You saw the claim somewhere.

“Open a US LLC. Pay zero tax.”

It sounds clean. It sounds unfair. It sounds like a cheat code.

Then reality hits.

A bank asks for tax forms. Stripe flags your account. A state sends an annual bill. Your accountant mentions Form 5472 and a $25,000 penalty for getting it wrong.

Here’s the truth for 2026.

A foreign-owned US LLC can end up owing $0 in US federal income tax, but only when your facts support it.

No US trade or business. No US-source taxable income. Clean structure.

That still does not mean “no paperwork” or “no costs.”

You can still face IRS reporting, state fees, sales tax rules, and BOI checks.

This guide breaks it down in plain language.

You will know what triggers tax, what triggers filings, and what you must budget every year.

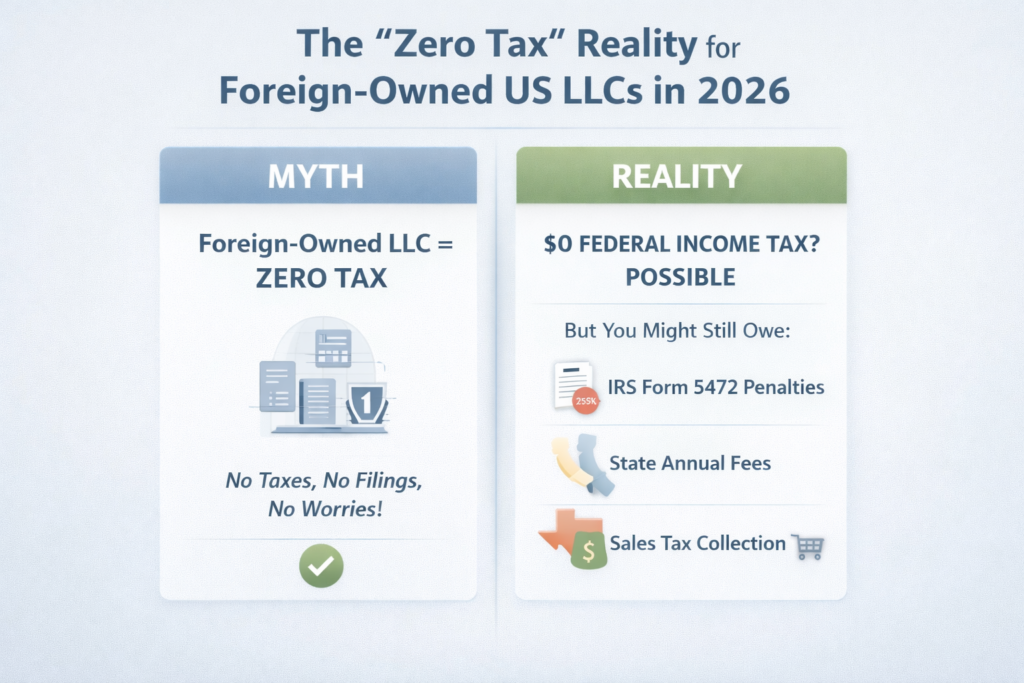

The “Zero Tax” Myth: What Foreign Founders Get Wrong

Foreign founders repeat “US LLC = zero tax” because they mix three different systems into one claim:

- Federal income tax

- Federal reporting (information returns)

- State fees/taxes + sales tax

Those systems run on different rules. They can all apply even when your federal income tax is $0.

Myth 1: “Foreign-owned LLC = no US tax”

A US LLC does not create a tax-free bubble.

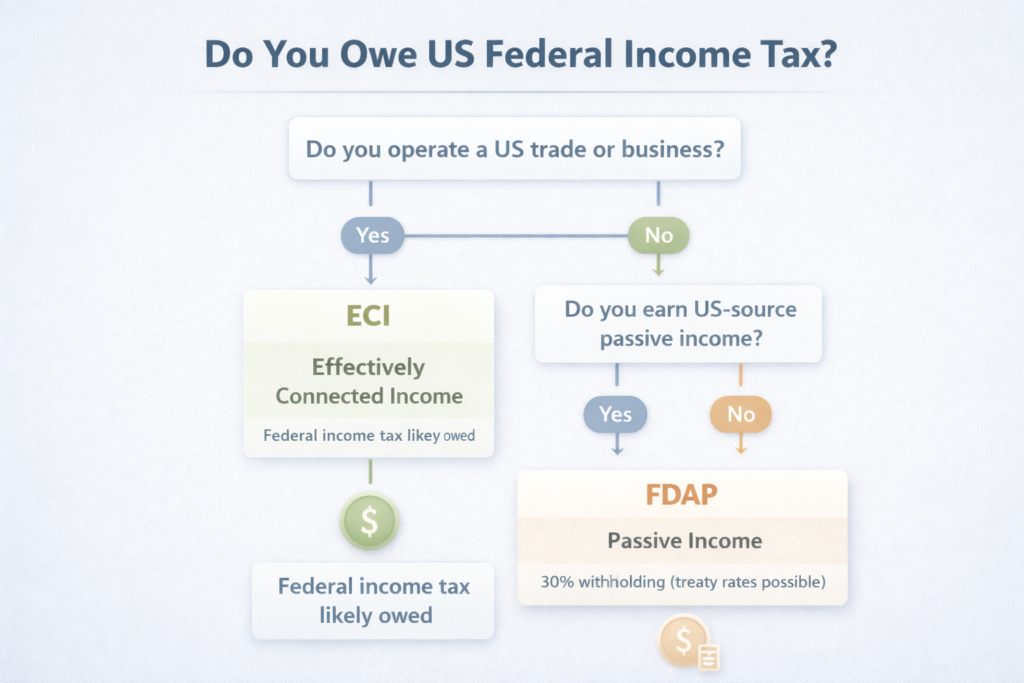

US federal income tax for nonresidents depends on:

- US-source income, and

- income effectively connected to a US trade or business

The IRS explains this framework for nonresident aliens and how the US taxes ECI vs passive income. IRS – Publication 519, IRS – Taxation of nonresident aliens

What this means for you:

“Zero federal income tax” can be real, but only if your facts keep you out of US-source taxable income and US trade/business exposure.

Myth 2: “No revenue means no filings”

This myth is expensive.

Foreign-owned LLCs often trigger information reporting even when:

- revenue is $0

- profit is $0

- the LLC only moved money between the owner and the business account

The biggest trap is Form 5472.

The IRS states a $25,000 penalty applies if a reporting corporation fails to file Form 5472 when due and in the required manner (and the penalty can also apply for failure to maintain required records).

The IRS also explains Form 5472 exists to report reportable transactions between a reporting corporation and related parties.

What founders miss:

Owner funding, reimbursements, loans, and intercompany charges can create reportable transactions even with “no business activity.”

Myth 3: “I’m outside the US, so I’m not doing business in the US”

Your passport does not control your tax outcome. Your facts do.

The IRS explains:

- ECI gets taxed after allowable deductions at graduated rates, and

- FDAP is generally taxed at 30% (or lower treaty rate) with no deductions. IRS – Taxation of nonresident aliens

So if your operations create a US trade or business, your “zero tax” claim can collapse fast.

Myth 4: “Even if federal tax is $0, everything is free”

States can still charge you.

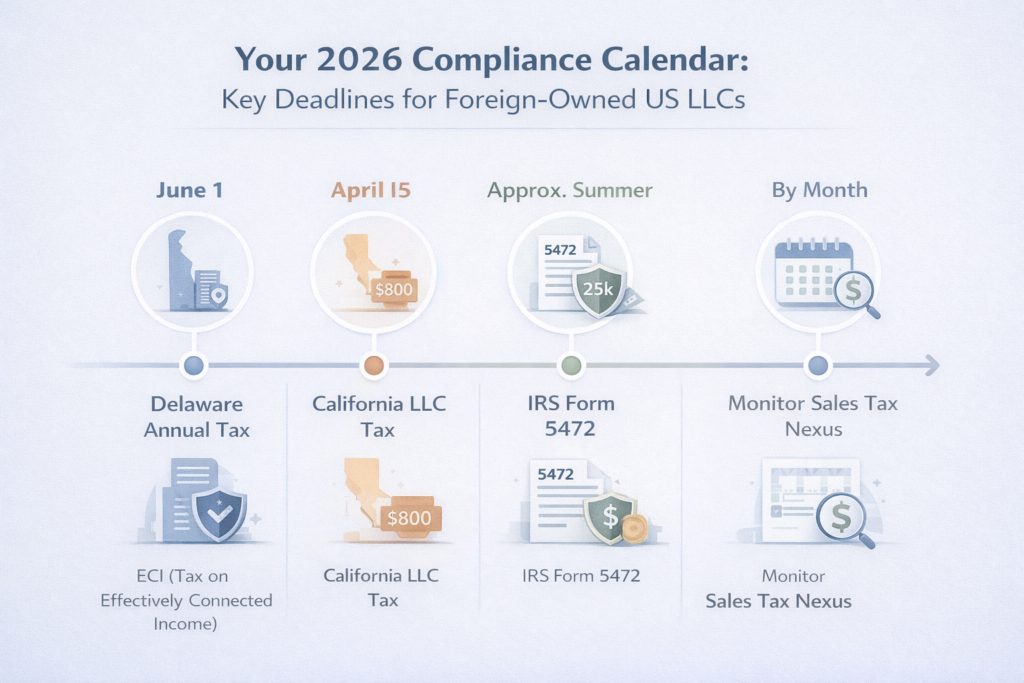

Example: Delaware’s Division of Corporations states that alternative entity taxes are due on or before June 1, and late payment triggers penalties and interest.

Founder translation:

You can owe $0 in federal income tax and still pay annual state fees and file state reports.

How the IRS Classifies a Foreign-Owned US LLC (2026 Basics)

Before you talk about “zero tax,” you must understand how the IRS classifies your LLC.

This classification decides who is taxed, what forms exist, and which penalties apply.

Single-member LLC: usually a disregarded entity

If your LLC has one owner, the IRS treats it as a disregarded entity for federal income tax purposes unless you elect otherwise.

That means:

- The LLC itself does not pay federal income tax.

- The IRS looks through the LLC to the foreign owner.

- Reporting duties can still exist at the entity level, even if income tax is $0.

Multi-member LLC: partnership by default

If your LLC has more than one member, the IRS generally treats it as a partnership by default, unless the LLC files an election to be taxed as a corporation.

This changes the compliance picture:

- The LLC becomes a pass-through entity.

- Partnership-level filings and partner reporting rules apply.

- Foreign owners can face additional reporting and withholding exposure. IRS – Entity classification rules (“check-the-box”

Electing corporate treatment (Form 8832)

An LLC can choose to be taxed as a corporation by filing Form 8832.

This is not automatic. It is a deliberate election.

Once made:

- The company becomes the taxpayer.

- Corporate income tax rules apply.

- Dividend and withholding rules may apply to foreign owners.

Why classification matters for the “zero tax” claim

This is where many founders get confused.

Even if your federal income tax is legitimately $0, classification can still trigger mandatory filings.

Example:

- A foreign-owned single-member LLC can be required to file Form 5472, even with no revenue.

- The IRS states the penalty for failing to file Form 5472 correctly starts at $25,000 per year. IRS – Instructions for Form 5472

The one question that controls everything

Before worrying about rates or loopholes, ask this:

Did your classified entity earn US-source income or engage in a US trade or business during the year?

That question is the IRS starting point for foreign owners. IRS – Taxation of nonresident aliens

Form 5472 Explained: Why Foreign-Owned LLCs Get Penalized Even With Zero Revenue

If there is one IRS form foreign founders underestimate, it is Form 5472.

Most penalties in “my LLC made no money but I still got fined” stories trace back to this form.

What Form 5472 actually is

Form 5472 is an information return.

It is not a tax return.

The IRS uses it to track transactions between a US entity and its foreign owner or other related parties.

That is why profit does not matter here. IRS – About Form 5472

Who must file Form 5472

You must pay attention to Form 5472 if all three are true:

- You own a US LLC

- You are a foreign person or foreign company

- The LLC is treated as a disregarded entity for federal income tax

In this setup, the IRS treats the LLC as a reporting corporation solely for Form 5472 purposes. IRS – Instructions for Form 5472

“But my LLC had no revenue” — why that doesn’t help

Form 5472 is triggered by reportable transactions, not sales.

Reportable transactions include:

- Owner funding the LLC

- Owner paying LLC expenses

- LLC reimbursing the owner

- Loans between owner and LLC

- Intercompany charges

So if you:

- opened a bank account,

- transferred money in to start operations,

- paid for software, hosting, or ads,

you likely created a reportable transaction.

The penalty most founders discover too late

The IRS states clearly:

- Failure to file a complete and correct Form 5472 by the due date carries a $25,000 penalty

- If the failure continues after IRS notice, additional $25,000 penalties can apply

- There is no maximum cap

This penalty applies even if no tax is owed.

What you actually file (simple version)

Foreign-owned disregarded LLCs usually must submit:

- Form 5472

- A pro forma Form 1120 (cover page only, no income figures)

You do not e-file this return.

It must be filed by mail or approved fax methods. IRS – Instructions for Form 5472 (Reportable Transactions)

Why this form kills the “US LLC = tax haven” idea

Here is the uncomfortable truth:

You can owe:

- $0 in federal income tax

- $0 in state income tax

- $25,000 in IRS penalties

Form 5472 is why “zero tax” stories collapse in real life.

Practical checklist to stay safe

If you run a foreign-owned single-member US LLC:

- Track every transfer between you and the LLC

- Keep bank records and invoices

- Confirm whether Form 5472 applies every year

- File on time, even if activity was minimal

Starting from Pakistan and want the setup done right from day one? Use this step-by-step guide to register a US LLC from Pakistan without missing the compliance basics.

When Form 1120-F Is Required (Even If You Owe $0 Tax)

Form 1120-F is another filing foreign founders misunderstand.

Many believe:

“If I don’t owe US tax, I don’t file anything.”

That belief is wrong.

What Form 1120-F actually is

Form 1120-F is the US income tax return for foreign corporations.

It applies when a foreign company (not an individual) is:

- engaged in a US trade or business, or

- earning income that is effectively connected with that US activity.

When foreign founders trigger Form 1120-F

You may need to care about Form 1120-F if:

- Your LLC owner is a foreign corporation, or

- You operate through a foreign parent company, or

- You elected corporate treatment and your structure routes income through a foreign entity

If that foreign corporation is considered to be doing business in the US, the filing requirement exists even if the final tax due is zero.

“But the tax treaty reduces my tax to zero”

This is another common trap.

US tax treaties can reduce or eliminate tax owed, but they do not remove filing obligations.

The IRS states that to claim treaty benefits, a foreign corporation must:

- file Form 1120-F, and

- properly disclose treaty positions

If you do not file, you can lose deductions and treaty protection entirely.

Why filing matters even with no tax due

If you fail to file Form 1120-F:

- The IRS can deny deductions

- The IRS can assess tax on gross income

- You lose the ability to rely on treaty protections

So “no tax due” does not mean “safe to skip the return.”

How Form 1120-F fits into the “zero tax” myth

Here’s the reality:

- Some foreign-owned structures legitimately owe $0 US income tax

- That same structure may still be required to file Form 1120-F

- Skipping the filing can turn a $0 outcome into a costly problem

This is another reason “US LLC = tax haven” is an oversimplification.

Quick decision check

Form 1120-F is likely relevant if:

- A foreign corporation is involved, and

- There is any US trade or business activity, even limited

If you are a foreign individual owning a disregarded LLC directly, Form 1120-F may not apply; but Form 5472 often does, which we already covered. IRS – About Form 1120-F

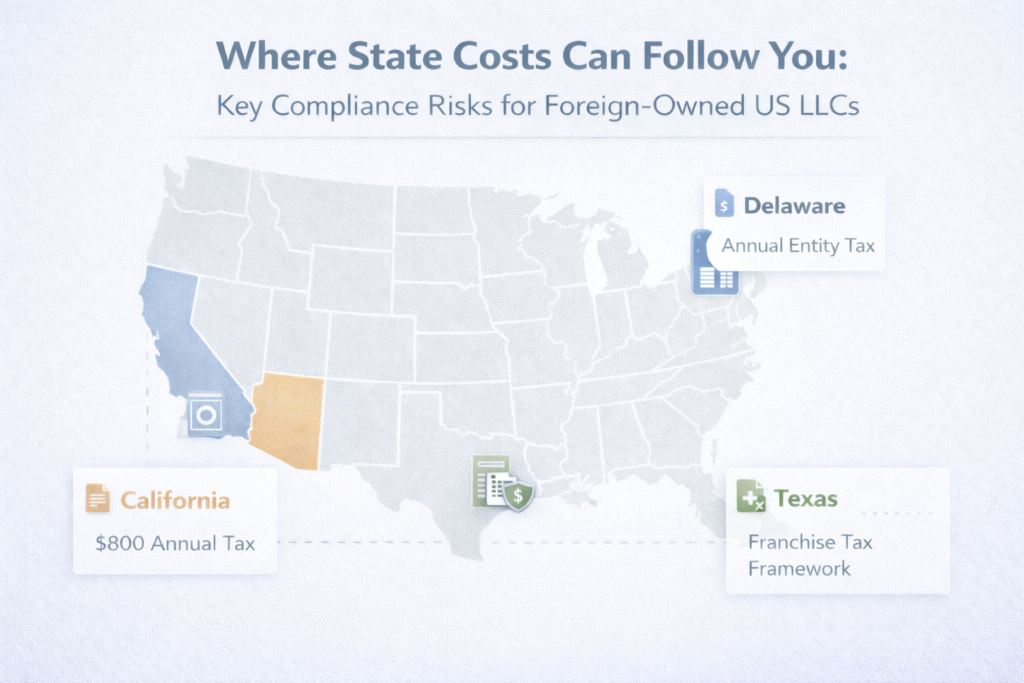

State Taxes and Annual Fees: Why States Still Charge You When Federal Tax Is $0

Federal income tax is only one layer.

States run their own systems, and they do not care that you are foreign or that your federal tax bill is zero.

This is where many founders get surprised.

Why states can charge you even when the IRS doesn’t

States can impose obligations based on:

- where your LLC is formed

- where your LLC is registered to do business

- where you operate, sell, or have presence

These obligations are often:

- flat annual fees

- franchise or privilege taxes

- mandatory annual reports

They apply even with no revenue.

Delaware: the most common misunderstanding

Many foreign founders form in Delaware and assume it is “tax-free.”

It is not.

Delaware charges an annual alternative entity tax on LLCs, due June 1 every year.

- The tax applies even if:

- you had no revenue

- you did no business in Delaware

- Late payment triggers penalties and interest. Delaware Division of Corporations – Alternative Entity Tax

Founder takeaway:

If you form a Delaware LLC, you must budget the yearly fee. There is no “inactive” exemption.

California: the $800 annual tax trap

California is where many “remote” businesses accidentally land in trouble.

If your LLC is:

- formed in California, or

- considered to be doing business in California

you generally owe an $800 annual LLC tax.

This applies even if:

- revenue is $0

- the business is foreign-owned

- activity was minimal

California defines “doing business” broadly, which can include:

- sales into California

- contractors working from California

- management activity connected to the state. California Franchise Tax Board – LLC Annual Tax

Texas: franchise tax even with no income tax

Texas does not have a traditional income tax, but it does impose a franchise tax on entities:

- formed in Texas, or

- doing business in Texas

Even when no tax is due, reports may still be required.

Missing the filing can trigger penalties or loss of good standing. Texas Comptroller – Franchise Tax Overview

New York: foreign qualification and publication costs

New York adds a different type of cost.

If you register a foreign LLC to do business in New York, the state requires:

- publication of formation notices in two newspapers

- filing a Certificate of Publication

Failure to comply can suspend your authority to do business. New York Department of State – Publication Requirement

Why state costs break the “zero tax” story

Here is the hard truth:

You can owe:

- $0 federal income tax

- $0 IRS penalties (if you file correctly)

- hundreds or thousands per year in state fees

This is normal. It is not a mistake.

States charge for the privilege of existence or operation, not for profit.

Practical state compliance checklist

If you are a foreign founder:

- Track where your LLC is formed

- Track where it is registered

- Review where you actually operate or sell

- Budget state fees separately from federal tax

Ignoring states is how “cheap US LLCs” turn expensive.

Not sure whether Delaware, Wyoming, or your operating state makes sense? Use this state-selection guide so you don’t pick a “popular” state that quietly increases your yearly costs and filing burden.

Sales Tax and Economic Nexus: “I’m Foreign” Does Not Matter (Tight)

Sales tax is not federal income tax.

It is a state collection duty. Your passport does not protect you.

If you sell into US states, you can be required to:

- register

- collect sales tax

- file returns

Even when your federal income tax is $0.

Why this exists (the Wayfair shift)

In South Dakota v. Wayfair (June 21, 2018), the US Supreme Court upheld sales tax collection requirements for remote sellers based on economic thresholds, not just physical presence. Supreme Court opinion

What “economic nexus” means in real life

Most states set thresholds based on:

- gross sales into the state, and/or

- number of transactions

The Streamlined Sales Tax organization maintains a state-by-state “Remote Seller State Guidance” list showing these threshold rules and effective dates.

They also clarify that when a threshold is based on “gross sales,” it can include taxable and nontaxable sales into the state, depending on the state rule. Streamlined Sales Tax – Remote Seller State Guidance

Texas example (shows why “rules vary by state”)

Texas uses a higher threshold than many states. The Texas Comptroller states remote sellers are not required to collect Texas tax if total Texas revenue is less than $500,000 in the preceding 12 months.

Streamlined Sales Tax also lists Texas’s $500,000 threshold in its tables.

The clean workflow that prevents surprise notices

Do this monthly:

- Track your sales by state

- Watch for threshold states (sales or transactions)

- Register and start collecting once you cross the state’s rule

Do not wait for a letter. By then, you are usually late.

BOI / CTA in 2026: What You Must Verify (Short)

A lot of BOI advice online is outdated.

FinCEN says BOI reporting requirements are back in effect, and it also says entities created in the United States are now exempt from BOI reporting under the interim final rule. FinCEN also says foreign companies registered to do business in a US state can still fall in scope and must follow the BOI filing rules and deadlines that apply to them.

Action you should take

- Do not trust a forum screenshot.

- Check your status on FinCEN’s BOI page.

- If you are a foreign entity registering to do business in a state, read the fact sheet and follow the timeline.

2026 Timeline: What Foreign Founders Usually Owe Each Year (Practical)

Use this as a repeatable yearly checklist. It covers the common traps.

Do you run a foreign-owned single-member LLC and want a clean filing plan? Follow this filing guide to understand what to file, when to file, and what records to keep so you avoid the $25,000 Form 5472 penalty.

“Zero Federal Tax” Checklist: What Must Be True

| Checklist item (must be true) | What it means in plain words | Quick self-check question |

| You do not operate a US trade or business | Your business activity is not carried on in the US in a way that creates ECI exposure | “Do I run operations in the US or through a US base?” |

| You do not perform services in the US | You are not physically delivering services from inside the US | “Did I work in the US for clients this year?” |

| You do not have US-based people doing core work | US-based staff/contractors are not doing work that makes the business look US-run | “Is anyone in the US doing core delivery, sales closing, or management for me?” |

| You do not earn US-source taxable income that triggers ECI/FDAP | You’re not earning US-source passive income or connected business income that triggers tax or withholding | “Am I receiving US-source payments like royalties, interest, dividends, rent, or similar?” |

| You still file required information returns on time | Even with $0 tax, you don’t skip compliance (example: Form 5472 if applicable) | “Am I filing every required form even if my tax due is $0?” |

Source: IRS – Taxation of nonresident aliens

https://www.irs.gov/individuals/international-taxpayers/taxation-of-nonresident-aliens

Source: IRS – Publication 519

https://www.irs.gov/publications/p519

Final Thoughts: The Real 2026 Answer

A foreign-owned US LLC is not a tax haven.

You can reach $0 US federal income tax in clean fact patterns.

You still need to respect:

- IRS reporting (Form 5472 is the big one)

- state annual fees (Delaware, California)

- sales tax nexus rules

- BOI status checks where applicable

The “zero tax” pitch fails because it ignores compliance reality.

Unsure if your US LLC really owes $0 tax in 2026?

Scounts.pk helps you register your company, manage taxes, and handle compliance in Pakistan and the USA; so you don’t rely on guesses or outdated forum advice.

Need help? Chat with us on WhatsApp or visit our Contact Us page.

FAQ

Do foreign-owned US LLCs “pay no tax”?

Sometimes they pay no federal income tax. Many still owe filings and state fees.IRS – Publication 519

Do I file Form 5472 if my LLC had no revenue?

Revenue is not the trigger. Reportable transactions can still exist. The IRS states the penalty starts at $25,000 if you fail to file when due and as required. IRS – Instructions for Form 5472

Does having US customers create US federal income tax?

US customers alone do not decide federal income tax. The IRS looks at US-source income and whether you run a US trade or business. IRS – Taxation of nonresident aliens

What is the easiest way to accidentally trigger state costs?

Form in a state, then ignore the annual fee rules. Delaware and California are the common traps. Delaware Division of Corporations

Do I need BOI reporting for my US LLC in 2026?

FinCEN says entities created in the US are exempt under the interim final rule. Foreign entities registered to do business in a state can still be in scope. Verify on FinCEN’s BOI page and fact sheet. FinCEN – BOI

Do I need to worry about sales tax if I live outside the US?

Yes, if you sell into US states and cross a state’s economic nexus threshold. Wayfair made threshold-based rules enforceable.Supreme Court – Wayfair

Sources

https://www.streamlinedsalestax.org/state-tables

https://comptroller.texas.gov/taxes/sales/remote-sellers.php

https://www.streamlinedsalestax.org/for-businesses/remote-seller-faqs/remote-seller-state-guidance

https://www.supremecourt.gov/opinions/17pdf/17-494_j4el.pdf

https://dos.ny.gov/limited-liability-companies

https://comptroller.texas.gov/taxes/franchise

https://www.ftb.ca.gov/file/business/types/limited-liability-company/index.html

https://www.irs.gov/forms-pubs/about-form-1120-f

https://www.irs.gov/individuals/international-taxpayers/taxation-of-nonresident-aliens

https://www.irs.gov/instructions/i5472

https://www.irs.gov/forms-pubs/about-form-8832

Disclaimer: This article is authored by a writer at Scounts Private Limited. Please note that the fees mentioned are subject to change and may not be accurate at the time of reading. The content has not yet reviewed by any of our LLC taxation experts. For expert advice or services, feel free to contact us.