A Detailed Compliance Guide for Foreign-Owned LLCs

This article focuses on IRS Form 5472, a federal reporting requirement that applies to many U.S. companies with foreign ownership or foreign-related transactions. The form is often overlooked because it does not calculate tax payable. However, failure to file can result in significant penalties. This guide explains who must file, what must be reported, and how foreign owners can avoid unnecessary compliance risks.

Intended Audience – Foreign Owners and International Founders of U.S. Businesses:

This article is written for foreign individuals and entities, including Pakistani entrepreneurs, who own U.S. LLCs or corporations. It is particularly relevant for single-member LLCs, holding companies, and entities formed for banking, payment processing, or international trade. The content assumes limited knowledge of U.S. tax reporting rules.

Why This Topic Is Important – Penalties Apply Even When No Tax Is Due

Form 5472 carries one of the highest penalties under U.S. information reporting rules. Many foreign owners believe that if a company has no revenue, no filing is required. This assumption is incorrect. The IRS imposes penalties for non-filing regardless of income, profit, or business activity. Understanding this obligation is essential to avoid avoidable penalties.

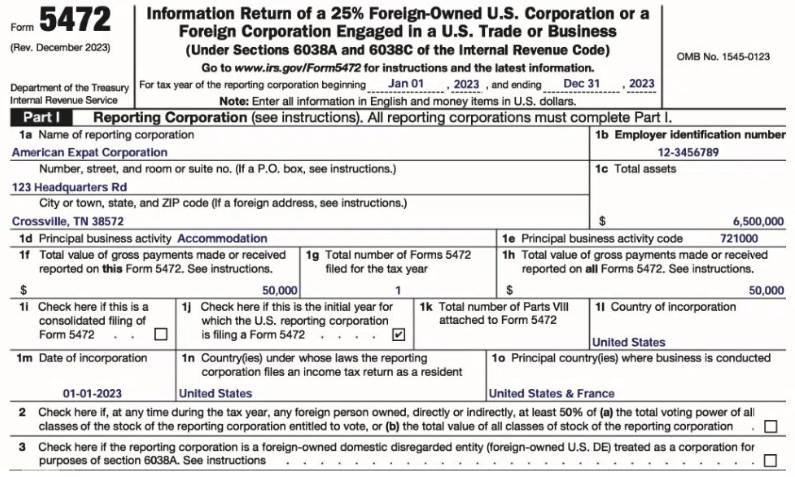

What Is IRS Form 5472 and Why Does the IRS Require It?

IRS Form 5472 is an information return used to report ownership details and transactions between a U.S. company and its foreign owners or related foreign parties. The form allows the IRS to monitor cross-border ownership structures and related-party transactions. It is filed together with a pro-forma income tax return but does not itself calculate tax.

For official details and form instructions, readers may refer to the IRS Form 5472 overview:

https://www.irs.gov/forms-pubs/about-form-5472

Which U.S. Companies Are Required to File Form 5472?

Form 5472 filing requirements generally apply to the following entities:

| Entity Type | Filing Requirement |

| U.S. Corporation with ≥25% foreign ownership | Required |

| Single-member U.S. LLC owned by a foreign person | Required |

| U.S. entity with foreign related-party transactions | Required |

| U.S. entity with no foreign ownership or transactions | Not required |

Even if the company has no income or employees, filing may still be required.

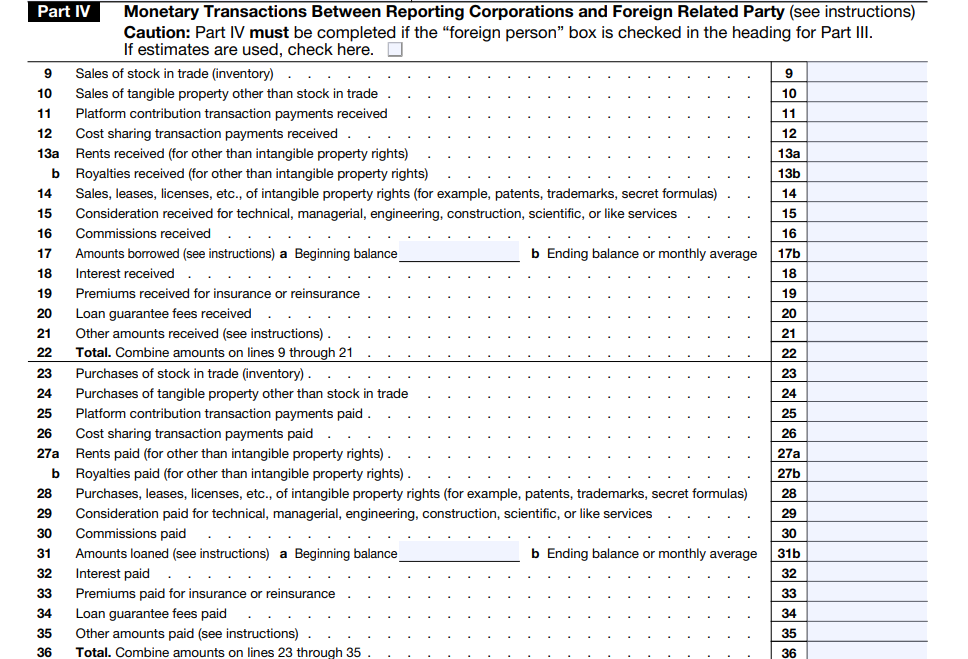

What Are Reportable Transactions Under Form 5472?

A reportable transaction is any financial or non-financial interaction between the U.S. company and a foreign owner or related party. These transactions must be disclosed even if no cash is exchanged.

Examples include:

| Transaction Type | Reportable? |

|---|---|

| Capital contribution by foreign owner | Yes |

| Loan given to or received from foreign owner | Yes |

| Payment of company expenses by owner | Yes |

| Use of company funds for personal expenses | Yes |

| No transactions during the year | Still file (if applicable) |

Common Compliance Errors Made by Foreign Owners:

Foreign owners often face penalties because they:

- Assume Form 5472 is only required when tax is payable

- File state-level documents but ignore federal reporting

- Do not track owner contributions or reimbursements

- Miss filing deadlines or fail to attach the form correctly

These issues typically arise from lack of awareness rather than intent.

Form 5472 Filing Deadlines and Extensions:

Form 5472 is generally due by April 15 for calendar-year companies. If an extension is filed for the associated income tax return, the Form 5472 deadline is also extended. Late filing or failure to respond to IRS notices may trigger penalties.

For detailed instructions and deadline rules, readers may consult the official IRS instructions:

https://www.irs.gov/instructions/i5472

Penalties for Failure to File or Incorrect Filing:

Failure to file Form 5472 can result in:

- A $25,000 penalty per year per form

- Additional penalties if the failure continues after IRS notification

These penalties apply even if the company owes no tax or has no activity.

Step-by-Step Process for Form 5472 Compliance

Step 1: Determine Whether Form 5472 Applies

Confirm whether the U.S. entity has foreign ownership or foreign-related transactions.

Step 2: Identify and Document Reportable Transactions

All transactions between the company and foreign owners must be identified and recorded.

Step 3: Prepare the Pro-Forma Tax Return

Foreign-owned single-member LLCs must prepare a pro-forma Form 1120 to attach Form 5472.

Step 4: Complete and Review Form 5472

Ownership and transaction details must be completed accurately before filing.

Step 5: File and Retain Records

The form is filed with the IRS, and records should be retained for compliance purposes.

Compliance Perspective – Why Form 5472 Requires Ongoing Attention

From a compliance point of view, Form 5472 is a recurring obligation for foreign-owned U.S. companies. Changes in ownership or new transactions can trigger new reporting requirements. Treating Form 5472 as optional or one-time increases exposure to penalties. Proper tracking and timely filing reduce compliance risk.

Most Common Form 5472 Filing and Documentation Errors:

Common Form 5472 errors include failure to report all related party transactions, missing or late filings, omission of required information, and inadequate documentation to support reported transactions. These issues often arise when foreign owned companies assume that limited activity or zero income removes the filing obligation, which is not the case.

How Filing Errors on Form 5472 Can Lead to Significant IRS Penalties:

Errors on Form 5472 can result in substantial IRS penalties when the form is not filed in the required manner, required records are not properly maintained, or incomplete, inaccurate, or misleading information is submitted. The IRS may impose a penalty of 25,000 dollars per Form 5472. An additional 25,000 dollar penalty may apply if the failure continues after the IRS issues a formal notice.

Correcting Form 5472 Errors Before and After Submission:

Before submitting Form 5472, businesses should carefully review the form to confirm that all applicable information is complete and accurate. If an error is identified before filing, a corrected form should be prepared and submitted. If a mistake is discovered after filing, the IRS may require an amended Form 5472 along with a written explanation describing the correction.

How Scounts.pk Assists with Form 5472 Compliance:

Scounts.pk supports foreign-owned U.S. businesses with Form 5472 applicability review, transaction identification, form preparation, and timely filing. The firm works with international founders to help meet U.S. reporting requirements and reduce penalty exposure.

Official IRS Guidance for Reference:

For official instructions and definitions related to Form 5472, readers may refer to IRS resources:

Key Takeaways for Foreign Owners:

Form 5472 is a mandatory reporting requirement for many foreign-owned U.S. entities. Penalties apply even when no tax is due. Understanding filing obligations, deadlines, and reportable transactions is essential for maintaining U.S. tax compliance.