Are you dreaming of starting your own business? If yes, choosing the right business structure for you; either LLC or sole proprietorship, is the most crucial decision. Don’t sweat over there, we will help you pick the best-suited option for your venture. Choosing the right business structure is essential because it influences the core areas of your business; liability, taxes, and management. Your company’s legal structure identifies the protection of your assets from any lawsuits or business debts.

Moreover, varying structures also play a role in taxation, as tax authorities tax each one differently. These structures also dictate how owners manage and control their businesses. Do not get anxious because, for your convenience, we have made this guide comparing the core features of LLCs and Sole Proprietorships to help you decide which one is best for starting your own business.

Sole Proprietorship vs. LLC

Many people consider a sole proprietorship to be the most straightforward business structure. A single individual owns and operates this type of business. There is no legal distinction between the business and the owner, making it a straightforward way to start a small business. There is sole ownership meaning having control over the business decisions. Moreover, sole proprietorships have fewer legal formalities than other business structures like LLCs or corporations.

Conversely, the Limited Liability Company (LLC) provides a hybrid structure that balances a sole proprietorship’s simplicity with a corporation’s liability protection. In an LLC, owners benefit from limited liability protection, which shields personal assets from business debts and liabilities. Choosing the best business structure is the core purpose of this article, to do so, follow us until the end. If you want to learn more about whether to choose the sole proprietorship or partnership then click here.

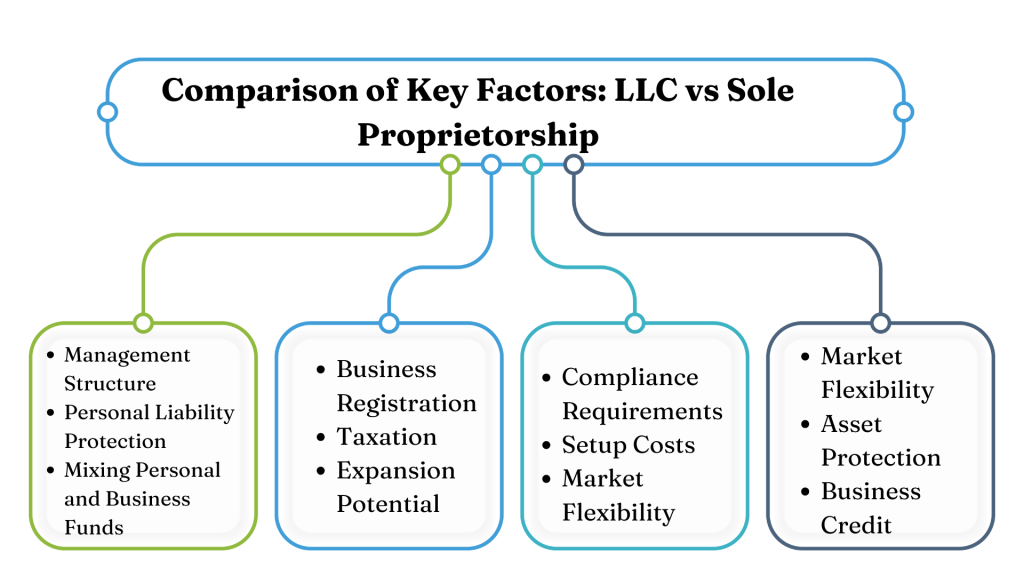

Hence, by understanding the benefits and requirements of both LLC and sole proprietorship, you can make an informed decision about choosing the best business structure for your needs. To make things more clear for you, we have made this table to help you evaluate your decision.

Comparison of key factors: LLC vs. Sole Proprietorship

Key Factor LLC Sole Proprietorship

| Key Factor | LLC | Sole Proprietorship |

| Management Structure | Owned by one or more members; can be managed by members or appointed managers. | Single owner has complete control over decisions. |

| Personal Liability Protection | Offers personal liability protection, separating personal assets from business liabilities. | There is no liability protection; personal assets are at risk for business debts and lawsuits. |

| Mixing Personal and Business Funds | Requires strict separation of personal and business finances to maintain liability protection. | There is no legal requirement to separate funds, but it’s recommended for tax clarity. |

| Business Registration | Must register with the state and include “LLC” in the business name; offers name protection within the state. | Minimal registration is required; a DBA (“doing business as”) registration may be needed if using a business name. |

| Taxation | Flexible taxation; can choose pass-through (default) or corporate tax structures. | Pass-through taxation only; business income is reported on the owner’s tax return. |

| Credibility | Generally considered more credible by clients, vendors, and lenders due to formal structure. | Lower perceived credibility, which may affect business credit and financing opportunities. |

| Compliance Requirements | Annual state filings, possible additional taxes (e.g., unemployment tax), and industry-specific licensing requirements. | Minimal compliance; no annual filings or special business taxes. |

| Setup Costs | Higher initial and ongoing costs due to registration, annual filings, and potential professional fees. | Lower initial setup costs; inexpensive to establish. |

| Market Flexibility | Flexible membership; can have multiple members, including partnerships and corporations. | Limited to a single owner, with minimal flexibility in bringing on partners or investors. |

| Asset Protection | Members’ liability is limited to their investment, protecting personal assets from business liabilities. | No asset protection; personal credit is directly tied to business, risking assets in case of business issues. |

| Business Credit | Separate from personal credit, making it easier to build business credit. | Business and personal credit are tied; it is challenging to build separate business credit. |

| Self-Employment Tax | Pass-through taxation allows flexibility in tax planning; and may avoid some self-employment tax if structured accordingly. | Pays self-employment tax on net profit, with typically higher quarterly tax payments. |

| Expansion Potential | Suitable for growth and expansion; can easily add members or appoint managers. | It is limited to one owner, which may restrict the ability to grow or attract investment. |

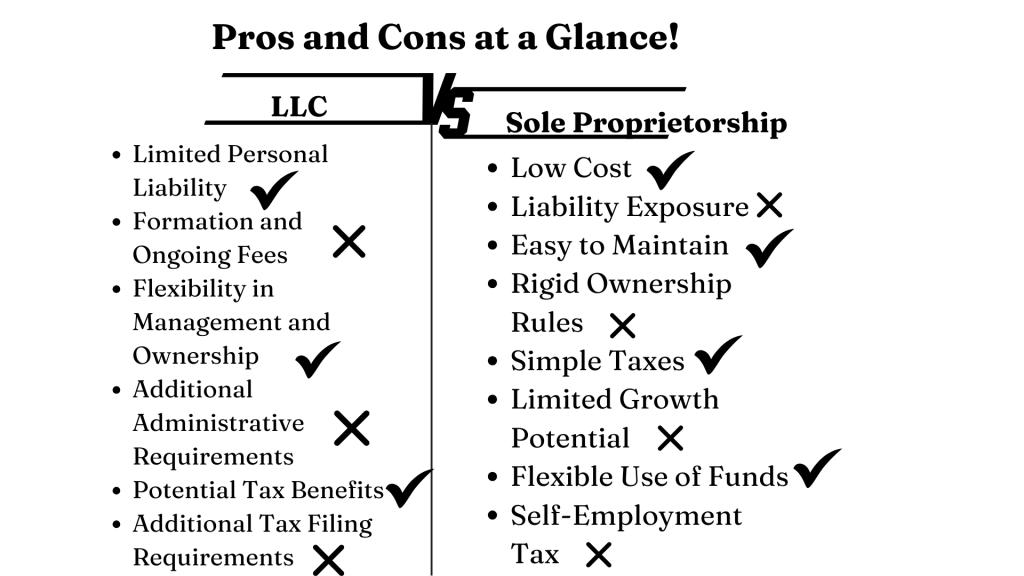

LLC vs. Sole Proprietorship: Pros and Cons in Choosing the Best Business Structure

Pros and Cons of LLC

To help you easily evaluate the differences focus on the Pros and cons of LLC vs. sole proprietorship mentioned below.

| Advantages of LLC | Disadvantages of LLC |

| Limited Personal Liability: Protects owners’ assets from business debts and lawsuits. | Formation and Ongoing Fees: LLCs require registration, and states charge filing and renewal fees. |

| Flexibility in Management and Ownership: There is no limit to the number or type of owners (individuals, trusts, corporations, partnerships). | Additional Administrative Requirements: Must file annual or biennial reports; may need state EIN and tax IDs. |

| Potential Tax Benefits: Pass-through taxation allows income to flow directly to owners, avoiding corporate tax. | Additional Tax Filing Requirements: Multi-member LLCs treated as partnerships or corporations may require additional forms (e.g., Form 1065 and K-1 for partnerships). |

| Market Credibility: Provides greater credibility and the ability to build business credit separately from personal credit. | Potential for Involuntary Dissolution: Risk of state dissolution if filing and compliance requirements aren’t met. |

| Flexible Taxation: Can choose to be taxed as a sole proprietor, partnership, or corporation, depending on needs. | Costs and Paperwork: Generally more expensive and complex to maintain than a sole proprietorship. |

Pros and Cons of Sole Proprietorship

| Advantages of Sole Proprietorship | Disadvantages of Sole Proprietorship |

| Low Cost: No registration fees, making it affordable for startups. | Liability Exposure: Owner is personally liable for business debts, putting personal assets at risk. |

| Control: Owner has complete control and ownership of the business. | Difficulty Raising Funds: Harder to secure loans and funding since stock can’t be issued. |

| Easy to Maintain: Minimal paperwork and easy to dissolve if needed. | Rigid Ownership Rules: Sole proprietorships cannot have additional owners, and changing ownership requires forming a new business entity. |

| Simple Taxes: Business income reported on personal tax return using Schedule C. | Limited Growth Potential: Typically lacks credibility with investors and faces challenges in establishing business credit. |

| Flexible Use of Funds: No strict separation between business and personal funds is required. | Self-Employment Tax: Owners must pay self-employment taxes, often every quarter. |

Choosing the Best Business Structure: Key Factors to Consider

The key factors for decision-making LLC vs. Sole Proprietorship are as followed:

1. Liability Protection

- Sole Proprietorship: Unlimited personal liability.

- LLC: Limited personal liability, protecting your assets.

2. Taxes

- Sole Proprietorship: You report business income on your tax return.

- LLC: You can choose to have your LLC taxed as a sole proprietorship or a corporation, providing flexibility.

3. Ease of Formation

- Sole Proprietorship: Simpler to set up, with minimal paperwork.

- LLC: Requires more paperwork and state filing fees.

4. Cost

- Sole Proprietorship: Generally lower initial costs.

- LLC: Higher initial costs due to formation fees and ongoing maintenance.

5. Growth Potential

- Sole Proprietorship: Limited growth potential, especially when seeking funding or attracting investors.

- LLC: More attractive to investors and can accommodate growth and expansion.

6. Legal and Administrative Requirements

- Sole Proprietorship: Fewer legal formalities and less paperwork.

- LLC: More complex legal and administrative requirements, including annual filings and compliance with state regulations.

By carefully considering these factors and consulting with a legal or tax professional, you can decide the best business structure for your specific needs. These factors will also help you differentiate between an LLC and a sole proprietorship.