A US state can decide if you “do business there” even if you never set foot in the US.

That single decision can force you to:

- Register for sales tax

- Collect sales tax when your offer is taxable

- File returns on a schedule

This trigger is called sales tax nexus (your state-level sales tax connection).

Foreign sellers miss nexus for one reason.

They track revenue. They do not track nexus rules by state.

This guide makes nexus simple.

You will follow one repeatable system to check every state, using real rules like Texas’s $500,000 sales-only threshold and Kentucky’s $100,000 or 200 transactions threshold.

You sell SaaS (software you deliver online), run Amazon FBA (Amazon stores and ships your inventory), or offer agency services (done-for-you work).

The same nexus logic still applies. Only your inputs change.

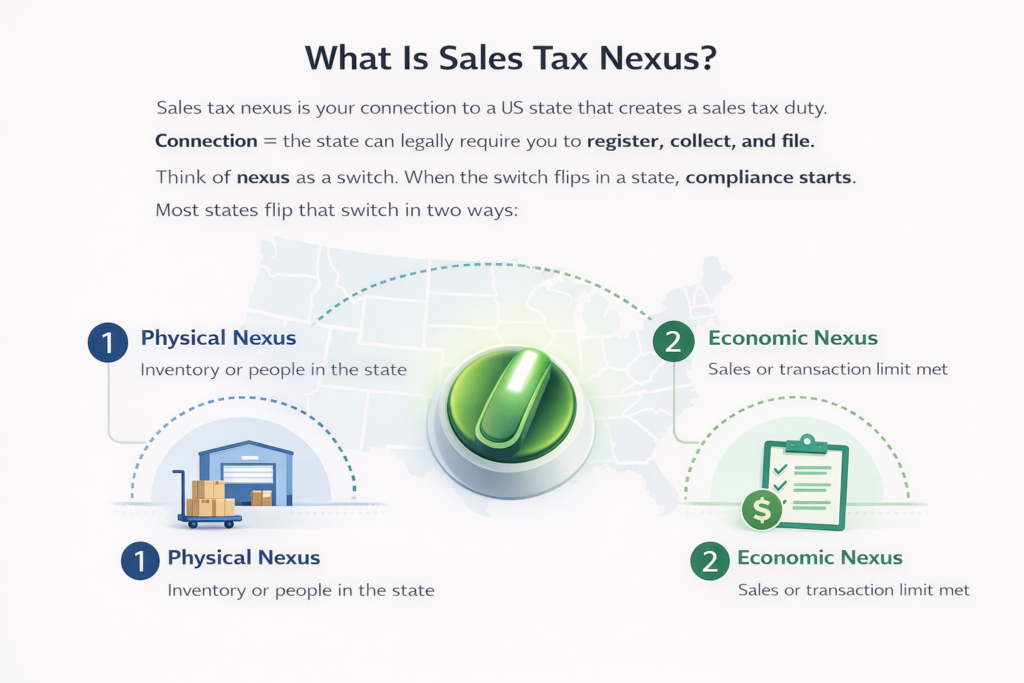

What Is Sales Tax Nexus?

Sales tax nexus is your connection to a US state that creates a sales tax duty.

Connection = the state can legally require you to register, collect, and file.

Think of nexus as a switch.When the switch flips in a state, compliance starts.

Most states flip that switch in two ways:

Physical Nexus (You Have A Real Presence)

Physical nexus means you have people or property in the state (real presence).

Common triggers:

- Inventory stored in the state (Amazon FBA, 3PL warehouses)

- Employees or contractors working there

- Office, warehouse, or equipment in the state

You can trigger physical nexus on day one.

Sales volume does not matter.

Economic Nexus (You Hit A Sales Threshold)

Economic nexus means you trigger nexus through sales activity, even with zero physical presence.

States usually set:

- A sales dollar threshold (example: $100k, $500k)

- Sometimes a transaction threshold (number of orders/invoices)

Texas is a clean example.

Texas gives a safe harbor if your total Texas revenue is under $500,000 in the preceding 12 months, and Texas counts gross revenue from taxable and nontaxable sales of tangible personal property and services into Texas.

New York is different.

New York requires both $500,000 in gross receipts and more than 100 transactions, measured over the immediately preceding four sales tax quarters.

Florida is different again.

Florida applies if you have taxable remote sales over $100,000 in the previous calendar year.

Why This Matters For Foreign Sellers

States do not look at:

- Your passport

- Your country

- Whether you have a US bank account

States look at:

- Where your customers are

- How much you sold into each state

- Whether you crossed that state’s trigger

That is why “I don’t own US property” is not a nexus test anymore.

Want to know how you will actually pay and remit once nexus kicks in (without getting stuck on banking)?

Read our guide on opening a US bank account for your LLC.

The Assumptions That Make Foreign Sellers Miss Nexus

Most nexus mistakes come from bad assumptions, not bad intent.

Fix these early. You save months of cleanup.

Assumption 1: “No US Office Means No Nexus”

Many states can trigger nexus from sales activity alone.

They do not need your office, warehouse, or property.

States use economic nexus (sales-based nexus) thresholds.

Cross the threshold, and you may need to register and start compliance.

Real example (Texas):

Texas gives a safe harbor if your total Texas revenue stays under $500,000 in the preceding 12 months.

Texas also counts gross revenue from taxable and nontaxable sales of tangible personal property and services into Texas.

That means you can trigger the Texas nexus without stepping into the US.

Assumption 2: “A Marketplace Handles Tax, So I Can Ignore Nexus”

A marketplace can collect tax for marketplace orders.

That does not mean you can ignore nexus tracking.

You still need to know:

- Which states you are close to triggering

- Which states you already triggered through direct sales (your own checkout or invoices)

- Which channel you sold through (direct vs marketplace)

This matters for registration, filings, and audit records.

Use marketplace rules as a workflow detail.

Do not treat them as a nexus exemption.

Assumption 3: “Only Big States Use Complex Tests”

Some states use a clean sales-only test.

Some use transactions.

Some require both.

Real example (New York):

New York requires both:

- More than $500,000 in gross receipts from NY sales, and

- More than 100 sales transactions into NY

Measured over the immediately preceding four sales tax quarters (last 4 quarter periods).

If you only track annual revenue, you can miss the timing.

Assumption 4: “If My Offer Is Not Taxable, Nexus Does Not Matter”

Nexus decides whether you must register and file.

Taxability decides whether you must collect sales tax.

You can have nexus and still collect $0 tax.

You may still need to file returns.

Real example (Florida):

Florida’s remote seller rule applies when you exceed $100,000 in taxable remote sales over the previous calendar year.

Even service-heavy businesses can hit this if they sell taxable items, bundles, or add-ons.

Understanding Economic Nexus Thresholds (The Rules That Actually Trigger Compliance)

Economic nexus is where most foreign sellers cross the line without realizing it.

It is not vague.

It is rule-based.

Each state sets clear numeric triggers. When you cross them, nexus flips on.

Think of the economic nexus as a sales limit per state.

Stay under it, you monitor.

Cross it, you act.

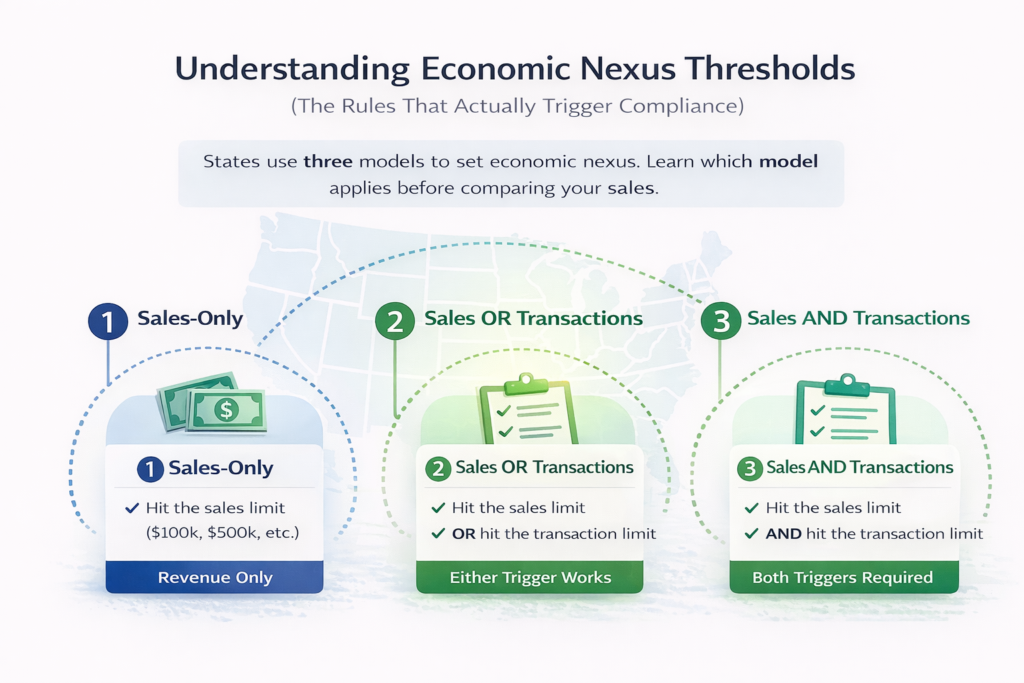

How States Set Economic Nexus Thresholds

States use three models.

You must know which model a state uses before you compare your numbers.

1) Sales-Only Thresholds (Revenue-Based Trigger)

This model looks only at sales value.

No transaction counting.

No order volume math.

If your sales into the state exceed the dollar limit, nexus is triggered.

Simplified:

“If money sold into this state is more than X, you must register.”

Common example:

- $100,000 in sales (many states)

- $500,000 in sales (higher-volume states)

Real example (Texas):

Texas uses a sales-only test.

If your total Texas revenue exceeds $500,000 in the preceding 12 months, nexus is triggered.

Texas counts gross revenue from:

- Taxable and nontaxable sales

- Tangible personal property and services

- Fees, handling, installation

- Sales for resale and sales to exempt entities

Simplified:

“Texas counts almost everything you bill to Texas customers.”

This is why sellers often undercount Texas exposure.

2) Sales OR Transaction Thresholds (Either Trigger Works)

This model gives states two ways to trigger nexus.

You cross either:

- A sales amount, or

- A transaction count

It does not matter which one you hit first.

Simplified:

“High value or high volume can both trigger nexus.”

Real example (Kentucky):

Kentucky triggers nexus if you have:

- $100,000 or more in gross receipts, or

- 200 or more transactions

Measured in the current or previous calendar year.

Why this matters:

Low-price SaaS, subscriptions, or agency invoices can trigger nexus through volume, even if revenue stays below $100,000.

3) Sales AND Transaction Thresholds (Both Must Be Met)

This model is stricter but less common.

You must exceed both:

- A sales amount, and

- A transaction count

If you miss one, nexus does not trigger.

Real example (New York):

New York requires:

- More than $500,000 in gross receipts, and

- More than 100 transactions

Measured over the immediately preceding four sales tax quarters

(last four quarterly filing periods, not calendar year).

Simplified:

“In New York, big revenue alone is not enough. Volume matters too.”

Many sellers miss New York nexus because they only check annual revenue.

Measurement Periods Matter More Than You Think

States do not measure thresholds the same way.

Common measurement windows:

- Previous calendar year (example: Florida)

- Current or previous calendar year (example: California)

- Trailing 12 months (example: Texas)

- Preceding four sales tax quarters (example: New York)

Simplified:

“You must match your sales data to the state’s clock, not yours.”

Using the wrong time window is a common reason sellers think they are safe when they are not.

The Ongoing Shift Toward Sales-Only Thresholds

Many states are removing transaction counts.

Recent changes include:

- Indiana: transaction threshold removed (effective Jan 1, 2024)

- North Carolina: transaction threshold removed (effective July 1, 2024)

- Wyoming: transaction threshold removed (effective July 1, 2024)

- Alaska: transaction threshold removed (effective Jan 1, 2025)

What this means for you:

Tracking revenue is becoming more important than tracking order count.

But transaction thresholds still exist in some states, so you cannot ignore them yet.

Key Rule Before You Move On

Do not compare your numbers yet.

First:

- Identify which threshold model the state uses

- Identify the measurement period

- Identify what the state counts as “sales”

Only then do you run your numbers.

Key State Nexus Thresholds For Common US Markets

Use this table as your “first check” list.

It covers the states most foreign sellers hit early: WA, TX, CA, FL, NY, IL, KY.

Reminder: “Economic nexus” = sales-based nexus (triggered by sales volume, not presence).

Your LLC state choice can change how many states you deal with later.

Read choosing the right state for your LLC before you scale sales across the US.

How To Read This Table Without Overthinking It

- Sales-only states: you track one number (sales dollars).

Texas and Florida are good examples, but Florida uses taxable sales.

- Sales OR transaction states: low-value, high-volume businesses get hit first (subscriptions, small invoices).

Kentucky and Illinois are the clean examples.

- Sales AND transaction states: revenue alone is not enough.

New York requires both tests and uses a 4-quarter lookback.

Step-By-Step: How To Check Nexus In Any US State (The Exact Workflow)

This is the section most guides skip.

Use this workflow exactly as written. It works for every state.

Step 1: Pull Your State-Level Sales Data

Start with facts, not assumptions.

Export sales data for at least the last 12 months (some states need more).

You need, per state:

- Gross sales

- Taxable sales (if your system separates them)

- Number of transactions

- Sale dates

- Sales channel (direct vs marketplace)

Simplified:

“I need to know how much I sold, how often I sold, and when.”

Do not adjust numbers yet. Just export and lock them.

Step 2: Separate Sales By Channel

Split your data into:

- Direct sales (your checkout, invoices, subscriptions)

- Marketplace sales (Amazon, Etsy, app stores)

- Partner or reseller sales

Why this matters:

- Marketplaces may collect tax for you

- Direct sales remain your responsibility

- Some states count marketplace sales differently for thresholds

Simplified:

“Who sold it matters almost as much as how much I sold.”

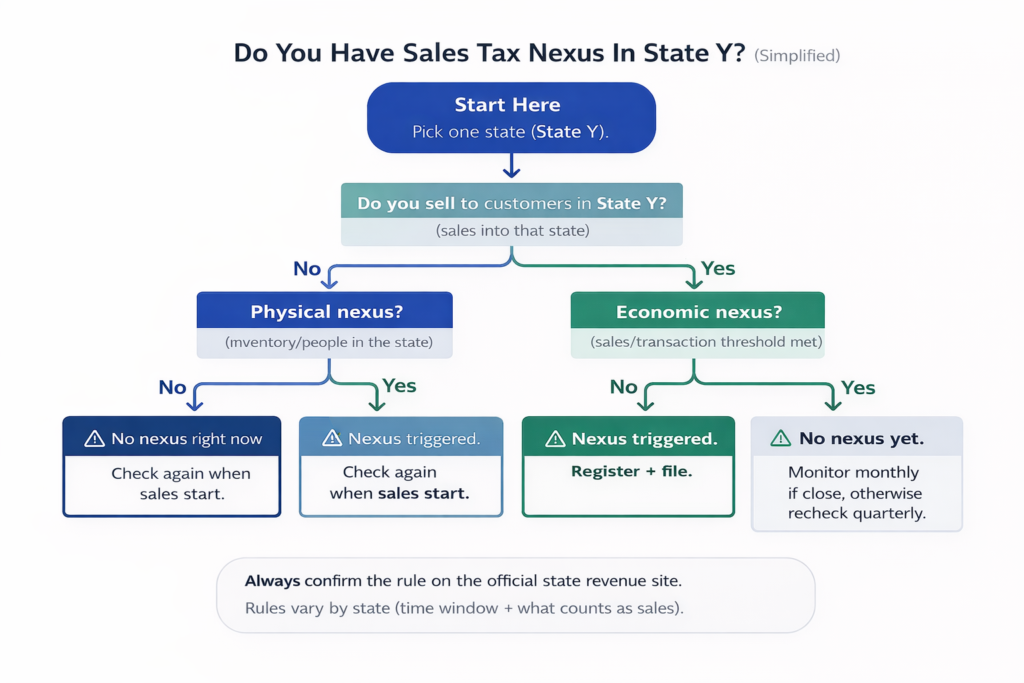

Step 3: Check Physical Nexus First (Fast Elimination)

Before touching thresholds, ask one question:

Do I have a physical presence in this state?

Check for:

- Inventory stored in the state (FBA, 3PL)

- Employees or contractors working there

- Office, warehouse, or equipment

- On-site services, installs, or recurring in-person work

If yes, nexus likely exists regardless of sales volume.

FBA example:

If Amazon stores your inventory in a state, physical nexus risk exists even if your sales are small.

Simplified:

“If something of mine is already there, sales volume does not save me.”

Step 4: Identify The State’s Economic Nexus Rule

Now pull the official state rule.

For each state, write down:

- Threshold amount (example: $100k, $500k)

- Transaction test (if any)

- AND vs OR logic

- Measurement window

- What the state counts as “sales”

This information lives on the state revenue department website.

Directories help you find the page. They are not the final authority.

Simplified:

“I don’t use averages. I use the state’s exact rule.”

Step 5: Match Your Data To The State’s Measurement Window

This step causes most mistakes.

Examples:

- Texas → trailing 12 months

- Florida → previous calendar year

- California → current or prior calendar year

- New York → preceding four sales tax quarters

Your numbers must match their clock, not yours.

Simplified:

“Same data, wrong time window = wrong answer.”

Step 6: Compare Your Numbers To The Threshold

Now run the test.

Example 1: Texas (Sales-Only State)

Your Texas sales:

- Q1: $120,000

- Q2: $150,000

- Q3: $180,000

- Q4: $85,000

Total over the preceding 12 months: $535,000

Texas safe harbor: under $500,000

Result:

- Threshold exceeded

- Economic nexus triggered

- Registration required

Simplified:

“Over $500k in 12 months = Texas nexus.”

Example 2: Kentucky (Sales OR Transactions)

Your Kentucky sales:

- Revenue: $95,000

- Transactions: 215

Kentucky threshold:

- $100,000 OR

- 200 transactions

Result:

- Revenue test failed

- Transaction test passed

- Nexus triggered

Simplified:

“Low revenue does not save you if volume is high.”

Step 7: Decide Your Action

Use a simple rule:

- Threshold exceeded → Register and plan collection

- 75–90% of threshold → Monitor monthly

- Well below threshold → Review quarterly

Do not wait “until year-end” if the state uses rolling periods.

Step 8: Document Everything

Create a nexus tracker with:

- State

- Threshold rule link

- Measurement window

- Your numbers

- Decision date

- Status (Triggered / Monitor / No)

This is your audit defense file.

Simplified:

“If you can’t show your work, the state will do it for you.”

Tools And Resources To Monitor Nexus

You do not need fancy software to check nexus once.

You do need a system to monitor it as sales grow.

Rule First

Tools help you track numbers.

States decide nexus.

(Tool = tracker, not judge.)

Free And Official Resources

State Revenue Websites (Source Of Truth)

Look for pages labeled:

- Remote sellers

- Economic nexus

- Marketplace facilitator

Use these pages to confirm:

- Threshold amount

- Measurement window

- What counts as “sales”

Directories (Use For Speed)

Use them to find the right state pages fast:

- Sales Tax Institute nexus chart

- Streamlined Sales Tax directory

- TaxJar nexus guides

Then confirm on the state site.

Manual Tracking (Enough For Most Sellers)

Use a simple tracker with one row per state:

- Threshold + measurement window

- Gross sales, taxable sales, transactions

- Channel split (direct vs marketplace)

- Status: No nexus / Monitor / Triggered

- Last review date

Review schedule:

- Monthly if you are near a threshold (75–90%)

- Quarterly for everything else

Automated Tools (When Manual Tracking Breaks)

Consider tools if you sell in many states:

- TaxJar

- Avalara

- TaxCloud

- Quaderno

Use them for:

- State-level totals

- Threshold alerts

- Reporting speed

Do not use them as your only source of truth.

Final Thoughts

Sales tax nexus is a numbers test, not a location test.

Use the same workflow for every state:

- Pull state-level sales, transactions, and dates.

- Check the physical nexus first (inventory, people, operations).

- Check economic nexus next (sales-only, sales OR transactions, sales AND transactions).

- Match the state’s measurement window, then compare your numbers to the threshold.

- If you crossed it, register. If you are close, monitor monthly.

Start with your top states first, then expand.

Save your calculations and the state rule link every time. That record protects you.

Need Help Checking Your Nexus?

Unsure whether you’ve already crossed a state threshold?

That uncertainty is where most compliance mistakes begin.

scounts.pk helps foreign sellers:

- Review state-level sales and transaction data

- Identify states where nexus is already triggered

- Spot high-risk states before penalties start

- Decide whether to register now or monitor safely

Contact scounts.pk to get clarity before states come knocking.

Disclaimer: This article is authored by a writer at Scounts Private Limited. Please note that the fees mentioned are subject to change and may not be accurate at the time of reading. The content has not yet reviewed by any of our LLC taxation experts. For expert advice or services, feel free to contact us.