Owning a U.S. Limited Liability Company (LLC) as a Pakistani resident brings opportunities — and complex tax responsibilities. The U.S. tax system emphasizes compliance and timely information reporting, even for foreign-owned entities with no income. Missing a filing deadline can lead to severe penalties, so understanding what, when, and how to file is crucial.

This guide simplifies the key deadlines, forms, and compliance steps for Pakistani non-resident owners for the 2025 tax year (filed in 2026).

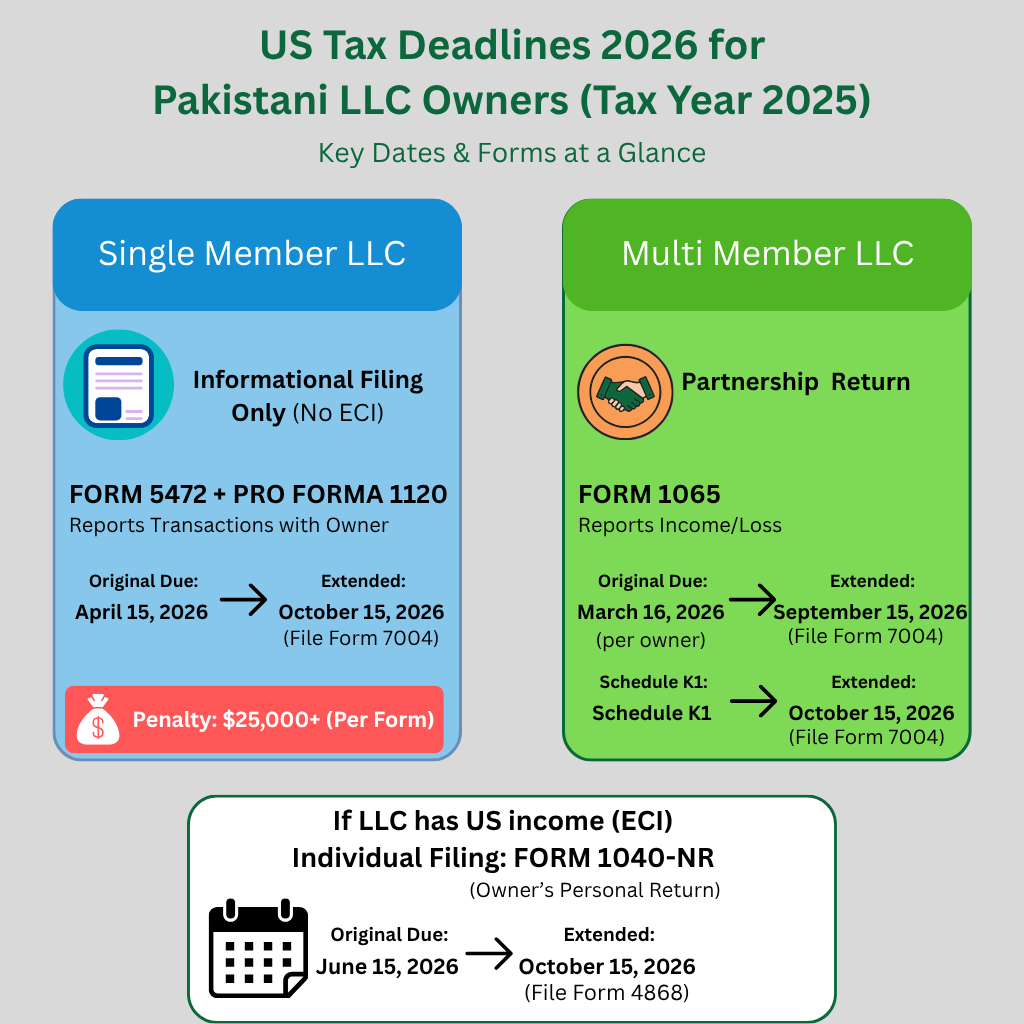

Key Deadlines Overview

| LLC Type (Default) | Purpose | Key Forms | Original Due Date | Extension To |

| Single-Member LLC (SMLLC) | Informational filing (no U.S. income) | Pro Forma 1120 + Form 5472 | April 15, 2026 | October 15, 2026 (Form 7004) |

| Multi-Member LLC (MMLLC) | Partnership informational return | Form 1065 | March 16, 2026 | September 15, 2026 (Form 7004) |

| SMLLC or MMLLC with U.S. ECI | Income tax return | Form 1040-NR (owner) | June 15, 2026 | October 15, 2026 (Form 4868) |

1. Understanding Your Filing Categories

Your compliance duties generally fall into two categories:

A. Informational Reporting (Even with No Income)

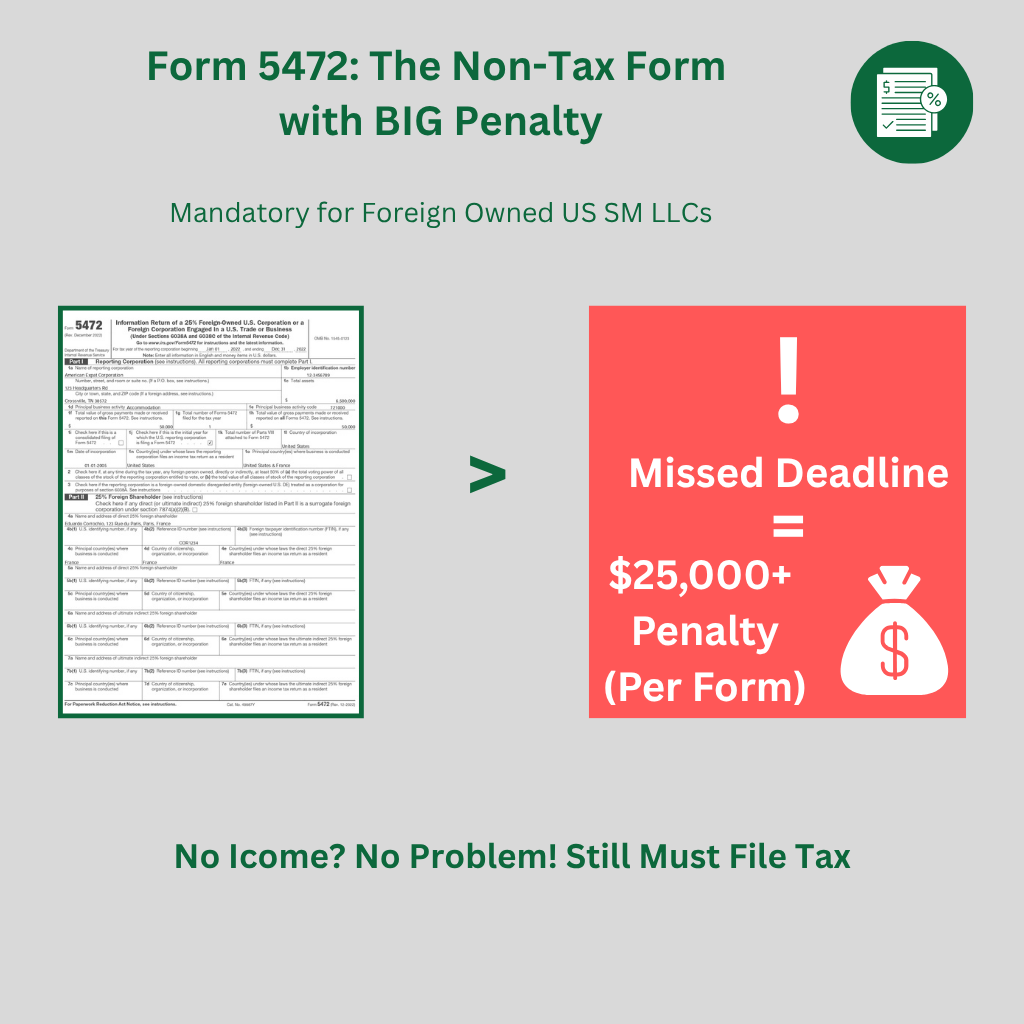

For foreign-owned LLCs, this is the most overlooked but most penalized area.

Single-Member LLC (Disregarded Entity): If you’re the sole foreign owner, your LLC must file:

| Form | Filed By | Purpose | Penalty |

| Form 5472 | The U.S. LLC | Reports transactions with the foreign owner (contributions, loans, or payments). | $25,000 minimum |

| Pro Forma Form 1120 | The U.S. LLC | Serves as a cover sheet for Form 5472. Must state ‘Foreign-Owned U.S. DE’ at the top. | Filed with Form 5472 |

Note: Even if your LLC earned no income, these forms must be filed by April 15, 2026. File Form 7004 for a six-month extension.

B. Partnership Return (Multi-Member LLC)

If your LLC has multiple owners, it is treated as a partnership for U.S. tax purposes.

Form 1065 (Return of Partnership Income) – Due March 16, 2026.

Schedule K-1 – Sent to each partner, showing their share of income or loss.

Extension – File Form 7004 for an automatic extension to September 15, 2026.

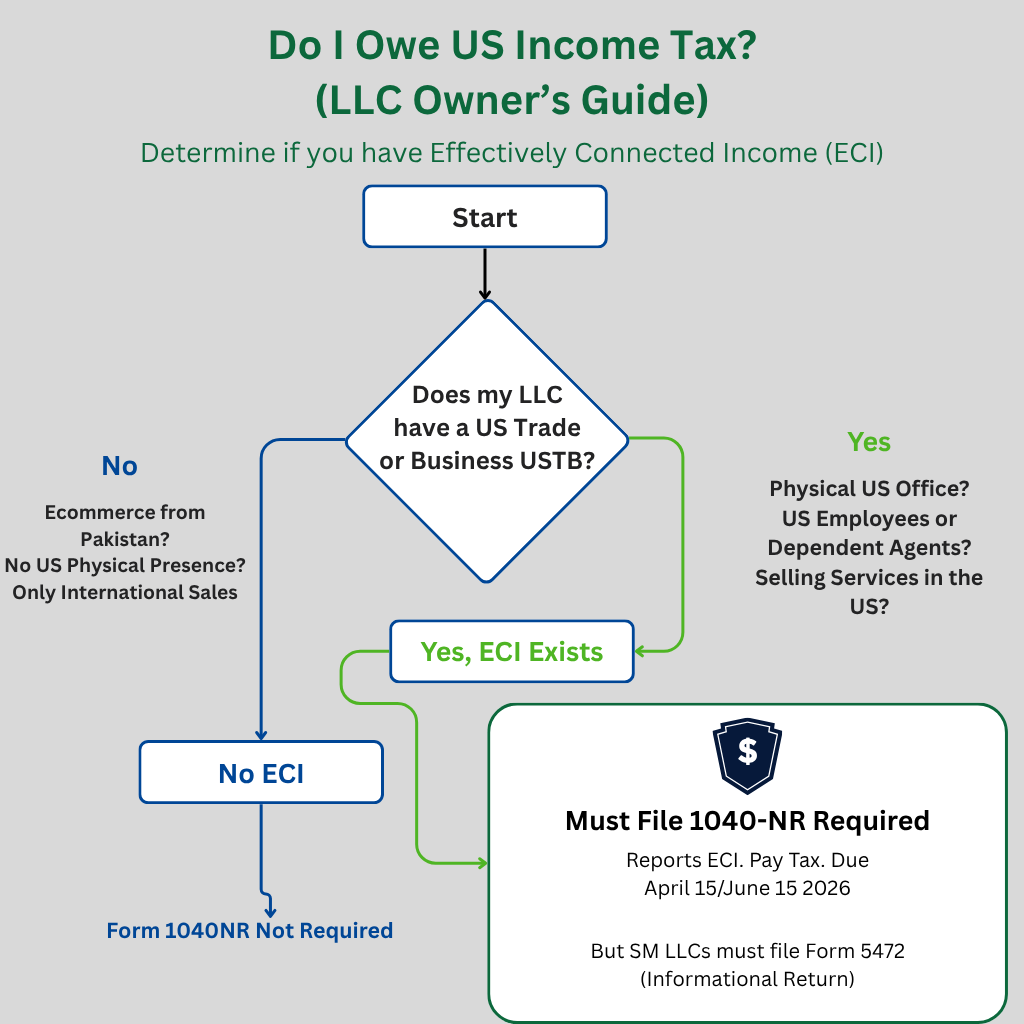

2. Determining If You Must Pay U.S. Income Tax (Form 1040-NR)

As a Non-Resident Alien (NRA) in Pakistan, you’re taxed only on U.S.-source income that is Effectively Connected Income (ECI) with a U.S. Trade or Business (USTB).

| If Your LLC Has… | You Must File… | Due Date |

| U.S. Trade or Business (ECI) | Form 1040-NR (individual owner) | June 15, 2026 |

| No U.S. Presence (no ECI) | No Form 1040-NR usually required | N/A |

Tax Payment Tip: Even if you file an extension, any tax owed is still due April 15, 2026.

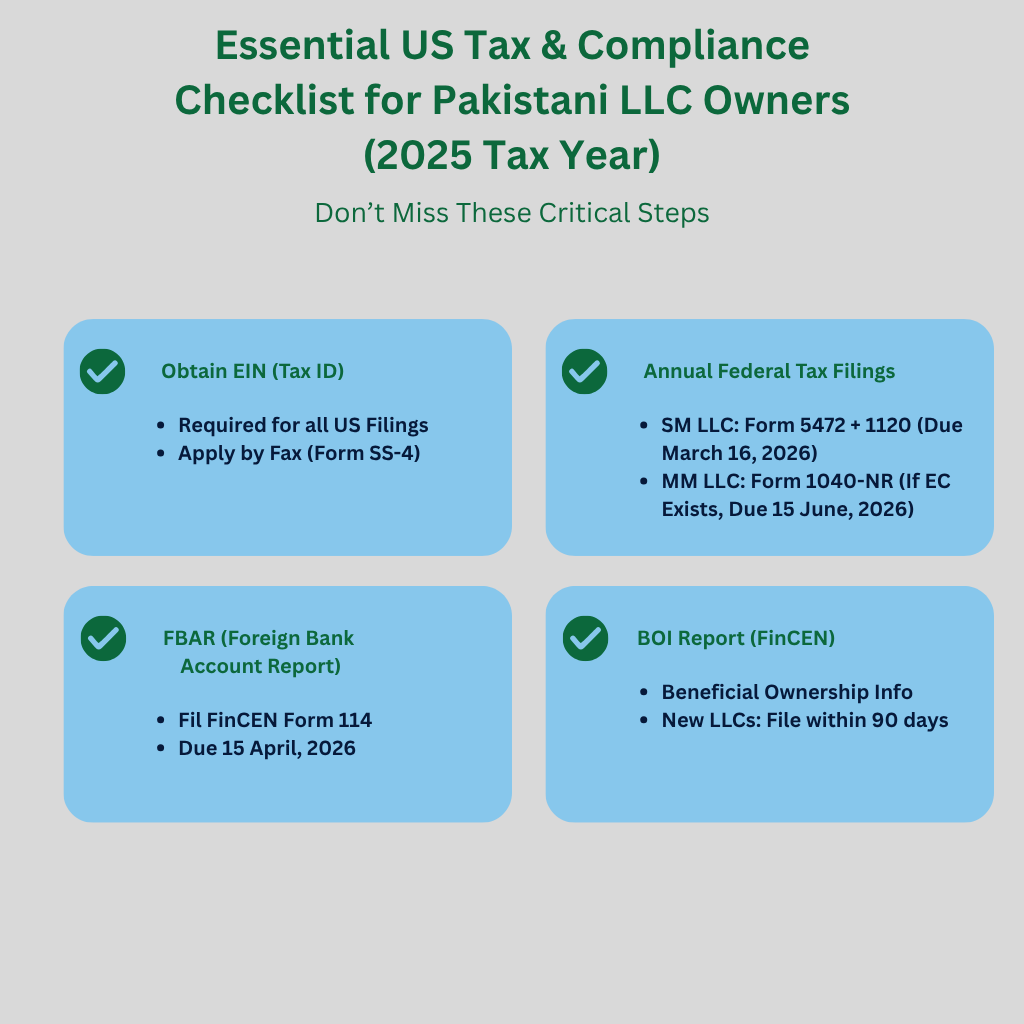

3. Other Critical Compliance Filings

A. FBAR (Foreign Bank Account Report)

Form: FinCEN Form 114

Who Files: Any U.S. entity with foreign accounts exceeding $10,000 (aggregate).

Due: April 15, 2026 (auto-extended to October 15).

Penalty: Starts at $12,921 for non-willful violations.

B. BOI (Beneficial Ownership Information) Report

Authority: Corporate Transparency Act (CTA)

Who Files: Most LLCs must report beneficial owners (25%+ ownership or substantial control).

Platform: FinCEN BOI e-Filing System

Deadline: Within 90 days of LLC formation (if formed in 2025).

Penalty: Up to $591/day for willful violations.

C. EIN (Employer Identification Number)

Every LLC needs an EIN to file tax forms. Non-residents without an SSN must apply via Form SS-4 by fax. Processing time: 30+ days.

4. Professional Help for Pakistani LLC Owners

Given the high penalties and cross-border complexity, consider engaging U.S. tax professionals experienced with non-resident compliance.

1. IRS Acceptance Agents in Pakistan

Locally certified professionals who handle ITIN and EIN applications.

Examples:

| If Your LLC Has… | You Must File… | Due Date |

| U.S. Trade or Business (ECI) | Form 1040-NR (individual owner) | June 15, 2026 |

| No U.S. Presence (no ECI) | No Form 1040-NR usually required | N/A |

| If Your LLC Has… | You Must File… | Due Date |

2. Specialized Remote U.S. Tax Firms

Operate entirely online; ideal for cross-border clients:

1. Dark Horse CPAs – Cross-border entity compliance experts.

2. The Wolf Group – Specialists in international returns (Form 5472, 1040-NR, W-8 series).

3. Taxes for Expats (TFX) – Handles complex non-resident filings.

4. H&R Block Expat Tax Services – Global brand with non-resident expertise.

3. Global Accounting Networks

For larger setups:

1. RSM US

2. Crowe LLP

3. PwC

These firms handle transfer pricing, permanent establishment (PE) risk, and treaty application.

Next Steps

1. Contact at least two firms from the above list.

2. Ask about their experience with Form 5472 for foreign-owned SMLLCs.

3. Confirm familiarity with the U.S.–Pakistan Tax Treaty to optimize tax outcomes.

Credible Sources

1. IRS Instructions for Form 5472: https://www.irs.gov/forms-pubs/about-form-5472

2. IRS Publication 519 – U.S. Tax Guide for Aliens: https://www.irs.gov/publications/p519

3. FinCEN – FBAR & BOI Reporting: https://fincen.gov

Disclaimer: This article is for general purpose guidance only which implies that it is not written by a tax expert.

Contact us today for expert tax solutions!