders is Form 5472 with a pro-forma Form 1120. This requirement applies based on ownership, not income. Even inactive foreign-owned single-member LLCs must file it annually. Missing it triggers an automatic penalty that starts at $25,000, regardless of revenue. IRS

Because this filing often confuses non-resident founders, Scounts.pk explains it in detail in its Foreign-Owned Single-Member LLC Tax Filing Guide, which many founders use as deeper reading before filing.

Other federal returns apply depending on structure. Multi-member LLCs must file Form 1065. C-Corporations and foreign corporations engaged in US business may need Form 1120 or 1120-F. Filing the wrong return or missing one can invalidate deductions. IRS

At the individual level, non-resident owners may also need to file Form 1040-NR if they earned US-source income personally. This obligation is separate from the company’s filings. IRS

FinCEN & Transparency Obligations (Often Ignored)

FinCEN filings are not tax returns, which is why many foreign founders overlook them completely.

One key requirement is FBAR (FinCEN Form 114). If foreign financial accounts exceed $10,000 in total at any point during the year, an FBAR filing may be required. This can include non-US bank accounts and certain payment platforms such as Wise. FinCEN

Another major obligation comes from the Corporate Transparency Act, which requires many US LLCs to report beneficial ownership information (BOI) to FinCEN within a set timeframe after formation or ownership changes. This filing applies regardless of citizenship and regardless of income. FinCEN

This is often the point where founders want confirmation, especially when ownership structures or formation dates are unclear. Many choose to book a Free Tax Consultation simply to verify whether BOI reporting applies to them.

State-Level Compliance (Silent Risk Area)

State compliance exists independently from federal compliance.

Most states require annual reports and franchise taxes or fixed fees to keep an LLC in good standing. These obligations apply even when the business has zero revenue.

For example:

- Wyoming requires annual reports to keep the LLC active.

- Delaware charges an annual franchise tax regardless of activity.

- Texas requires franchise reporting even when no tax is due.

Failure to meet state requirements can result in administrative dissolution, even if all IRS filings are up to date.

https://www.nass.org/business-services

Because state rules vary significantly, choosing the right state at formation has long-term compliance consequences. Scounts.pk covers these differences in detail in its guide on How to Choose the Right State for Your LLC.

Compliance Blind Spots Most Foreign Founders Never See Coming

These are not myths. They are patterns seen repeatedly when non-resident founders review their compliance after something goes wrong.

Informational Filings Are Not Tax Filings

Many founders assume a filing is only required if tax is owed. In the US system, several filings exist purely to report ownership or transactions. Missing them can trigger penalties even when the tax bill is zero. Form 5472 is the most common example of this blind spot. IRS

Zero Revenue Does Not Mean Zero Responsibility

US compliance is triggered by existence and structure, not business activity. An LLC that earned nothing can still be required to file federal forms and maintain state good standing. This is why penalties often surprise founders who believed nothing needed to be done yet. IRS

Personal or Foreign Accounts Can Still Trigger Reporting

Founders often assume reporting only applies to US bank accounts. In reality, foreign accounts and payment platforms can trigger separate reporting obligations based on balances, not income. These requirements sit outside the tax system and are easy to miss. FinCEN

State Dissolution Does Not Cancel Federal Duties

Some founders believe that if a state administratively dissolves an LLC, federal obligations disappear. They do not. Federal filing requirements can continue to apply even when a company is no longer in good standing at the state level, which often creates back-filing issues later.

Penalties, Deadlines & Why Timing Matters More Than Amounts

Most non-resident founders focus on how much tax they might owe.

In practice, the bigger risk is missing a deadline, not underpaying tax.

Many US penalties apply automatically once a filing date passes, regardless of intent or revenue.

Common Compliance Deadlines and Consequences (2026)

| Filing | Deadline | Penalty Type |

| Form 5472 + Pro-Forma 1120 | April 15, 2026 | Automatic penalty starting at $25,000 |

| Partnership Return (Form 1065) | March 15, 2026 | Monthly late-filing penalties |

| Corporate Return (Form 1120 / 1120-F) | April 15, 2026 | Penalties, interest, loss of deductions |

| FBAR (FinCEN Form 114) | April 15, 2026 (auto-extend to Oct 15) | Civil penalties for non-filing |

| BOI Reporting (CTA) | Within required period after formation or change | Civil penalties for non-compliance |

| State Annual Report / Franchise Tax | Varies by state | Loss of good standing or dissolution |

The Form 5472 penalty is one of the most severe. The IRS imposes a minimum $25,000 penalty for failure to file, even if the company had no income and no tax due. This penalty applies automatically once the deadline is missed. IRS

Under the Corporate Transparency Act, FinCEN can impose civil penalties for failing to file or update beneficial ownership information on time. These penalties are separate from tax enforcement.

At the state level, missing annual reports or franchise taxes can lead to loss of good standing or administrative dissolution, even if federal filings are current.

https://www.nass.org/business-services

Late extensions do not protect you if they are filed after the original deadline. Extensions must be requested on time to be valid. IRS

This is typically the point where founders seek help, not to reduce tax, but to limit exposure and correct filings before penalties escalate. This is where professional US LLC Tax Filing Services become relevant.

Ongoing Compliance Habits (What to Track All Year)

Staying compliant is less about filing season and more about what you track throughout the year.

The first habit is record retention. US tax rules require businesses to keep supporting records for multiple years. This includes contracts, invoices, receipts, and ownership documents. For most filings, keeping records for at least seven years is a safe baseline. IRS

Next is maintaining related-party transaction logs. Any money moving between you and your US LLC matters. Capital contributions, reimbursements, or expenses paid personally should be logged clearly, even if the amounts are small. These transactions often become reportable later.

You should also retain payment processor reports. Monthly statements from platforms like Wise or Stripe help determine reporting obligations and explain cash flow if questions arise later.

Finally, keep bank statements for all accounts connected to the business. These records support tax filings, information returns, and financial reporting obligations.

These habits are not about preparing for an audit. They are about making compliance predictable instead of reactive. Founders who track consistently rarely face surprises at filing time.

FAQs Based on Real Founder Questions

I made no money. Do I still need to file anything?

Yes. Several US filings are based on ownership and structure, not profit. Foreign-owned US LLCs may still need to file information returns even when revenue is zero and no tax is due. IRS

What if my LLC was inactive all year?

“Inactive” does not remove filing obligations. If the LLC existed during the year and remained registered, certain federal and state requirements can still apply regardless of activity. IRS

What if I missed last year’s filings?

Missed filings do not disappear. Penalties usually apply from the original due date, and ignoring them can increase exposure. The first step is identifying what was required for that year. IRS

Does Wise or Payoneer count as a foreign account?

In some cases, yes. Reporting rules focus on account location and balances, not whether the platform feels like a traditional bank. This is assessed based on how the account is structured and held. FinCEN

I paid expenses personally. Does that matter?

Yes. Personal payments on behalf of the LLC can be treated as reportable transactions between you and the company. Even small amounts can matter for information reporting purposes. IRS

My state dissolved my LLC. Do I still need to file federally?

Possibly. State dissolution does not automatically cancel federal filing obligations. Federal requirements depend on whether the entity existed during the tax year and its ownership structure.

Is the Corporate Transparency Act actually enforced for foreign founders?

The CTA applies to many US entities regardless of the owner’s nationality. Beneficial ownership reporting is handled by FinCEN, not the IRS, and penalties exist for non-compliance. FinCEN

Final Thoughts

US compliance is rarely missed because founders are careless.

It is missed because the system is fragmented, silent, and unforgiving about deadlines.

If you are a non-resident US LLC owner, staying compliant does not require constant stress or deep legal knowledge. It requires clarity, timing, and a single reliable checklist.

When you understand:

- Which filings apply to your structure

- Which deadlines arrive before year-end

- Which obligations exist even with zero income

Compliance becomes predictable instead of reactive.

This guide was built to give you that clarity for 2026.

Use it as a reference. Revisit it during the year. And do not wait for a notice to confirm something was required.

Not sure if you’ve missed something already?

If you’re unsure whether a filing applies to you, whether a deadline has passed, or whether your setup is still compliant, it’s usually better to confirm early than to guess.

You can chat with us on WhatsApp or visit our Contact Us page to discuss your specific situation and get clarity before small issues turn into larger ones.

Sources

https://www.irs.gov/businesses/small-businesses-self-employed/recordkeeping

https://www.irs.gov/instructions/i5472

https://www.fincen.gov/report-foreign-bank-and-financial-accounts

https://www.irs.gov/businesses